7 Types of Trading Which One is Most Profitable

From the lightning-fast pace of scalping to the patient, long-term approach of position trading, the world of trading is vast and varied. Each style serves a different personality and comes with its own unique risk profile. This guide will demystify them all, providing a clear framework to help you identify the most profitable and suitable trading type for your goals.

For aspiring traders in the US, UK, and globally, understanding these styles is the first step to developing a disciplined strategy on platforms like Interactive Brokers, Schwab, or eToro.

Summary Table

| Aspect | Detail |

|---|---|

| Number of Primary Types | 7 |

| Most Common For Beginners | Swing Trading, Position Trading |

| Most Complex / Advanced | Scalping, Algorithmic Trading |

| Key Decision Factor | Time Commitment, Risk Tolerance, Personality |

| Key Takeaway | Profitability is personal. Consistency in a style that fits you is more profitable than chasing the “best” one. |

Why Understanding the Different Types of Trading Matters

Jumping into the markets without a defined strategy is like sailing without a compass—you’re at the mercy of the waves and likely to get lost. Choosing the wrong trading style for your personality can lead to stress, burnout, and significant financial loss. Understanding these frameworks is not academic; it’s the foundational step to making informed, disciplined, and confident decisions with your capital.

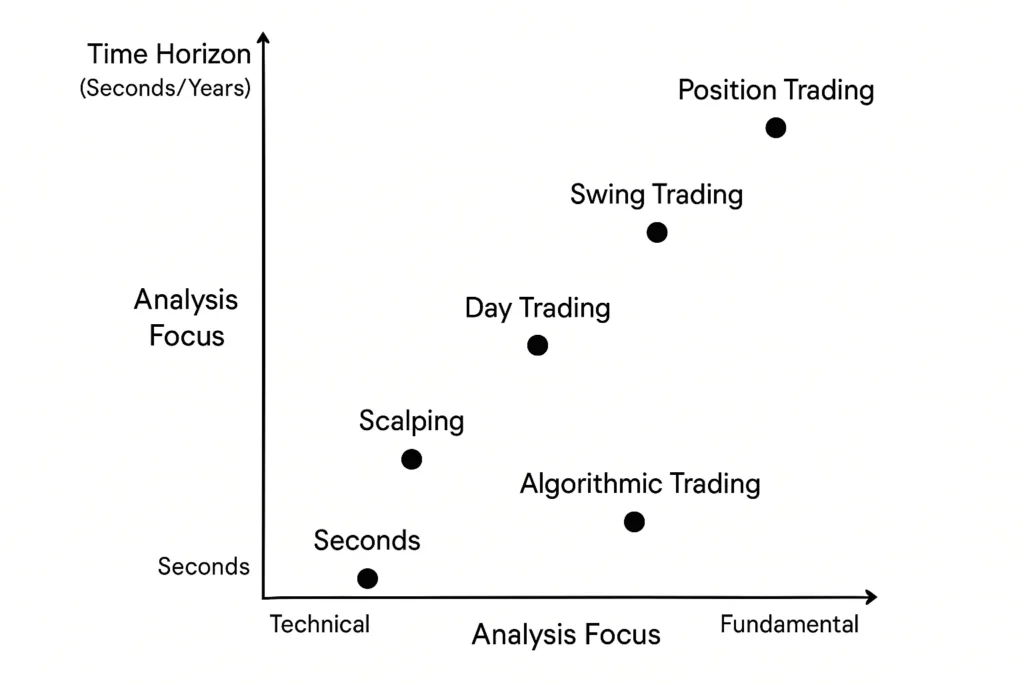

We will categorize the primary trading styles based on timeframe and strategy, which are the two most critical differentiators.

How to Break Down the World of Trading

Before we dive into the specific styles, let’s establish the framework. We can break down trading types along two primary axes:

- By Time Horizon: This is the length of time a trade is held, ranging from seconds to years. It’s the most straightforward way to categorize trading.

- By Strategy & Analysis: This refers to the method used to identify trades, such as technical analysis (charts), fundamental analysis (company/value data), or a quantitative approach (algorithms).

The 7 Types of Trading

The world of trading is broadly defined by seven primary styles, each with a unique timeframe and risk profile. These range from the lightning-fast, high-frequency executions of Scalping (seconds to minutes) and the intensive, full-day focus of Day Trading (minutes to hours), to the more patient, technical approach of Swing Trading (days to weeks) and the long-term, fundamental-based strategy of Position Trading (months to years).

