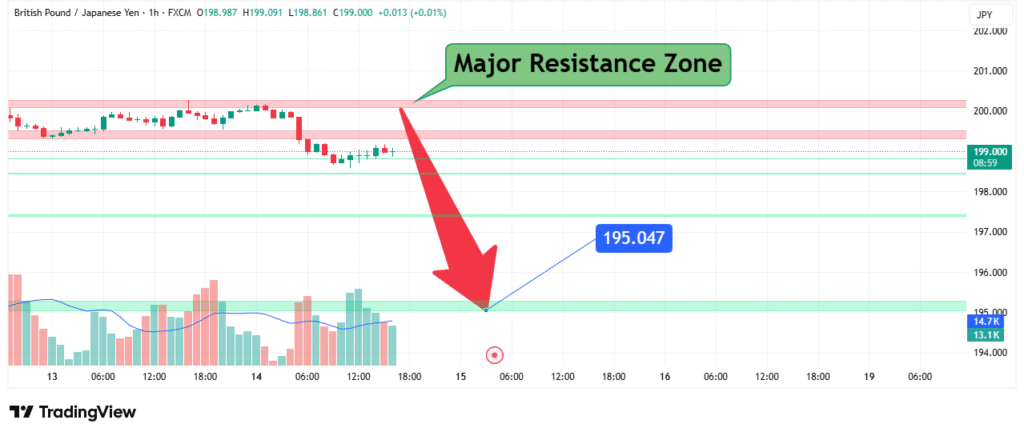

GBPJPY Short Opportunity 200-Pip Drop to 195 Likely

The GBP/JPY hourly chart reveals the pair testing a major resistance zone at 199.00, presenting a high-probability short opportunity with our target set at 195.00. Currently trading at 199.000 (+0.01%), the pair shows clear signs of exhaustion after its recent rally, suggesting an impending reversal. This analysis will examine the key technical factors supporting our bearish outlook.

Current Market Position and Bearish Signals

GBP/JPY displays several concerning technical characteristics:

- Price Rejection: Failed breakout attempt at 199.091

- Bearish Divergence: Momentum weakening at highs

- Resistance Test: Third touch of 199.00 zone

- Overbought Conditions: On multiple timeframes

- Volume Profile: Declining volume on up-moves

The narrow 23-pip range (198.861-199.091) represents compression before likely downside resolution.

Critical Resistance and Downside Targets

Resistance Structure (Confirmation Zone):

- Immediate Resistance: 199.091 (today’s high)

- Psychological Barrier: 199.500

- Major Resistance Zone: 200.00-202.000

Downside Pathway to Target:

- First Breakdown Level: 198.861 (today’s low)

- Confirmation Level: 198.000 (psychological support)

- Primary Target: 195.047 (strong historical support)

- Extension Potential: 194.000 (yearly lows)

The 195.047 level holds particular importance as it’s a former swing high that should now act as strong support.

Technical Indicators Supporting Bearish View

- Trend Exhaustion: Multiple tests of resistance without breakout

- Volume Divergence: Lower volume on recent highs

- Mean Reversion: Far from 200-period moving average

- Risk Sentiment: JPY strengthening as safe-haven flows return

Bearish Trading Strategy

Entry Approaches:

- Aggressive: Current levels (199.00) with tight stop

- Conservative: Wait for break below 198.800

Stop Placement:

- Above 199.200 (accounting for spreads/slippage)

Profit Targets:

- First Target: 198.000 (50% position)

- Final Target: 195.047 (full position)

- Trailing Stop: Move to breakeven at 198.500

Key Risk Factors to Monitor

- BOJ Intervention: Potential JPY weakness

- UK Economic Data: GBP-positive surprises

- Risk Appetite: Stock market rallies hurting JPY

- Technical Failure: Unexpected break above 199.200

Conclusion: High-Probability Bearish Setup

GBP/JPY presents one of the more compelling short opportunities in the FX market, with clear technical resistance and a favorable risk-reward ratio. Our 195 target represents a 200-pip move (2% decline) that aligns perfectly with the strong historical support level. Traders should look for confirmation of the breakdown below 198.800 to validate the bearish scenario.