In recent years, the term “Metaverse” has garnered significant attention. It refers to a collective, virtual shared space created by the convergence of virtually enhanced physical reality and persistent digital environments. As this concept continues to gain traction, businesses are rapidly moving to establish their presence within this emerging digital frontier. Consequently, Metaverse stock have become an attractive investment avenue, offering long-term growth potential in a rapidly evolving sector.

In this comprehensive guide, we’ll explore what Metaverse stocks are, how to identify top investment opportunities, the benefits of investing in the Metaverse, and answer frequently asked questions to help you better understand how to get involved.

Key Takeaways

What Is the Metaverse?

Before diving into Metaverse stocks, it’s essential to understand the Metaverse itself and how it intersects with sectors such as technology, gaming, and digital assets. At its central, the Metaverse is a digital environment where users cooperate in immersive 3D atmospheres in real time. Think of it as the next iteration of the internet, where instead of browsing static web pages, individuals explore dynamic, interactive spaces via avatars using AR and VR technologies.

The Metaverse is not a single product or company it’s an interconnected digital ecosystem. When investing in Metaverse stocks, don’t expect instant returns based on hype alone. True gains often come from identifying companies with a clear product-market fit and a long-term commitment to immersive technology infrastructure.

Key technologies that enable the Metaverse include:

- Virtual Reality (VR): Immersive, computer-generated environments.

- Augmented Reality (AR): Digital overlaps on the natural world.

- Artificial Intelligence (AI): Powers intelligent avatars and non-playable characters (NPCs).

- Blockchain: Ensures secure ownership of digital assets like NFTs (non-fungible tokens).

- 5G/6G Connectivity: Delivers the ultra-low latency and high-speed data transmission needed for seamless Metaverse interactions.

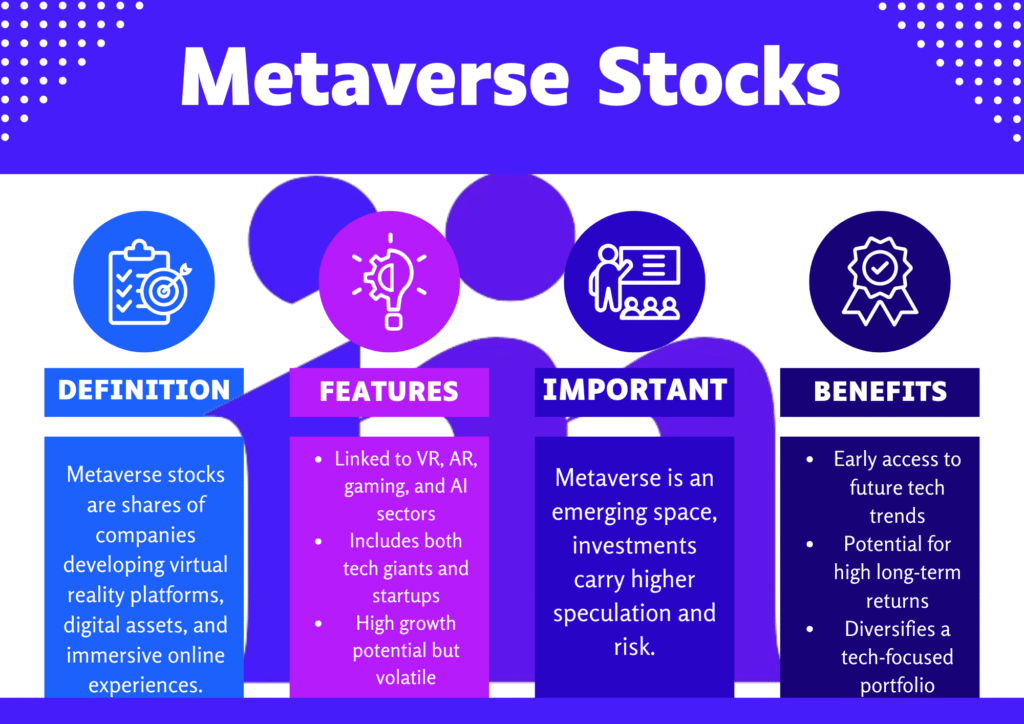

What Are Metaverse Stocks?

Metaverse stocks refer to securities of companies dynamically involved in developing, supporting, or assisting the Metaverse. These firms may produce hardware (like VR headsets), software platforms (such as virtual environments or games), or services that underpin the infrastructure of the Metaverse. As interest and investment in the space increase, these companies offer the potential for capital appreciation.

When analyzing Metaverse-related companies, check for patent activity and developer engagement. A firm actively filing technology patents or hosting developer conferences (like Meta’s Connect or NVIDIA’s GTC) is likely investing heavily in innovation often a sign of future growth and product leadership.

