Financial Education 101 The Pillars of Money Management

Financial education is more than just balancing a checkbook; it’s the foundational knowledge that empowers you to make informed decisions with your money. This guide breaks down the essential components of financial literacy, from basic budgeting to complex investing, providing a clear path to financial security and freedom, whether you’re in the US, UK, or beyond.

What is Financial Education

Financial education is the process of acquiring the knowledge, skills, and confidence necessary to make effective and informed financial decisions throughout all stages of life. It’s not about memorizing complex formulas; it’s about understanding fundamental principles like budgeting, saving, investing, managing debt, and planning for the future. Think of it as learning the rules of the road before you get behind the wheel of a car, it provides the framework for navigating the financial world safely and successfully, turning money from a source of stress into a tool for achieving your goals.

Key Takeaways

| Life Stage | Key Financial Education Focus | Desired Outcome |

|---|---|---|

| Young Adult | Budgeting, Building Credit | Establishing financial independence |

| Growing Family | Debt Management, Insurance, Saving | Protecting assets and saving for future goals |

| Peak Earning Years | Investing, Retirement Planning | Building long-term wealth for retirement |

| Retirement | Estate Planning, Withdrawal Strategies | Preserving wealth and ensuring it lasts a lifetime |

The Essential Components of Financial Literacy

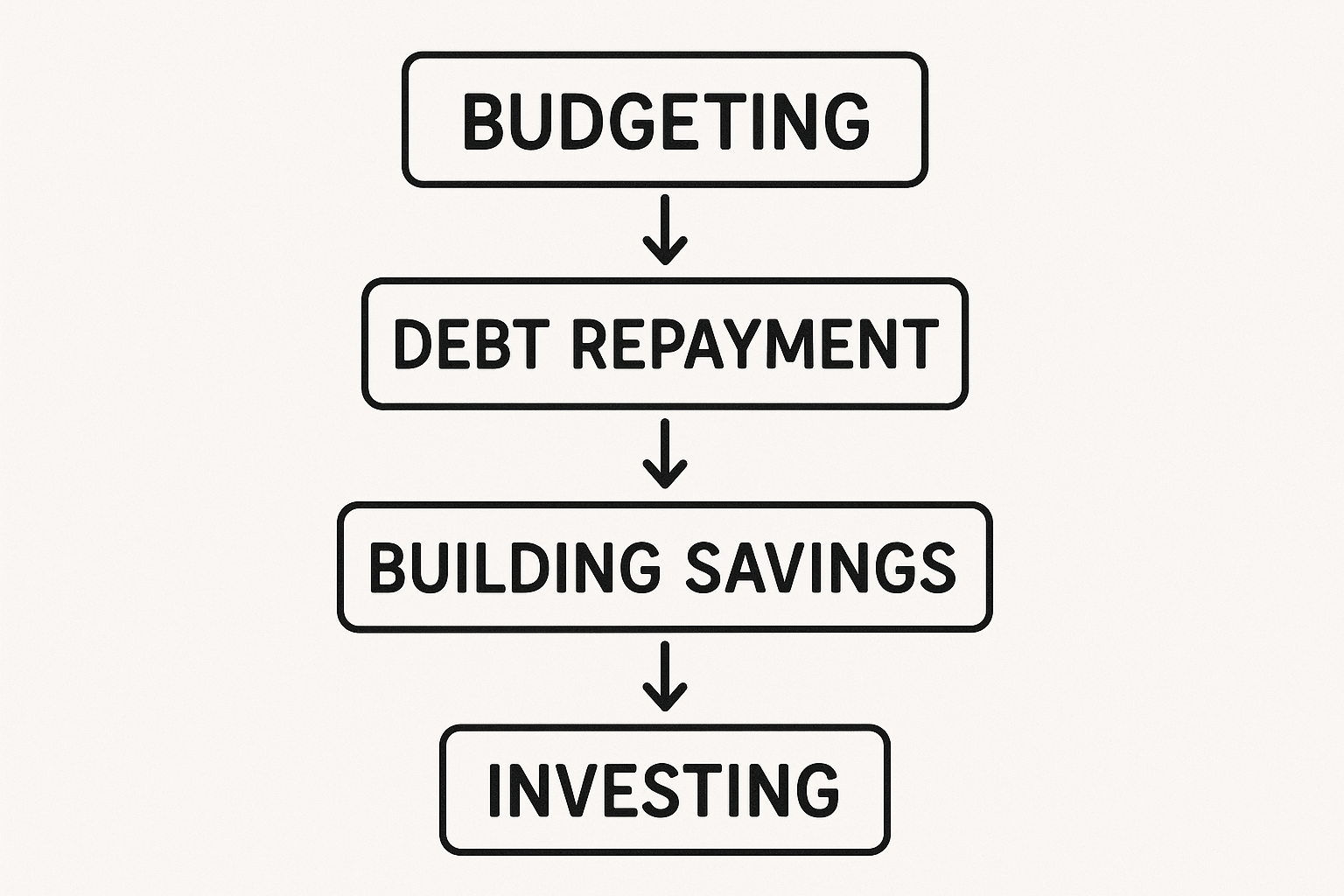

True financial education is built on several interconnected pillars. Mastering these core areas provides a comprehensive understanding of how to manage personal finances effectively.

