Amortization Calculator Calculate Loan Payments & Schedule

Amortization Calculator

Calculate your loan amortization schedule with our free tool. Understand how your payments are allocated between principal and interest over the life of your loan. Make informed decisions about loans for mortgages, cars, or personal financing.

Calculate Your Amortization Schedule

Your Results

Payment breakdown visualization will appear here

Amortization Schedule

Your detailed payment schedule will appear here after calculation

How to Use the Amortization Calculator

Step-by-Step Instructions

- Select Currency: Choose your preferred currency (USD, GBP, CAD, or AUD)

- Enter Loan Amount: Input the total amount you’re borrowing

- Set Interest Rate: Use the slider or input field to set your annual interest rate

- Choose Loan Term: Select how many years you’ll be repaying the loan

- Set Start Date: Choose when your loan payments will begin

- Add Extra Payments (Optional): Enter any additional monthly payments toward principal

- View Results: See your monthly payment, total interest, and full amortization schedule

Understanding the Inputs

- Loan Amount: The principal amount you’re borrowing

- Interest Rate: The annual percentage rate (APR) charged on the loan

- Loan Term: The length of time you have to repay the loan

- Extra Payments: Additional amounts paid toward principal to reduce loan term and interest

Interpreting the Results

- Monthly Payment: Your fixed monthly payment amount

- Total Interest: The total interest you’ll pay over the life of the loan

- Total Payments: Principal + Interest over the loan term

- Payoff Date: When the loan will be fully repaid

- Amortization Schedule: Detailed breakdown of each payment showing principal vs. interest

How Amortization is Calculated

The Amortization Formula

The calculator uses the standard amortization formula:

Monthly Payment = P × [r(1+r)^n] / [(1+r)^n – 1]

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual rate ÷ 12)

- n = Total number of payments (loan term in years × 12)

Payment Breakdown

Each payment is divided between:

- Interest: Calculated on the current loan balance

- Principal: The remainder reducing your loan balance

Example Calculation

For a $250,000 loan at 5.5% interest over 30 years:

- Monthly payment: $1,419.47

- Total interest: $261,008.98

- Total payments: $511,008.98

How to Apply These Results to Your Financial Strategy

Actionable Advice Based on Results

- If your interest payments are high: Consider making extra payments to reduce principal faster

- If you have a short loan term: You’ll pay less interest but have higher monthly payments

- If you have a long loan term: Monthly payments are lower but total interest is significantly higher

Adjusting Inputs to Achieve Goals

- To pay off loan faster: Increase monthly payments or make lump-sum principal payments

- To reduce monthly payments: Extend loan term or refinance at a lower interest rate

- To save on interest: Focus on paying down principal in early years of the loan

Common Mistakes to Avoid

- Only making minimum payments throughout the loan term

- Not understanding how much interest you’re paying over time

- Ignoring the impact of extra payments on total interest savings

Advanced Calculation Scenarios

Comparing Loan Options

Use the calculator to compare:

- 15-year vs. 30-year mortgages

- Different interest rates from various lenders

- The impact of points or fees on effective interest rate

Refinancing Analysis

Calculate whether refinancing makes sense by comparing:

- Current loan remaining payments vs. new loan terms

- Break-even point for refinancing costs

- Long-term interest savings

Extra Payment Strategies

Test different scenarios:

- Making one extra payment per year

- Adding $100-$500 to monthly payments

- Making lump-sum payments from bonuses or tax refunds

Important Considerations

What the Calculator Doesn’t Account For

- Loan fees and closing costs

- Property taxes and insurance (for mortgages)

- Potential tax deductions on mortgage interest

- Variable interest rates (assumes fixed rate)

