USDJPY Price Analysis Bullish Momentum Builds Above Key Support Zone

The USD/JPY currency pair is showing signs of bullish momentum after rebounding from a critical support area. Current technical patterns indicate that buyers are regaining control, with the potential for a move toward higher resistance levels in the short term. This analysis covers the recent market action, key price levels, and the possible outlook for traders watching this pair closely.

Current Price Overview

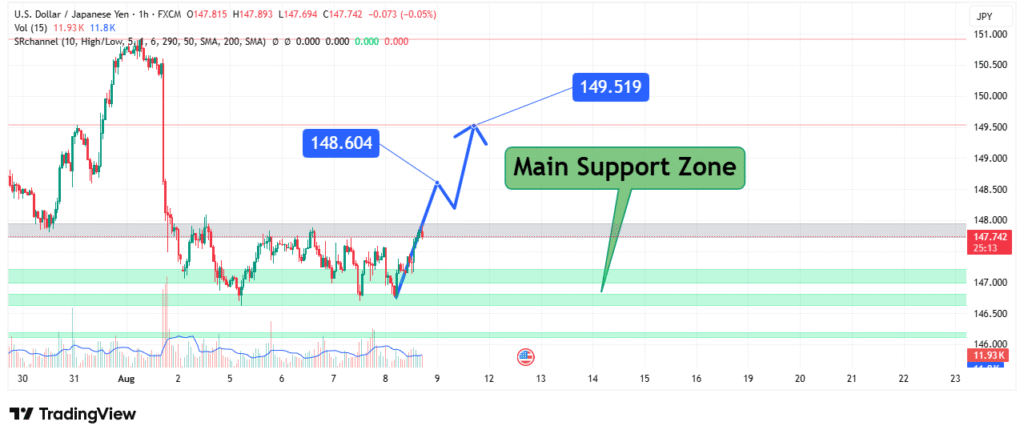

As of this analysis, USD/JPY is trading near 147.74, showing a steady upward push after a period of sideways movement. The main support zone, marked in green on the chart, lies between 146.00 and 147.00. This area has consistently acted as a strong floor for price action, absorbing selling pressure and preventing deeper declines.

Recent Market Structure and Price Action

The recent price behavior reflects a shift from consolidation to upward momentum. Following a sharp drop in early August, the pair stabilized within the support area. Buyers then stepped in, producing a strong bullish breakout from the range and forming a higher low—a classic sign of bullish intent.

Volume readings support this move, indicating increased buying interest as price moved higher. The market now appears to be setting up for further gains toward key resistance points.

Key Resistance Levels to Watch

Traders should keep an eye on two important upside targets:

- 148.604 – This is the immediate resistance and the first test for bullish strength. A break above this level would likely encourage additional buying pressure.

- 149.519 – This represents the next potential target if momentum continues. It aligns with previous price reactions, making it a significant zone for sellers to defend.

A decisive move through 148.604 with sustained volume could open the path toward 149.519.

Support Zone and Downside Risk

The main support zone around 146.00 – 147.00 remains the critical defense for bulls. If the pair fails to sustain above this area, it could trigger renewed selling pressure, potentially revisiting the 146.00 level or lower. However, as long as the price holds this zone, the bias stays tilted toward the upside.

Technical Outlook

- Trend Bias: Short-term bullish

- Immediate Support: 147.00 – 146.00

- Immediate Resistance: 148.604

- Next Target Resistance: 149.519

- Market Structure: Recovery from consolidation with bullish breakout potential

Conclusion

USD/JPY is showing encouraging signs for the bulls, trading above a strong support base and aiming for higher resistance levels. A break above 148.604 could serve as the trigger for a move toward 149.519, while holding above the support zone will be crucial for sustaining upward momentum. Traders should monitor volume and price action closely in the coming sessions to gauge the strength of this potential breakout.