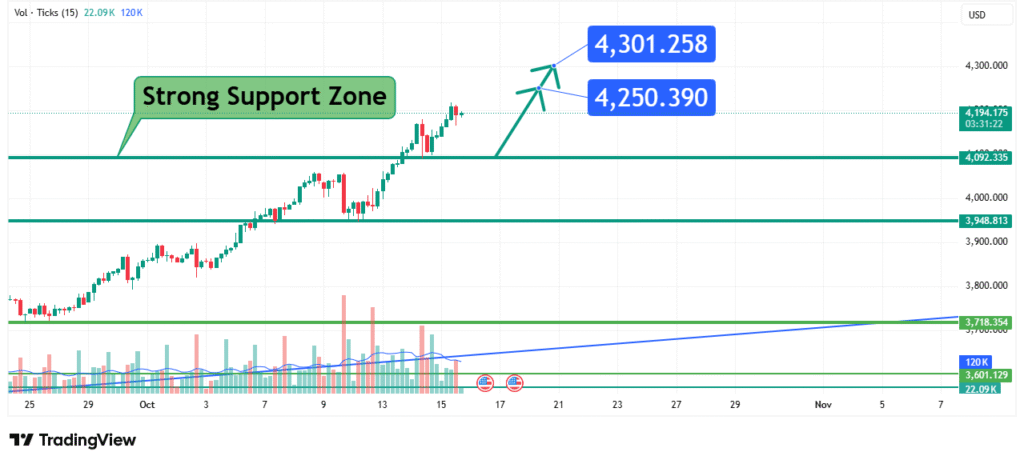

Gold Bullish Setup Strong Support Holds, $4250 and $4300 in Sight

Gold’s price has been consolidating in a bullish flag pattern after a strong rally, finding firm support above the $4,175 level. This price action suggests underlying strength and a building bullish bias. Our analysis projects a move towards an initial target of $4,250, followed by a primary target of $4,300. This prediction is based on a confluence of technical factors, including the defense of a strong support zone and the pattern of higher lows.

Current Market Structure and Price Action

The current market structure for Gold is bullish. The asset recently surged to new all-time highs and is now undergoing a healthy period of consolidation. The price is currently interacting with a strong support zone between $4,100 and $4,175. Recent price action has shown a contraction in volatility and a series of higher lows within this consolidation, indicating that sellers are exhausted and buyers are stepping in at progressively higher levels. This structure suggests that a breakout to the upside is the most probable next move.

Identification of the Key Support Zone

The most critical technical element on the Gold chart is the Strong Support Zone between $4,100 and $4,175. The strength of this zone is derived from:

- Historical Significance: This area previously acted as a significant resistance level. Once broken, former resistance often transforms into strong support, which is precisely what the chart illustrates. The price has successfully retested this zone multiple times in early November, with each test being met with buying pressure.

- Technical Confluence: The zone aligns with key psychological levels (e.g., $4,100) and likely coincides with important moving averages (like the 21-day EMA) that are not shown but are standard in trend analysis, adding to its technical robustness.

- Market Psychology: This area represents a battleground where the sentiment of bulls is being tested. The repeated failure of the price to break down confirms that the bullish conviction remains strong, and market participants view dips to this zone as a buying opportunity.

This multi-faceted confluence makes it a high-probability level for a bullish reaction and the launch point for the next leg higher.

Technical Target(s) and Rationale

Our analysis identifies the following price targets:

- Initial Target (PT1): $4,250

- Primary Target (PT2): $4,300

Rationale for PT1 ($4,250): This level represents the recent all-time high and a key psychological barrier. A break above this level would confirm the resumption of the bullish trend and trigger further buying interest from breakout traders.

Rationale for PT2 ($4,300): This is the primary target, acting as a measured move projection. The height of the initial rally that preceded the consolidation is projected upward from the breakout point. This technical projection aligns perfectly with the $4,300 level, making it a logical profit-taking zone.

Prediction: We forecast that the price will hold above the $4,100-$4,175 support zone and break above the consolidation range to move towards our initial target at $4,250. A sustained move above that level would then open the path towards our primary target at $4,300.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish thesis is invalidated if the price achieves a daily close (UTC) below $4,075. This level is placed just below the strong support zone to avoid being stopped out by normal market noise. A close below this level would indicate a failure of the support structure and signal a potential for a deeper correction.

- Position Sizing: Any long positions taken should be sized so that a loss triggered at the $4,075 invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Factor 1: Geopolitical Tensions: Ongoing global conflicts continue to bolster gold’s status as a premier safe-haven asset, creating a underlying bid in the market.

- Factor 2: Federal Reserve Policy: Market expectations for a pause or pivot in the Fed’s hiking cycle are weighing on the US Dollar and real yields, a primary driver of gold prices. This creates a supportive environment.

- Factor 3: Central Bank Buying: Robust gold purchases by central banks worldwide continue to provide structural, long-term support to the market.

These factors contribute to the bullish sentiment surrounding Gold and provide a fundamental tailwind for the technical breakout.

Conclusion

Gold is consolidating bullishly above a critical support zone. The weight of evidence suggests a bullish resolution, targeting a move first to $4,250 and then towards $4,300. Traders should monitor for a confirmed breakout above the consolidation high and manage risk diligently by respecting the key invalidation level at $4,075. The reaction at the $4,300 target will be crucial for determining the next major directional move.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.