Stock options have become an increasingly recognized method of asset allocation and employee compensation. Understanding how stock options work can offer you a strategic opportunity to build wealth, manage risk, and diversify your portfolio. Whether you’re an experienced investor, a beginner looking to enhance your knowledge, or someone evaluating compensation packages, this guide will walk you through what stock options are, how they operate, their benefits, and frequently asked questions (FAQs).

KEY TAKEAWAYS

What Are Stock Options?

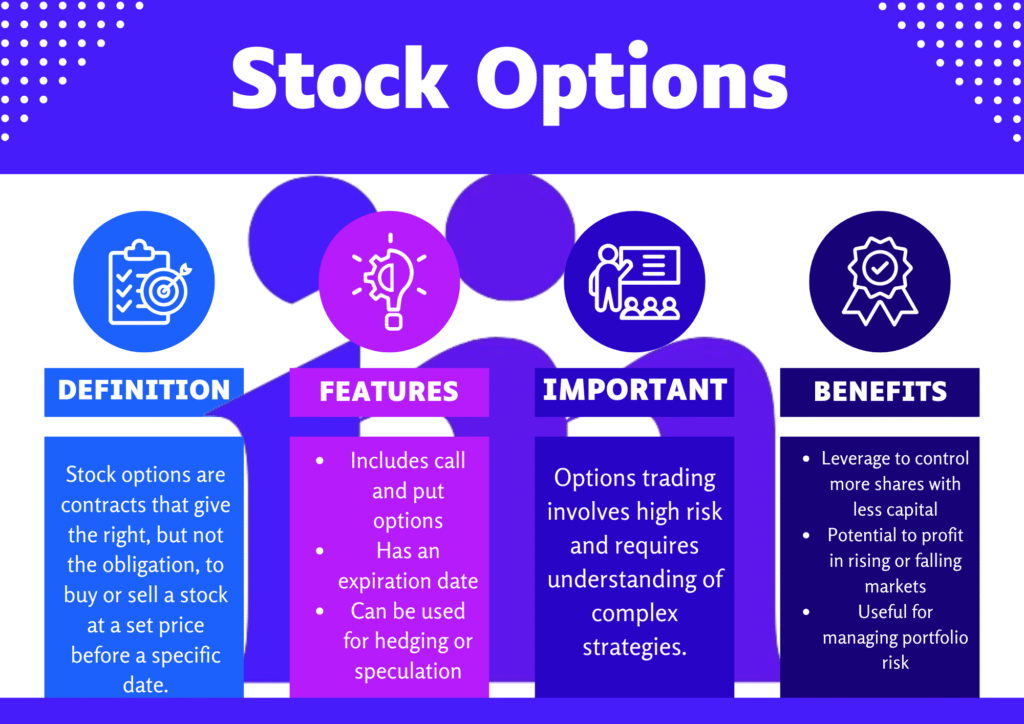

Stock options are economic derivatives that offer investors the privilege but not the responsibility to purchase or put up for sale at a required price (strike price) within a described interval. They are commonly used either as part of an employee compensation plan or as a trading strategy in the equity markets.

At their core, stock options are agreements between two revelries: the option purchaser and the option seller. The purchaser gives a premium for the authority to sell the agreement in the future, while the seller is thankful to fulfill the contract if the purchaser selects to sell it.

Stock options aren’t inherently “safer” or “riskier” than stocks, they’re just different tools. They require a different mindset. Unlike owning shares, you’re working with contracts that expire, so timing, volatility, and pricing models matter. Always evaluate your financial goals before using options.

Types of Stock Options

There are two key categories of stock options:

- Call Options: Grant the owner the authority to buy a stock at a specific hit price within a set termination period.

- Put Options: Grant the owner the obligation to sell a stock at a pre-defined hit price within a set termination time.

When I first started exploring options, I treated them like a side bet, cheap calls on trending stocks. I won a few, lost more. What changed the game for me was learning risk-defined strategies like credit spreads and using puts for portfolio insurance. That’s when options became a consistent tool, not just a thrill. Mastering the discipline changed everything.

How Stock Options Work

Understanding the mechanics of stock options is key to making informed investment decisions. Here’s how they function:

Key Components of an Option Contract

- Underlying Asset: The financial tool that the option contract is based on.

- Strike Price: The worth at which the option possessor can purchase (call) or sell (put) the essential asset.

- Expiration Date: The final day the option remains valid and can be exercised or closed.

- Premium: The cost paid by the buyer to acquire the option, similar to a non-refundable deposit.

- Option Type: Specifies whether the agreement is a call or a put.