1. Budgeting and Cash Flow Management

Budgeting is the cornerstone of financial education. It’s the process of creating a plan for how you will spend your money, ensuring you have enough for the things you need and the things that are important to you. It is the absolute essential first step. Without understanding your cash flow, all other financial goals become much harder to achieve.

Key Features:

- Tracking income and expenses.

- Categorizing spending (needs vs. wants).

- Planning for irregular and unexpected expenses.

- Aligning spending with personal values and goals.

- Provides immediate clarity on your financial situation.

- Prevents overspending and helps control debt.

- Reduces financial stress.

- Requires discipline and consistency to maintain.

- Can feel restrictive if not approached correctly.

It is the non-negotiable foundation of all financial stability.

2. Saving and Emergency Planning

This pillar teaches the discipline of setting aside money for future needs and unexpected events. An emergency fund is a key product of this knowledge, acting as a financial safety net.

Key Features:

- Paying yourself first (automating savings).

- Setting specific savings goals (e.g., vacation, car, house).

- Building an emergency fund with 3-6 months of expenses.

- Prevents the need for high-interest debt in an emergency.

- Provides peace of mind and financial security.

- Creates capital for future investment opportunities.

- Requires sacrificing current consumption for future benefit.

It is the bedrock of financial security that allows you to take calculated risks.

3. Investing and Wealth Building

This component moves beyond saving to focus on growing wealth. It involves understanding different asset classes (stocks, bonds, real estate) and strategies to build capital for long-term goals like retirement.

Key Features:

- Understanding compound interest.

- Asset allocation and diversification.

- Risk tolerance assessment.

- Retirement account options (401(k), IRA, ISA).

- Is the primary path to achieving long-term financial freedom.

- Helps your savings outpace inflation.

- Takes advantage of compounding over time.

- Involves inherent risk of loss.

- Can be complex and intimidating for beginners.

- Requires a long-term perspective.

It is the essential engine for long-term wealth creation that everyone should understand.

4. Debt and Credit Management

This pillar provides the knowledge to use debt as a tool rather than a trap. It covers how to manage existing debt efficiently and how to build and maintain a healthy credit score, which affects loan eligibility and interest rates.

Key Features:

- Understanding interest rates (APR).

- Strategies for debt repayment (e.g., avalanche vs. snowball method).

- How to form and sustain a good credit score.

- Differentiating between “good” debt (mortgages) and “bad” debt (high-interest credit cards).

- Saves thousands of dollars in interest payments over a lifetime.

- Provides access to better financial products and lower rates.

- Reduces the stress and burden of high-interest debt.

- Requires discipline to avoid misusing credit.

- Repairing poor credit is a slow and difficult process.

It is critical for financial health, as mismanaged debt is one of the biggest obstacles to building wealth.

5. Retirement Planning

This focuses on preparing for the specific goal of retirement. It involves calculating future needs, understanding retirement-specific accounts, and creating a sustainable plan to replace your income when you stop working.

Key Features:

- Estimating retirement expenses and income needs.

- Understanding pensions, 401(k)s, IRAs, and other retirement vehicles.

- Understanding withdrawal rules and tax implications.

- Planning for healthcare costs.

- Provides clarity and confidence about your future.

- Allows you to take full advantage of tax-advantaged accounts.

- Ensures you can maintain your desired lifestyle after work.

- Requires forecasting far into the future, which is inherently uncertain.

- Can be complex due to changing tax laws and market conditions.

It is a non-negotiable pillar for anyone who does not want to work indefinitely.

6. Insurance and Risk Management

This is the defensive component of financial education. It involves understanding how to use insurance products to transfer financial risks you cannot afford to bear yourself, protecting your wealth from unexpected events.

Key Features:

- Identifying key risks (death, disability, property loss, liability).

- Understanding different types of insurance (life, health, disability, property, liability).

- Determining appropriate coverage levels and deductibles.

- Protects your wealth and your family’s financial future from disaster.

