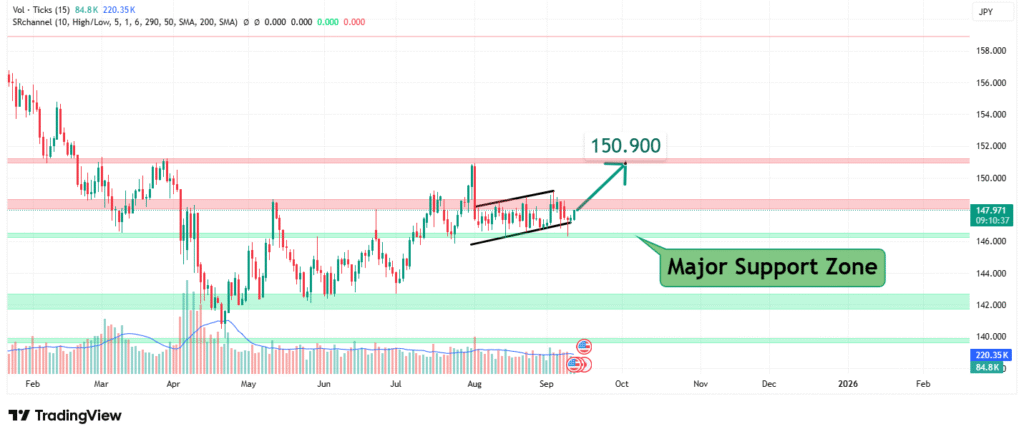

USDJPY Price Analysis Bullish Breakout Targeting 150.90

USD/JPY’s price has been undergoing a healthy pullback within a strong, established bullish trend. This price action suggests a potential consolidation of gains before the next leg up. Our analysis projects a bullish move towards a primary target of 150.90, which represents a major psychological and technical resistance level. This prediction is based on the strength of the underlying trend and the significance of the current area as a support zone from which buyers are expected to emerge.

Current Market Structure and Price Action

The broader market structure for USD/JPY is decisively bullish, characterized by a consistent pattern of higher highs and higher lows. The current price action shows a pullback from recent highs, which is testing a key support area. This is a normal and healthy phenomenon within a strong uptrend, often creating a better risk-to-reward entry point for bullish positions. The ability to hold this support is critical for the continuation of the upward move.

2. Identification of the Key Support Zone & Target

The most critical technical element for this bullish forecast is the current support zone around ~147.90, from which we anticipate a bounce. The strength of the bullish thesis, however, is defined by the Major Target at 150.90. The significance of this target is derived from:

- Psychological Significance: The 150.00/150.90 area is a major psychological barrier. A break above this level would be a hugely significant event, confirming strength and potentially triggering a further wave of bullish momentum as shorts are squeezed and new buyers enter the market.

- Historical Resistance: This level has acted as a major swing high and a significant resistance area in the past. A successful breach of this zone would open the path for a much larger extension of the bullish trend.

- Technical Confluence: Major round number targets like this often align with key Fibonacci extension levels (e.g., 127.2% or 161.8%) or measured move targets, adding to their technical importance as a profit-taking or decision point.

Technical Target(s) and Rationale

Our analysis identifies the following price target:

Primary Target (PT1): 150.90

Rationale: This level is identified on the chart as the next major objective. It represents a strong area of historical and psychological selling pressure. A successful move to and break above this target would signify a powerful renewal of the bullish trend and would be a technically significant event.

Prediction: We forecast that USD/JPY will find strong support near the current levels, rally, and break above recent resistance to move towards our PT1 at 150.90. The reaction at this target zone will be crucial for determining if the trend can extend even further.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish thesis is invalidated if the price achieves a daily close below the recent significant swing low, which could be near the 146.00 or 145.50 area (the exact level should be determined from a more detailed chart). A break below this level would signify a deeper correction is underway and a failure of the immediate bullish setup, negating the upward projection towards 150.90.

- Position Sizing: Any long positions taken should be sized so that a loss triggered below the invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Monetary Policy Divergence: The primary driver remains the wide disparity between the hawkish U.S. Federal Reserve (high rates, potentially higher for longer) and the ultra-dovish Bank of Japan (negative rates, YCC). This divergence inherently supports a stronger USD against the JPY.

- US Economic Data: Strong US economic data, particularly inflation (CPI) and employment (NFP) figures, that reinforces the Fed’s hawkish stance would provide fundamental fuel for the bullish technical move.

- Risk Sentiment: While USD/JPY can act as a safe-haven pair, the dominant theme recently has been its function as a carry trade vehicle, supported by steady risk appetite.

These factors contribute to the bullish medium to long-term sentiment surrounding the pair.

Conclusion

USD/JPY is in a bullish trend and is currently testing a key support zone. The weight of evidence suggests this pullback will present a buying opportunity, leading to a bullish resolution that targets a move up to the major resistance at 150.90. Traders should monitor for confirmed bullish reversal signals at the current support and manage risk diligently by respecting the key invalidation level below. A break above 150.90 would be a technically profound development for the pair.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.