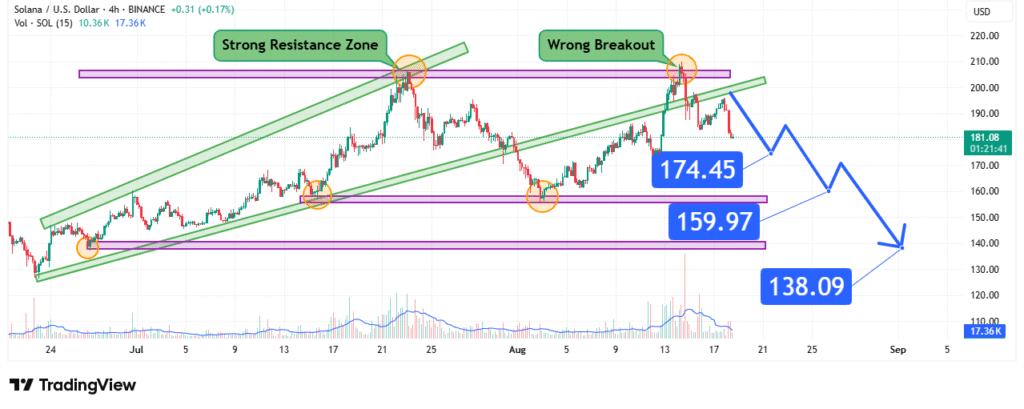

SOL Technical Analysis Failed Breakout Signals Deeper Correction

Solana (SOL), one of the leading blockchain platforms powering decentralized applications, is under pressure as recent bullish momentum failed to hold above resistance. The chart structure indicates that a “wrong breakout” has triggered renewed selling, leaving the cryptocurrency vulnerable to further downside moves. This article provides an in-depth technical outlook on SOL, highlighting critical levels to watch and projected downside targets of $174, $159, and $138 USD.

Strong Resistance Zone and Wrong Breakout

The chart clearly identifies a Strong Resistance Zone near the $200 – $210 range, where Solana has repeatedly faced rejection. Each attempt to break above this area has met with aggressive selling pressure, indicating that buyers lack the momentum to sustain higher levels.

Recently, Solana made another push beyond this resistance, but the breakout proved to be a false move (“Wrong Breakout”), as the price quickly reversed and dropped back into its prior trading range. Such failed breakouts often signal weakness and trigger a stronger bearish correction.

Key Support Levels and Bearish Targets

- First Target: $174.45

The immediate support lies near $174.45, a level that coincides with previous consolidation and price reactions. A drop below this mark would confirm short-term bearish momentum and encourage further selling. - Second Target: $159.97

If downward pressure continues, the next significant support sits at $159.97. This area has historically provided a strong cushion for buyers, but repeated tests could weaken it and make way for further declines. - Third Target: $138.09

The final projected target is $138.09, representing a deeper correction zone. If Solana falls to this level, it would reflect a larger bearish continuation pattern and could open doors for a broader trend shift if not defended by bulls.

Volume and Market Sentiment

Volume analysis indicates that selling activity increased significantly after the failed breakout, reinforcing bearish sentiment. Traders and investors are cautious as Solana struggles to reclaim levels above $190, while risk appetite in the crypto market remains uncertain amid broader macroeconomic pressures.

Technical Outlook

- Resistance Levels: $190, $200, $210

- Support Levels: $174, $159, $138

- Trend Bias: Bearish after failed breakout; outlook remains weak unless SOL reclaims $190+ convincingly.

Conclusion

Solana (SOL) is facing a bearish retracement after failing to sustain momentum above the $200 resistance zone. With sellers regaining control, price levels of $174, $159, and $138 stand out as key downside targets. Unless Solana manages to reclaim higher resistance levels with strong volume, the bearish scenario remains the dominant outlook.

How did this post make you feel?

Thanks for your reaction!