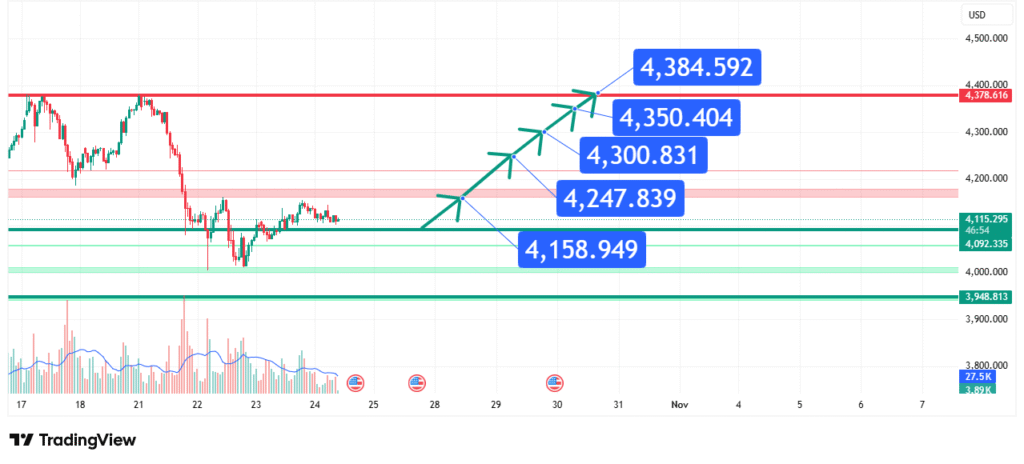

Gold Price Forecast Parabolic Rally Aims for $4,300 and Beyond

Gold’s price has experienced a historic, parabolic rally, breaking decisively above the $4,000 psychological barrier. The asset is currently taking a breather after its explosive move, consolidating near the $4,115 level. This price action suggests the bullish trend is merely pausing before its next leg higher. Our analysis projects a move towards a sequence of targets at $4,158, $4,247, $4,300, $4,350, and a primary objective at $4,384. This prediction is based on a confluence of technical factors, including the establishment of a new support base and the clear absence of any significant resistance overhead.

Current Market Structure and Price Action

The current market structure is unambiguously bullish, defined by a series of higher highs and higher lows. The price is currently interacting with the recent breakout level near $4,115, which now acts as immediate support. Recent price action has shown a healthy consolidation with a series of small-bodied candles, indicating a balance between buyers and sellers after the aggressive rally. This low-volatility compression often precedes the next directional move, and given the overarching trend, a bullish continuation is the higher probability outcome.

(Ad Placement Suggestion 2: Text Link or In-Article Anchor Ad within the “Key Support Zone” section)

Identification of the Key Support Zone

The most critical technical element is the Strong Support Zone between $4,050 and $4,115. The strength of this zone is derived from:

- Historical Significance: The $4,092-$4,115 area has acted as both resistance and support in recent sessions (November 4th-6th), establishing its technical relevance.

- Technical Confluence: The zone aligns with the psychological magnet of the $4,100 level and encompasses the swing low from November 4th ($4,054) and November 6th ($4,092), creating a dense area of buyer interest.

- Market Psychology: This area represents a point where dip-buyers have previously stepped in aggressively, viewing any pullback as a opportunity to enter the strong bullish trend.

This multi-touch confluence makes it a high-probability level for a bullish reaction and the launchpad for the next wave up.

Technical Target(s) and Rationale

Our analysis identifies a sequence of price targets, reflecting the multi-layered nature of this bullish structure:

Initial Target (PT1): $4,158

This is the immediate historical peak from November 1st. A break above this confirms the resumption of the uptrend.

Secondary Target (PT2): $4,247

This level represents the next significant swing high on the chart, acting as the next logical resistance.

Intermediate Target (PT3): $4,300

A key psychological round number that will likely attract profit-taking but also act as a magnet for price.

Primary Target (PT4): $4,350

This level aligns with a measured move projection and represents a substantial extension of the current bullish wave.

Extension Target (PT5): $4,384

This is the most ambitious target, representing the peak of the current parabolic arc and the ultimate objective of this bullish impulse.

Prediction: We forecast that Gold will hold above the $4,050-$4,115 support zone and embark on a new bullish impulse, sequentially targeting PT1 through PT5.

(Ad Placement Suggestion 3: Banner Ad before the “Risk Management” section)

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish thesis is invalidated if the price achieves a daily close below the $4,050 support level. This level represents a clear break of the immediate market structure (violating the recent higher low), signaling a deeper correction is underway.

- Position Sizing: Any long positions taken should be sized so that a loss triggered at the $4,050 invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is powerfully supported by the current fundamental landscape:

- Federal Reserve Policy Pivot: Growing expectations of a pause and eventual cuts in the US interest rate cycle are a primary driver, reducing the opportunity cost of holding non-yielding Gold.

- Geopolitical Turmoil: Ongoing global conflicts and tensions reinforce Gold’s status as the ultimate safe-haven asset, driving sustained demand.

- Central Bank Buying: Aggressive Gold accumulation by central banks worldwide, diversifying away from the US dollar, provides a structural bid underneath the market.

These factors contribute to a profoundly bullish fundamental sentiment surrounding Gold, providing a strong tailwind for the technical breakout.

Conclusion

Gold is in a historic bull run, trading at uncharted territory with immense momentum. The weight of evidence suggests a bullish continuation, targeting a sequential move towards $4,158, $4,247, $4,300, $4,350, and ultimately $4,384. Traders should monitor for a confirmed break above $4,158 and manage risk diligently by respecting the key invalidation level at $4,050. The reaction at each target will be crucial for taking profits and reassessing the momentum.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.