Example: How Call Options Work

Suppose you purchase a call option on Apple Inc. (AAPL) with the following terms:

- Strike Price: $150

- Premium: $5 per share

- Expiration: 30 days

You now have the right to buy AAPL shares at $150, even if the market price rises above that within 30 days. If AAPL trades at $170, you can still purchase shares at $150, earning a profit. If the stock stays under $150, your option terminates valueless, and you drop the $5 premium.

Example: How Put Options Work

Now consider a put option with these terms:

- Strike Price: $100

- Premium: $4 per share

- Expiration: 30 days

This provides you the authority to sell securities at $100 even if the market price decreases below that. If the stock decreases to $80, you can still sell at $100, benefitting from the difference. If the amount stays beyond $100, the option terminates worthless, and you drop the premium.

Exercising and Assignment of Options

- Exercise: As a buyer, you choose to exercise your right to buy (calls) or sell (puts) the underlying stock.

- Assignment: If you’re the seller and the buyer exercises the option, you’re obligated to fulfill the contract. For calls, this involves selling the security; for puts, it means purchasing the share at the hit price.

Always track the “Greeks” especially Theta and Delta. Theta shows how much value your option loses daily due to time decay. Delta specifies how much the value of the option changes with the share. Knowing these helps you manage risk better than just relying on strike prices and expiration dates.

Pros and Cons of Stock Options

| Pros | Cons |

|---|---|

| ✔ Leverage control of a larger position with a smaller capital outlay. | ✘ If the marketplace doesn’t change satisfactorily, you can drop the whole premium. |

| ✔ Potential for significant profits on favorable market moves. | ✘ Options lose value over time due to time decay. |

| ✔ Useful for speculation, income strategies, and hedging. | ✘ Requires advanced market knowledge to use effectively. |

| ✔ Strategies like covered calls can generate additional income. | ✘ Some approaches may lead to harms surpassing the opening investment. |

Benefits of Stock Options

- Potential for High Returns

Stock options allow you to control more shares for a lower upfront cost, potentially magnifying returns if the market moves in your favor. - Leverage

Options provide financial leverage, enabling you to benefit from price movements with less capital than buying shares outright. However, leverage also increases risk. - Hedging

Investors can use put options to hedge against declines in stock prices, functioning as a form of portfolio insurance. - Income Generation

Writing (selling) covered calls allows shareholders to earn premiums on stocks they already own, enhancing income when the stock remains below the strike price. - Tax Advantages

Certain employee stock options, such as Incentive Stock Options (ISOs), may offer favorable tax treatment if held according to required guidelines, potentially qualifying for long-term capital gains tax rates.

Roughly 90% of all options contracts expire worthless, especially out-of-the-money ones. That highlights most trade brokers lose the premium they rewarded. This stat alone emphasizes why understanding strategy is more important than hype.

How to Use Stock Options in Investing

- Speculation

Investors can speculate on price movements. Buying calls anticipates price increases; buying puts anticipates declines. - Income Generation with Covered Calls

Writing covered calls on possessed shares can produce consistent income. If the stock value remains below the strike price, you maintain both the stock and the premium. - Hedging with Puts

Buying puts on stocks you own provides downside protection, locking in a minimum sale price. - Spreads and Combinations

Complex strategies like vertical spreads, straddles, or strangles can help control risk and customize exposure. Instances contain bull call increases and bear put coverages.

In 2021, GameStop (GME) options saw an explosion in volume during the short squeeze. Many retail traders bought call options at $100+ strikes, and some made 10x or 20x returns in days. But those who entered late, when implied volatility spiked, lost nearly everything as prices normalized. This shows both the opportunity and danger of speculative option trades.

Risks of Stock Options

- Complete Loss of Premium

If the fundamental asset doesn’t change as estimated, the option may finish worthless, concluding in a total loss of your premium. - Time Decay (Theta)

Option value reduces as it approaches expiration, mostly for out-of-the-money options, which can corrode profitability. - Complexity

Options trading involves various factors, including volatility, interest rates, and pricing models (like Black-Scholes), making it more complex than stock trading. - Amplified Losses

Leverage can magnify losses as much as gains. Poorly executed strategies can result in significant financial damage, especially for inexperienced traders.

Never treat options like lottery tickets. It’s easy to be tempted by cheap, far out-of-the-money calls hoping for a big win. But that mindset leads to reckless losses. Options are tools for precision, not gambling. Without a strategy, you’re not investing, you’re speculating blindly.

Conclusion

Stock options are versatile financial instruments that can be used for speculation, income generation, and hedging. While they offer powerful opportunities, they also come with significant risks and require a solid understanding of market mechanics. Whether you’re just starting or looking to refine your investing strategy, mastering how stock options work is essential for making informed, strategic decisions.