1.Scalping

Scalping is an ultra-short-term strategy where traders aim to profit from very small price changes, sometimes just a few ticks. Scalpers enter and exit dozens or even hundreds of trades in a single day, holding positions for seconds to minutes. The core idea is to scalp a small profit from each trade, which can accumulate significantly by the end of the day.

Key Characteristics

- Timeframe: Seconds to minutes.

- Holding Period: Intra-day only (no overnight positions).

- Analysis: Purely technical (chart patterns, level 2 quotes, time & sales).

- Frequency: Extremely high number of trades per day.

- No overnight market risk

- Potential for steady, small gains

- Quick feedback on strategy

- Very high stress and intensity

- High transaction costs (commissions, spreads)

- Requires intense focus and screen time

- High capital requirements to make meaningful profits from small moves

Who Is It Best For?

Scalping is best for disciplined individuals with sharp reflexes, who can handle extreme stress, have significant starting capital, and can dedicate their full attention to the screens for hours at a time. It is not suitable for beginners.

2. Day Trading

Day trading involves buying and selling financial instruments within the same trading day. Unlike scalpers, day traders may hold positions for minutes to hours, aiming to capture more substantial intra-day price movements. All positions are closed before the market closes to avoid overnight risk.

Key Characteristics

- Timeframe: Minutes to hours.

- Holding Period: Intra-day only.

- Analysis: Primarily technical analysis.

- Frequency: Several trades per day or week.

- No overnight gap risk

- Can profit in both rising and falling markets

- Leverage can amplify returns (and losses)

- Still highly stressful

- Requires significant time daily

- Steep learning curve

- Not a “side hustle”; it’s a full-time job

Who Is It Best For?

Day trading is for individuals who can treat trading as a primary profession. It requires dedication, a solid understanding of technical analysis, risk management, and the emotional fortitude to handle the day’s volatility.

Mastering day trading starts with a reliable platform and real-time data. Choosing the right broker is critical. We’ve analyzed the top platforms for active traders to help you get started.

3. Swing Trading

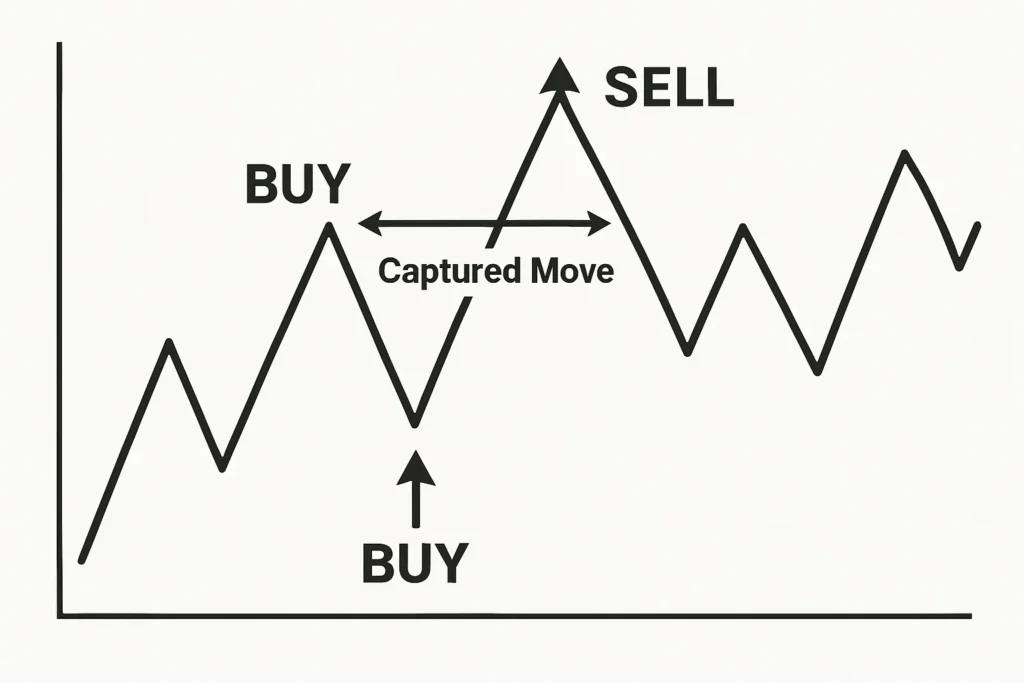

Swing trading aims to capture gains in a stock (or any asset) over a period of a few days to several weeks. Swing traders capitalize on the natural swings between optimism and pessimism in the market. They use technical analysis to identify the beginning of a price move and ride the swing until it shows signs of reversal.

