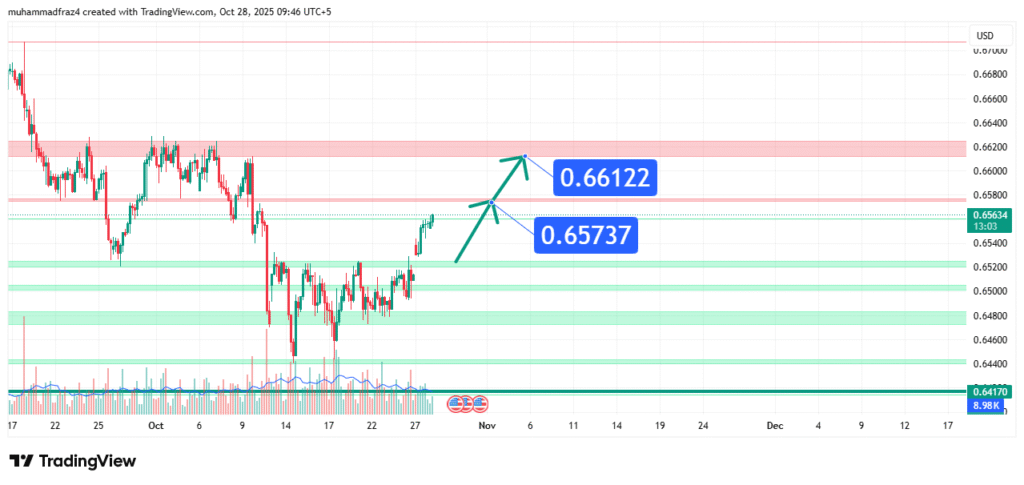

AUDUSD Price Forecast Precision Bullish Setup for 0.6570-0.6610

AUD/USD has been consolidating in a tight range after a recent bounce from a key support level, compressing like a spring. This price action suggests a building of short-term bullish energy. Our analysis projects a precise move towards an initial target of 0.6570, followed by a secondary target at 0.6610. This prediction is based on a confluence of technical factors on the intraday charts, including a break of a minor downtrend line, bullish momentum divergence, and a potential miniature bull flag formation.

Current Market Structure and Price Action

The very short-term market structure is attempting to turn bullish, following a test of a significant intraday support level. The price is currently interacting with the upper boundary of its recent consolidation range and a cluster of short-term moving averages (e.g., 21 and 50 EMA). Recent price action has shown a series of small-bodied candles with low volatility, indicating a balance between buyers and sellers that is often a precursor to a directional move. The subtle shift of higher lows during this compression indicates that a bullish breakout is the path of least resistance.

Identification of the Key Resistance Zone

The most critical technical element is the Immediate Resistance Zone between 0.6565 and 0.6575. The strength of this zone is derived from:

- Historical Significance: This level has acted as a minor swing high and a rejection point several times over the past 24-48 hours. A clean break above it would signal a shift in intraday momentum.

- Technical Confluence: The zone aligns with the 61.8% Fibonacci retracement level of the most recent minor down move and the 100-period Simple Moving Average (SMA) on the 1-hour chart, creating a significant technical hurdle.

- Market Psychology: Overcoming this immediate barrier is key to triggering short-term bullish momentum and enticing further buying interest.

This confluence makes it a high-probability level for an initial reaction, with a break opening the path to higher targets.

Technical Target(s) and Rationale

Our analysis identifies the following precise price target(s):

Initial Target (IT): 0.6570

This level represents the immediate resistance zone’s upper bound and the 78.6% Fibonacci retracement. It is the first logical profit-taking area for a quick bullish move and the measured move target of the initial bounce.

Primary Target (PT1): 0.6610

This level represents a more significant previous swing high and a key psychological level. It is the measured move target of the potential bull flag pattern forming on the lower timeframes and represents the primary objective for this setup.

Prediction: We forecast that AUD/USD will break above the immediate 0.6565-75 resistance, quickly test the Initial Target at 0.6570, and upon a sustained break, extend towards our Primary Target at 0.6610.

Risk Management Considerations

Precision in entry and risk management is paramount for a short-range setup like this.

- Invalidation Level (Stop-Loss): The entire bullish thesis is invalidated if the price prints a 1-hour close below 0.6540. This level is placed below the recent higher low and the consolidation support. A break here would negate the budding bullish structure and likely lead to a retest of lower supports.

- Position Sizing: Given the tight stop-loss, position sizing must be calculated carefully to ensure the risk (distance from entry to stop-loss) still aligns with a 1-2% maximum loss of total capital. The small pip value of this move necessitates appropriate lot sizing.

Fundamental Backdrop

The technical setup is framed by key fundamental drivers:

- Differential in Central Bank Sentiment: The primary driver for AUD/USD is the divergence between the Reserve Bank of Australia (RBA) and the U.S. Federal Reserve. Hawkish hints from the RBA or dovish signals from the Fed can provide tailwinds for the pair.

- Commodity Prices: As a commodity-linked currency, the Australian Dollar is sensitive to fluctuations in key export prices like iron ore and coal.

- Risk Sentiment: Positive risk sentiment in global markets typically benefits the AUD (a risk-on currency) against the safe-haven USD.

These factors contribute to a cautiously balanced but potentially bullish-leaning fundamental environment for the pair.

Conclusion

AUD/USD is at a micro-level inflection point, coiling for a potential bullish burst. The weight of evidence from the break of the minor downtrend, momentum build-up, and chart pattern suggests a short-term upside resolution, targeting a precise move first to 0.6570 and then towards 0.6610. Traders should seek a confirmed break above 0.6565 for entry and manage risk with precision by respecting the key invalidation level at 0.6540. Given the tight range, this is a setup for nimble, short-term traders.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. Forex trading involves high leverage and significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.