- Provides peace of mind and financial stability.

- Prevents a single event from derailing your entire financial plan.

- Adds an ongoing expense (premiums) to your budget.

- Policies can be complex and difficult to compare.

It is one of the essential safety net that protects all the other financial pillars you work so hard to build.

7. Credit Scores & Reports: Your Financial GPA

This pillar demystifies the system that lenders use to judge your creditworthiness. Your credit score is a numerical representation of your reliability with debt, and your report is the detailed history behind it. Understanding how they work is crucial for accessing credit at the best possible terms.

Key Features:

- Understanding the factors that make up a score: payment history, credit utilization, length of history, new credit, and credit mix.

- Knowing how to obtain and read your free annual credit report from all three bureaus (Equifax, Experian, TransUnion).

- Learning how to dispute errors and improve your score over time.

- Recognizing how your score affects loans, rentals, insurance, and even job applications.

- A good score can save you tens of thousands of dollars in interest over your life.

- Provides access to premium credit cards with valuable rewards and benefits.

- Makes approval for rentals and mortgages faster and easier.

- Errors on your report can damage your score and take time to fix.

- Building a good score requires patience and consistent good habits.

- Hard inquiries from applying for credit can temporarily lower your score.

It is an essential tool for navigating the modern financial world, directly impacting the cost of the money you borrow.

8. Estate Planning: Your Final Financial Plan

Estate planning is not just for the wealthy; it’s the process of designing a plan for what happens to your assets and who makes decisions for you if you become incapacitated or pass away. It’s a critical act of care for your loved ones, ensuring your wishes are followed and minimizing stress and conflict during a difficult time.

Key Features:

- Creating a Will to dictate asset distribution and name guardians for minor children.

- Setting up Trusts for more control over how and when assets are distributed.

- Preparing Advance Directives (Living Will and Healthcare Power of Attorney) for medical decisions.

- Designating a Financial Power of Attorney to manage affairs if you’re unable.

- Ensuring beneficiary designations on accounts (like IRAs, 401(k)s) are up-to-date.

- Offers peace of mind knowing your activities are in order.

- Protects your heirs from lengthy and costly probate court processes.

- Ensures your assets go to the people you choose, not according to state law.

- Allows you to clearly outline your healthcare wishes.

- Can be uncomfortable to think about mortality and potential incapacity.

- Properly done with an attorney can be expensive upfront (but cheaper than the alternative).

- Requires updating after major life events (marriage, divorce, birth of a child).

It is the ultimate act of financial responsibility, protecting your legacy and your loved ones from unnecessary hardship.

A Real-World Example: From Debt to Investment

Maria, a marketing manager in the US felt overwhelmed by $15,000 in credit card debt and had no savings. Her journey began with financial education. She learned to create a budget using a free app, identifying areas to cut back. She then learned about the ‘debt avalanche’ method, focusing on paying off her highest-interest debt first while making minimum payments on the rest.

Once her debt was cleared, she redirected those payments into building an emergency fund. Finally, armed with knowledge about index funds and compound interest, she began investing consistently in her company’s 401(k) and a personal IRA. Within five years, she went from being a debtor to an investor building long-term wealth.

Financial Education vs Financial Planning

| Feature | Financial Education | Financial Planning |

|---|---|---|

| Primary Focus | Acquiring knowledge and skills | Creating a specific action plan |

| Timeframe | Lifelong process | Often a one-time or periodic service |

| Cost | Free or low-cost (books, courses) | Can be expensive (advisor fees) |

| Outcome | Empowerment and confidence to decide | A tailored roadmap for your goals |

Conclusion

Ultimately, understanding what is financial education reveals it as the most valuable investment one can make. It is not a single class or book but a lifelong journey of learning that pays continuous dividends. Financial education provides the tools to break cycles of debt, build tangible wealth, and achieve a sense of freedom and confidence that comes from being in control of your financial destiny. It demystifies the complex world of finance and makes it accessible to everyone, regardless of income or background. The journey starts with a single step: a decision to learn and take action.

Ready to take the first step on your financial education journey? The best time to start was yesterday; the second-best time is now. Begin by reviewing one core pillar each week. For more guidance, explore our detailed reviews on the Best Books on Personal Finance and Top Financial Podcasts to continue your learning.

Related Terms

- Financial Literacy: The ability to understand and use various financial skills.

- Compound Interest: The powerful principle of earning interest on your interest, a key reason to invest early.

- Asset Allocation: The strategy of dividing investments among different categories (stocks, bonds) to manage risk.

- Fiduciary: A financial advisor legally obligated to act in your best interest.