Key Characteristics

- Timeframe: Several days to several weeks.

- Holding Period: Overnight and weekends.

- Analysis: Technical analysis (chart patterns, indicators like RSI and MACD).

- Frequency: A few trades per week or month.

- Doesn’t require constant screen watching

- More time for analysis and planning

- Potential for larger gains per trade than day trading

- Accessible for those with a full-time job

- Overnight and weekend gap risk exists

- Requires patience to wait for setups to develop

- Trades can take weeks to play out

- Can miss out on longer-term trends

Who Is It Best For?

Swing trading is often considered the sweet spot and is excellent for beginners and those with day jobs. It balances the need for analysis with a manageable time commitment and allows for meaningful gains without the intense stress of day trading.

4. Position Trading

Position trading is a long-term strategy where traders hold assets for weeks, months, or even years. The goal is to profit from major long-term trends, largely ignoring short-term fluctuations. This style relies heavily on fundamental analysis, assessing a company’s financial health, industry trends, and economic factors—to make investment decisions.

Key Characteristics

- Timeframe: Months to years.

- Holding Period: Long-term, through short-term volatility.

- Analysis: Primarily fundamental analysis.

- Frequency: Very few trades per year.

- Lowest time commitment

- Lower transaction costs

- Capitalizes on major economic trends

- Less daily stress

- Requires immense patience

- Can endure significant drawdowns

- Tied-up capital for long periods

- Requires strong conviction in analysis

Who Is It Best For?

Position trading is ideal for patient, long-term thinkers who are more interested in being investors than traders. It’s perfect for those who cannot or do not want to monitor the markets daily.

5. Algorithmic (Algo) Trading

Algorithmic trading uses computer programs that follow a defined set of instructions (an algorithm) to place trades. The algorithm, based on timing, price, quantity, or any mathematical model, can execute trades at a speed and frequency that is impossible for a human trader.

Key Characteristics

- Timeframe: Milliseconds to days (varies by strategy).

- Holding Period: Defined by the algorithm.

- Analysis: Quantitative and systematic.

- Frequency: Can be extremely high (High-Frequency Trading) or low.

- Removes emotion from trading

- Backtestable strategies

- Ability to execute complex strategies at high speed

- High technical barrier to entry (coding skills)

- Can incur significant losses if the algorithm fails

- Requires robust infrastructure and data feeds

- Model decay over time is a real risk

Who Is It Best For?

Algorithmic trading is for individuals with strong programming, mathematical, and statistical skills. It’s the domain of quantitative analysts, institutional firms, and highly technical retail traders.

6. Momentum Trading

Momentum traders jump on stocks or other assets that are moving significantly in one direction on high volume. The core belief is that assets that have performed well in the recent past will continue to perform well in the near future (and vice versa for shorting). They ride the wave until it shows signs of slowing down.

Key Characteristics

- Timeframe: Hours to days.

- Holding Period: Until the momentum slows.

- Analysis: Technical (volume, price breakouts, moving averages).

- Frequency: Can be high during volatile market periods.

- Potential for very rapid gains

- Clear entry and exit signals

- Can be very profitable in trending markets

- High risk of buying at the top (“catching a falling knife”)

- Requires quick decision-making

- Can lead to significant losses if the trend reverses abruptly

Who Is It Best For?

Traders who are comfortable with higher risk, can act decisively, and are skilled at identifying trend strength and exhaustion. It overlaps heavily with day and swing trading.

7. News Trading

This strategy is based on trading around market-moving events like earnings reports, economic data releases (e.g., GDP, Non-Farm Payrolls), or central bank announcements. Traders attempt to predict the market’s reaction to the news or react instantly as the news breaks.

Key Characteristics

- Timeframe: Seconds to hours.

- Holding Period: Very short-term.

- Analysis: Fundamental catalysts and market sentiment.

- Frequency: Event-driven.

- Potential for huge, rapid moves

- Clear catalyst for the price move

- Extremely volatile and unpredictable

- High risk of slippage (poor order fills)

- Requires access to ultra-fast news feeds

Who Is It Best For?

