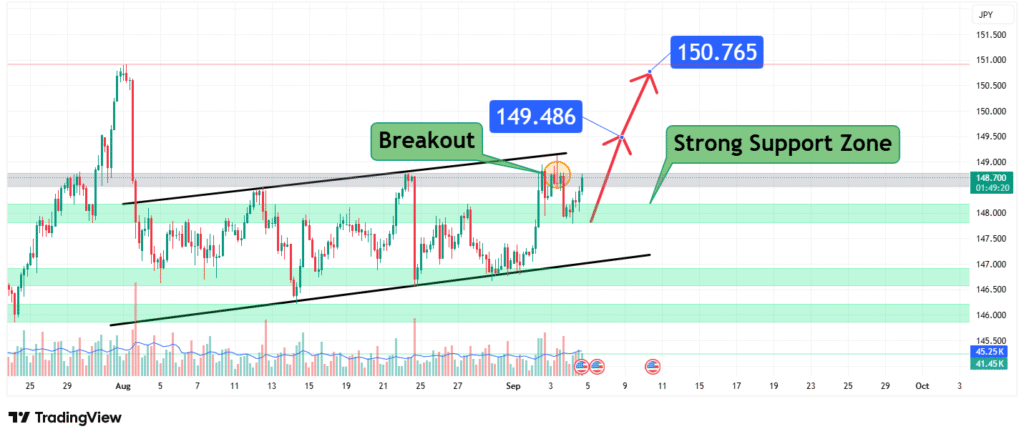

USDJPY Price Analysis Bearish Setup Targeting 149.4 and 150.7

USD/JPY has recently tested the upper boundary of its ascending channel and faced resistance near the 149.48 zone. Despite showing a short-term breakout attempt, momentum appears capped, and the pair is now poised for a bearish retracement. Our technical outlook sets a primary downside target at 149.4 and an extended move towards 150.7 before the next decisive reaction. This projection is guided by resistance rejection, historical price action, and a strong support confluence zone.

Current Market Structure and Price Action

The market has been consolidating within an upward-sloping channel, with buyers repeatedly testing resistance at 149.48. The latest rally stalled at this point, showing signs of exhaustion. The current structure suggests:

- Sellers defending the 149.4–149.5 zone aggressively.

- Buyers struggling to sustain above the breakout level.

- Price hovering above a strong support band at 148.0–148.5.

This dynamic signals a bearish setup forming in the near term.

Identification of Key Support and Resistance Zones

- Strong Resistance: 149.48 – A multi-touch zone acting as a breakout resistance.

- Immediate Support: 148.0 – 148.5 – Highlighted as a strong support zone, where buyers may attempt to re-enter.

- Secondary Support: 147.0 – 146.5 – Next lower band if selling pressure intensifies.

The rejection near 149.48 suggests that sellers remain in control short-term.

Technical Targets and Rationale

- Primary Target (PT1): 149.4

Rationale: Aligns with recent breakout resistance-turned-support and psychological round level. - Secondary Target (PT2): 150.7

Rationale: Represents an extended move into higher resistance before a potential larger bearish rejection.

Prediction: Price is expected to test 149.4 first, with the potential to spike towards 150.7 before a major bearish continuation unfolds.

Risk Management Considerations

- Invalidation Level (Stop-Loss): A daily close above 151.0 invalidates this bearish setup and signals renewed bullish momentum.

- Position Sizing: Traders should limit risk exposure to no more than 1–2% of account equity per trade, adjusting lot sizes according to the stop-loss distance.

- Caution Point: Watch for whipsaws around 149.48, as false breakouts are common near resistance zones.

Fundamental Backdrop

The broader macro environment adds weight to this technical bearish bias:

- U.S. Interest Rates: Fed policy expectations continue to influence USD strength.

- Japanese Monetary Policy: Bank of Japan’s dovish stance keeps the yen weaker, but intervention risks remain a wild card.

- Global Risk Sentiment: Equity market volatility and yields directly impact USD/JPY flows.

These factors suggest short-term volatility with potential downside pressure.

Conclusion

USD/JPY is trading at a crucial inflection point near 148.7. With resistance firmly holding at 149.48, our analysis favors a bearish trajectory, projecting a move towards 149.4 and an extended target at 150.7. Traders should watch for confirmation at the support zone and manage risk closely around invalidation levels.

Chart Source: TradingView

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading forex involves substantial risk of loss and is not suitable for all investors. Always conduct your own research and consult with a licensed financial advisor before making trading decisions.

How did this post make you feel?

Thanks for your reaction!