Ethereum Primed for Major Rally $6,500 Target Following Breakout

Ethereum (ETH/USD) has recently completed a significant technical breakout, suggesting the potential for substantial upside movement. My analysis points to $6,500 as the next major target for ETH, representing a potential 30%+ move from current levels. This article will explore the technical foundations of this prediction, key levels to watch, and the market conditions that could accelerate Ethereum’s ascent.

The Breakout: Technical Foundations

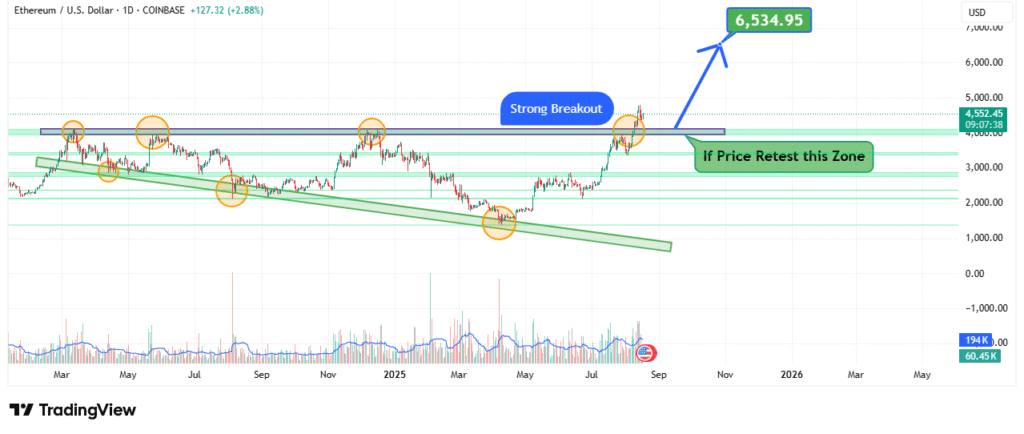

The daily chart shows Ethereum breaking out from a prolonged consolidation pattern with strong momentum. Several technical factors support the bullish case:

- Pattern Recognition:

- The breakout from a multi-month symmetrical triangle suggests the resolution of indecision in favor of bulls

- Volume has increased notably during the breakout, confirming genuine buying interest

- Moving Averages:

- The 50-day MA has crossed above the 200-day MA (Golden Cross), a classic bullish signal

- Price is trading comfortably above both key moving averages

- Momentum Indicators:

- RSI has entered bullish territory (60-70) without being overbought

- MACD shows strengthening upward momentum

Key Price Levels and Targets

Immediate Support Zones

- $4,500-$4,600: Previous resistance now turned support

- $4,200: Strong psychological and technical support level

Upside Targets

- $5,500: Intermediate resistance (23.6% Fibonacci extension)

- $6,000: Psychological round number and previous high

- $6,500: Primary target (38.2% Fib extension and measured move target)

Invalidation Level

- A daily close below $4,200 would negate the bullish outlook

Market Context and Catalysts

Several fundamental factors could accelerate Ethereum’s move toward $6,500:

- Network Upgrades:

- Continued improvements to Ethereum’s scalability post-Merge

- Growing adoption of layer-2 solutions

- Institutional Interest:

- Potential ETH ETF approvals following Bitcoin ETF success

- Increasing institutional allocations to crypto

- Macro Environment:

- Potential Fed rate cuts benefiting risk assets

- Dollar weakness potentially boosting crypto markets

Trading Strategy

For traders considering positions:

Entry:

- Current levels ($4,800-$5,000) offer reasonable risk/reward

- Alternatively, wait for pullback to $4,600 support

Stop-Loss:

- Below $4,200 for conservative traders

- Below $4,500 for more aggressive entries

Take-Profit:

- First target at $5,500 (partial profit)

- Second target at $6,000

- Final target at $6,500

Position Sizing:

- Given crypto volatility, limit position size to 1-3% of portfolio

- Consider scaling in rather than full allocation at once

Risk Factors

While the technical setup appears strong, traders should remain aware of:

- Macro Risks:

- Unexpected Fed policy shifts

- Geopolitical tensions impacting risk appetite

- Crypto-Specific Risks:

- Regulatory developments

- Network congestion or technical issues

- Competitor blockchain developments

- Technical Risks:

- False breakout potential

- Overextension leading to sharp corrections

Conclusion

Ethereum’s technical breakout suggests strong potential for continuation toward $6,500, supported by improving fundamentals and favorable market conditions. Traders should monitor the $4,500-$4,600 zone as crucial support and watch for confirmation of the uptrend through sustained higher highs and higher lows.

The $6,500 target represents a realistic but ambitious objective that could be achieved in the coming months if current momentum persists. As always in crypto markets, proper risk management remains essential to navigate the inherent volatility successfully.

How did this post make you feel?

Thanks for your reaction!