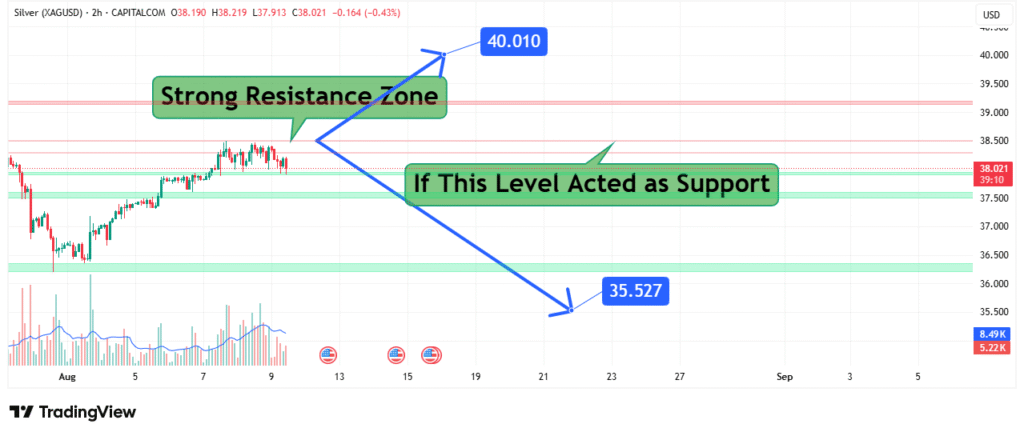

Silver at Critical Resistance $40 Breakout or $35.50 Retreat

The silver price chart reveals the precious metal at a pivotal technical crossroads, currently testing a strong resistance zone that will determine its next major directional move. With a clear resistance cluster between $35.53-$40.01, silver faces a critical decision point that could either propel it toward our $40 bullish target or trigger a pullback to the $35.50 support level. This analysis examines the key technical factors that will shape silver’s next significant price movement.

Current Market Structure and Price Action

Silver’s technical setup presents several crucial characteristics:

- Strong Resistance Zone: $35.53-$40.01 (multiple confluence levels)

- Immediate Support: $35.50 (recent swing high turned support)

- Bullish Target: $40.00 (breakout scenario)

- Bearish Target: $35.50 (rejection scenario)

- Recent Price Action: Testing upper bounds of resistance zone

The chart shows silver has repeatedly respected these key levels, making them particularly significant for future price direction.

Critical Price Levels and Market Framework

Resistance Structure (Must Break for Bullish Case):

- Primary Resistance Cluster: $35.53-$40.01 (multi-year highs)

- Psychological Barrier: $40.00 (major round number)

- Absolute Breakout Level: $40.01 (year-to-date high)

Support Framework (Bearish Scenario):

- Initial Support: $35.50 (recent breakout point)

- Stronger Support: $30.00 (psychological level)

- Major Floor: $25.00 (long-term trend support)

The $5.214 level mentioned on the chart may represent a volatility measurement or percentage move, suggesting significant price expansion potential upon resolution of this technical pattern.

Technical Considerations and Momentum Factors

Several technical elements shape the current outlook:

- Resistance Tests: Multiple attempts to break $40.01 level

- Volume Profile: Needs confirmation on breakout attempts

- Market Structure: Higher timeframe trend remains intact

- Historical Precedent: Strong reactions at these levels in past

Potential Price Scenarios and Trading Strategies

Bullish Breakout Scenario ($40 Target):

- Initial Signal: Daily close above $35.53

- Confirmation: Sustained trading above $38.00

- Target Achievement: Test of $40.01 resistance

- Extension Potential: $45.00+ upon successful breakout

Bearish Rejection Scenario ($35.50 Target):

- Warning Sign: Failure at $40.01 resistance

- Breakdown Signal: Close below $35.50 support

- Deeper Correction Potential: $30.00 support test

Strategic Trading Approach

For traders navigating this setup:

- Breakout Strategy:

- Entry: On confirmed break above $35.53

- Stop: Below $35.00

- Target: $40.00 (scale out partials at $38.00)

- Rejection Strategy:

- Entry: On failure at $40.01 with bearish reversal pattern

- Stop: Above $40.50

- Target: $35.50 (with potential to extend)

- Risk Management:

- Position sizing for increased volatility

- Trailing stops for breakout scenarios

- Patience for confirmation signals

Key Market Factors to Monitor

- Dollar Strength: Inverse correlation with USD

- Gold Ratio: Silver’s performance relative to gold

- Industrial Demand: Economic activity indicators

- Risk Sentiment: Safe-haven flows

- Inflation Data: Precious metals as inflation hedge

Conclusion: High-Stakes Technical Battle

Silver stands at one of its most important technical junctures in recent years, with the resolution of this resistance zone likely to determine its medium-term trajectory. The $40.01 level represents a major psychological and technical barrier that could either unlock significant upside potential or trigger a healthy correction. Traders should await clear confirmation before committing to positions, as the breakout or rejection from this zone could produce substantial follow-through movement.