Categories of Metaverse Stocks

- Technology Giants: Companies like Meta Platforms, Microsoft, and Alphabet are investing heavily in Metaverse development.

- Hardware Providers: Manufacturers such as NVIDIA, AMD, and Oculus develop essential hardware, including GPUs and VR devices.

- Gaming & Development Platforms: Firms like Roblox, Epic Games (creator of Fortnite), and Unity are building virtual environments for social interaction and gaming.

- Blockchain & NFT Ecosystems: Platforms like Decentraland and The Sandbox offer digital real estate and tokenized assets.

- Fintech Solutions: Firms such as PayPal and Block Inc. (formerly Square) facilitate digital transactions and payment systems within the Metaverse.

NVIDIA’s income from its data center section (used for powering virtual worlds and AI models) exceeded its gaming income for the first time in 2023 an indicator of how Metaverse substructure is becoming a fundamental business model, not just a revolutionary add-on.

How to Choose Metaverse Stocks

When evaluating Metaverse stocks, focus on the core components of the digital ecosystem: hardware, software, gaming, and financial technologies. Here’s a strategic approach:

1. Understand the Industry and Technology

Start by analyzing the technology landscape and a company’s specific role within it. Does the firm develop VR hardware, create immersive environments, or enable digital transactions? A deep understanding of the business model and future viability is crucial for informed investment decisions.

2. Assess Companies with a Durable Metaverse Strategy

Look for firms with a clearly articulated Metaverse vision and ongoing investments in relevant technologies. For example:

- Meta Platforms has reorganized its industry around AR and VR.

- Microsoft is incorporating mixed reality into organizational solutions and increasing through strategic acquisitions.

3. Diversify Across Metaverse Segments

Diversification reduces risk. Spread your investments across various Metaverse verticals hardware (e.g., NVIDIA), software (e.g., Unity), gaming (e.g., Roblox), and blockchain platforms (e.g., Decentraland).

4. Analyze Financial Health

Only invest in companies with solid balance sheets, positive cash flow, and manageable debt levels. Those committing substantial capital to Metaverse initiatives must maintain financial resilience to support long-term growth.

5. Track Market Trends and Innovations

The Metaverse is still nascent and constantly evolving. Stay updated on trends in immersive technologies, digital assets, and user adoption. Early identification of innovation leaders can yield significant investment advantages.

Not all “Metaverse” companies are created equal. Some use the term as a buzzword to attract investment without having tangible products or user adoption. Always verify whether a company’s Metaverse claims are backed by real-world application, partnerships, and user metrics not just press releases.

Benefits of Investing in Metaverse Stocks

Investing in Metaverse stocks offers various strategic advantages:

1. Exposure to Disruptive Technologies

Gain early access to emerging technologies, including VR, AR, AI, and blockchain, which are poised to redefine user interaction and digital engagement.

2. High-Growth Potential

The Metaverse is still in its early stages. Early investors could see significant upside as adoption scales and digital platforms mature.

3. Portfolio Diversification

Investments in the Metaverse span multiple sectors such as gaming, entertainment, and digital property, allowing you to diversify beyond traditional industries like banking or energy.

4. Participation in the Digital Asset Economy

Several Metaverse platforms integrate NFTs, providing exposure to the fast-growing market for virtual assets, collectibles, and real estate.

5. Long-Term Capital Appreciation

As digital ecosystems evolve and user engagement deepens, early investments in Metaverse-enabling companies may yield sustainable long-term returns.

In 2022, Roblox partnered with major fashion brands like Gucci and Nike to launch branded virtual experiences. This move not only created new revenue streams but also proved that consumer engagement in the Metaverse can drive real economic value especially among Gen Z users spending money on digital identity and experience.

Pros and Cons of Metaverse Stocks

| Pros | Cons |

|---|---|

| ✔ Exposure to cutting-edge technologies like VR, AR, and blockchain | ✘ High volatility due to the nascent stage of development |

| ✔ Potential for significant capital growth | ✘ Risk of increased competition and evolving regulatory frameworks |

| ✔ Portfolio diversification into non-traditional sectors | ✘ Uncertainty regarding mass-market adoption |

| ✔ Opportunity for long-term returns as the Metaverse matures | ✘ Platform and market fragmentation can affect stock performance |

Conclusion

Metaverse stocks present a compelling opportunity for investors seeking to benefit from the growing momentum around virtual environments, immersive technologies, and blockchain-based platforms. As the Metaverse expands, companies that power its development could deliver meaningful long-term value.

Understanding what Metaverse stocks are and how to choose the best investments requires thorough research, industry awareness, and strategic diversification. While the future of the Metaverse is still unfolding, investors who position themselves wisely today may capitalize on a transformative shift in how technology and digital finance intersect.