VeChain (VET) Targets $1.13 Critical Support and Breakout Levels to Watch

VeChain (VET/USD) is currently trading at a critical juncture, with its price action suggesting a potential breakout toward our $1.13 target. This analysis examines the technical framework, support and resistance levels, and market dynamics that will determine whether VET can overcome its consolidation phase and stage a sustained upward move.

Current Market Structure and Price Action

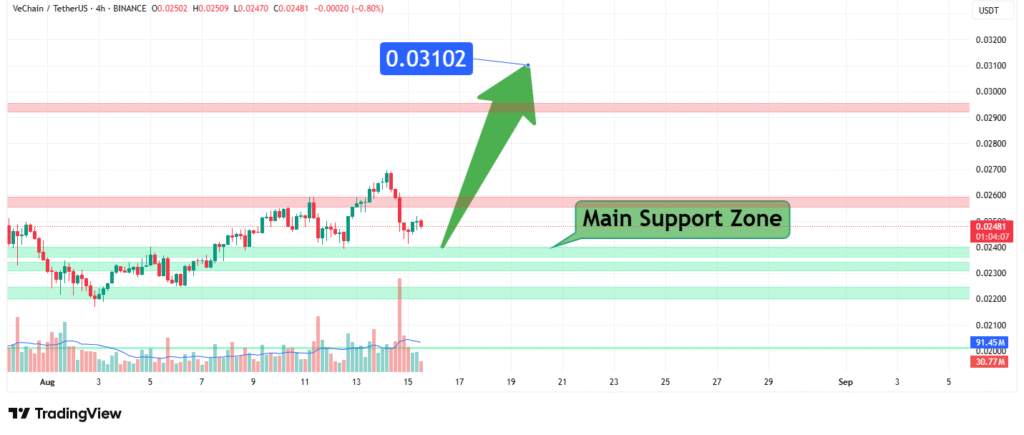

The daily chart reveals several key technical observations:

- Main Support Zone: $0.01900–$0.02400 (critical foundation for bullish momentum)

- Immediate Resistance: $0.02700 (recent swing high)

- Primary Target: $1.1300 (long-term bullish objective)

- Volume Profile: Requires stronger participation to confirm breakout attempts

- Market Sentiment: Neutral with cautious optimism

The $1.13 level represents a significant psychological and technical milestone, historically acting as a major resistance point.

Critical Price Levels and Trading Framework

Support Structure (Must Hold for Bullish Case)

- Strong Support Cluster: $0.01900–$0.02100 (2023 base)

- Psychological Support: $0.02000 (interim level)

- Absolute Floor: $0.01000 (must hold to maintain bullish structure)

Resistance Pathway to Target

- First Hurdle: $0.02700 (recent high)

- Key Breakout Level: $0.03000 (initial target)

- Primary Target: $1.1300 (long-term upside potential)

- Extension Potential: $1.1500 upon confirmed breakout

Technical Indicators and Momentum Factors

- Historical Precedent: Strong reactions at higher resistance levels

- Volume Analysis: Needs increased buying pressure for sustained moves

- Market Structure: Higher timeframe trend remains cautiously optimistic

- Relative Strength: Monitoring performance against major altcoins

Potential Price Scenarios

Bullish Scenario (Target Achievement)

- Initial Signal: Daily close above $0.02700

- Confirmation: Sustained trading above $0.03000

- Target Execution: Test of $1.1300 resistance

- Extension: Potential move toward $1.1500

Bearish Risk Scenario

- Warning Sign: Rejection at $0.02700

- Breakdown Signal: Close below $0.01900

- Critical Failure: Loss of $0.01000 support

Strategic Trading Approach

For traders targeting $1.13:

Entry Strategies

- Conservative: Wait for break above $0.03000

- Moderate: Scale in between $0.02000–$0.02400

- Aggressive: Current levels with tight stops

Risk Management

- Stop-loss below $0.01900

- Position sizing for volatility

Profit-Taking

- First target at $0.03000 (partial)

- Final target at $1.1300

- Consider trailing stops beyond $1.1000

Key Fundamental Catalysts

- Network Upgrades: VeChain’s roadmap developments

- Enterprise Adoption: Growth in real-world use cases

- Partnerships: Major collaborations driving utility

- Market Sentiment: Altcoin season indicators

- Exchange Flows: Large VET movements

Conclusion: A High-Potential Setup with Clear Risks

VeChain presents a compelling technical setup with a clear path to $1.13 if key resistance levels are breached. The $0.01900–$0.02400 support zone remains critical for maintaining bullish momentum. Traders should watch for confirmation at each resistance level while managing risk appropriately. The coming weeks will be decisive in determining whether VET can gather the necessary buying pressure to challenge higher price targets.

How did this post make you feel?

Thanks for your reaction!