- Early payment penalties

Assumptions Made

- Interest is compounded monthly

- Payments are made on time every month

- Extra payments are applied directly to principal

- Interest rates remain constant

When to Consult a Financial Professional

- Complex financial situations with multiple loans

- Considering adjustable-rate mortgages

- Significant life changes affecting income

- Investment opportunities that might offer better returns than paying down debt

Frequently Asked Questions

Other Financial Calculators You Might Find Useful

- Mortgage Affordability Calculator: Determine how much house you can afford based on your income and debts

- Debt Payoff Calculator: Create a strategy to pay off credit cards and other debts efficiently

- Compound Interest Calculator: See how your investments can grow over time with compound interest

- Retirement Savings Calculator: Plan for retirement by calculating how much you need to save

- Loan Comparison Calculator: Compare different loan offers to find the best terms

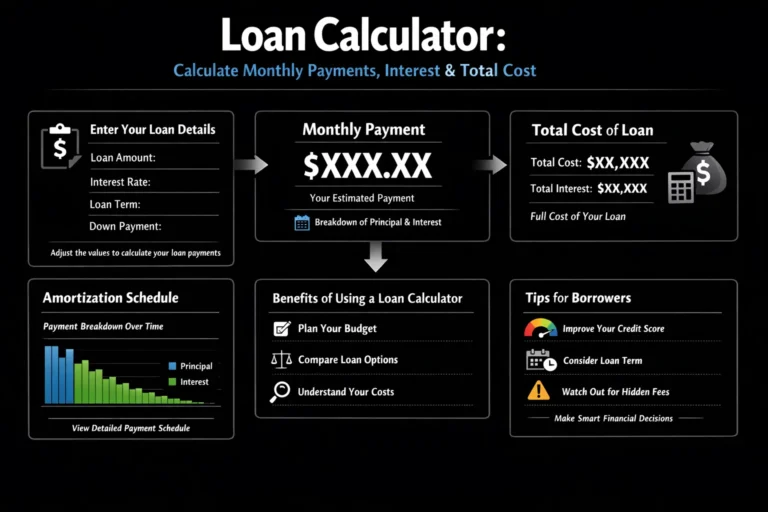

Visualizations and Charts

The calculator includes:

- Payment Breakdown Chart: Visual representation of principal vs. interest in your total payments

- Amortization Schedule: Detailed table showing how each payment affects your loan balance

- Interactive Sliders: Easy adjustment of interest rates and loan terms with real-time updates

Historical Context

Mortgage Interest Rate Trends

- 1980s: Average rates above 10%

- 2000s: Rates generally between 5-7%

- 2020s: Historic lows followed by increases

Understanding historical context helps you evaluate whether current rates are favorable for borrowing or refinancing.

Regulatory Considerations

United States

- Truth in Lending Act: Requires lenders to disclose loan terms clearly

- RESPA: Governs real estate settlement procedures

United Kingdom

- Financial Conduct Authority: Regulates mortgage lending

- Mortgage Credit Directive: EU standards for mortgage lending

Canada

- Office of the Superintendent of Financial Institutions: Oversees federal lenders

- Provincial regulations: Additional requirements vary by province

Australia

- National Consumer Credit Protection Act: Governs consumer lending

- ASIC: Australian Securities and Investments Commission regulation

Case Studies

Case Study 1: The Power of Extra Payments

Sarah had a $300,000 mortgage at 4.5% for 30 years. By adding $200 to her monthly payment, she:

- Reduced loan term by 7 years

- Saved $62,000 in interest

- Built equity faster

Case Study 2: Refinancing Analysis

The Johnson family refinanced from 6% to 4% on their $250,000 mortgage:

- Monthly payment reduced by $250

- Break-even on closing costs in 18 months

- Total interest savings: $85,000 over loan life

Glossary of Terms

- Amortization: The process of paying off a loan through regular payments over time

- Principal: The original amount of money borrowed

- Interest: The cost of borrowing money, expressed as a percentage

- APR (Annual Percentage Rate): The total cost of borrowing including interest and fees

- Equity: The difference between property value and outstanding loan balance

- Refinancing: Replacing an existing loan with a new one, typically with better terms