Experienced traders who understand market microstructure, can interpret economic data quickly, and have access to low-latency trading infrastructure. It is very high-risk.

Scalping vs Day Trading vs Swing Trading vs Position Trading

This master table allows you to quickly compare the most common trading styles.

| Feature | Scalping | Day Trading | Swing Trading | Position Trading |

|---|---|---|---|---|

| Timeframe | Seconds – Minutes | Minutes – Hours | Days – Weeks | Months – Years |

| Holding Period | Seconds | Intra-day Only | Overnights & Weekends | Long-Term |

| Analysis Method | Technical | Technical | Technical | Fundamental |

| Time Commitment | Very High (Full-Time) | High (Full-Time) | Moderate (Part-Time) | Low (Occasional) |

| Stress Level | Extremely High | High | Moderate | Low |

| Trade Frequency | 100+ per day | 1-10 per day | 1-10 per week | 1-10 per year |

| Transaction Costs | Very High | High | Moderate | Low |

| Best For | Professional, Focused Traders | Full-Time Active Traders | Beginners, Part-Time Traders | Long-Term Investors |

Selecting Your Trading Style

Transforming this information into an actionable decision requires honest self-assessment. Follow this framework:

- Audit Your Available Time: Be realistic. If you have a 9-5 job, scalping and day trading are off the table. Swing or position trading are your viable options.

- Determine Your Risk Tolerance: How much capital are you willing to lose on a single trade? Can you handle a 10% drawdown without panic-selling? If you are risk-averse, avoid scalping and news trading.

- Analyze Your Personality: Are you patient or impulsive? Do you enjoy staring at charts, or does it bore you? Your natural temperament is a huge factor.

- Assess Your Capital: Starting with a small account makes strategies like scalping impractical due to transaction costs and the inability to absorb small losses. Swing trading is more accessible for smaller accounts.

- Match the Style to Your Profile: Combine the answers from the steps above. For example: I have a full-time job (Time), am moderately risk-tolerant, and am fairly patient (Personality). Therefore, Swing Trading is the best initial fit for me.

Building a Strategy with Different Trading Types

Many successful traders don’t use just one style exclusively. They might have a core strategy and use others for specific opportunities. Here’s how they can work together:

- Example 1: The Hybrid Swing/Position Trader

- Core (80%): Position trades in long-term, fundamentally sound companies.

- Satellite (20%): Swing trades on technical setups to generate additional alpha and stay engaged with the market.

- Example 2: The Day Trader with a News Edge

- Core (90%): Standard intra-day technical trading.

- Edge (10%): Uses a news trading strategy during major economic announcements for high-probability, high-reward setups.

The Trader’s Mindset: Mastering the Mental Game

Each trading style demands a specific psychological profile. Understanding this can prevent burnout and failure.

- Scalping & Day Trading: Requires robotic discipline, ability to handle intense stress, and decisiveness. The biggest enemy is emotion—fear of missing out (FOMO) and the inability to take a quick loss.

- Swing Trading: Requires patience to wait for setups and the fortitude to hold through minor pullbacks without exiting prematurely. Impatience is the key psychological hurdle.

- Position Trading: Demands immense patience and conviction. The challenge is ignoring short-term market noise and media headlines that can shake your belief in a long-term thesis.

Calculating Your True Trading Costs

Profitability isn’t just about winning trades. It’s about what’s left after all costs. Many new traders underestimate these:

- Commissions: The fee paid to the broker per trade. Devastating for scalpers.

- Spread: The difference between the bid and ask price. A hidden cost on every trade.

- Slippage: The difference between the expected price of a trade and the price at which the trade is actually executed. Significant in fast markets or for large orders.

- Platform & Data Fees: Costs for real-time data, charting software, and news feeds.

- Taxes: Short-term capital gains (for trades held under a year in the US) are taxed at a higher rate than long-term gains, significantly impacting net profitability for active traders.

Conclusion

Navigating the diverse landscape of trading styles is less about finding a universally best option and more about a journey of self-discovery. The most profitable path is the one that aligns with your individual temperament, risk tolerance, and life schedule. Whether you are drawn to the rapid pace of a scalper or the patient outlook of a position trader, true success is forged not by the strategy itself, but by the discipline, continuous education, and rigorous risk management you apply to it. By understanding these seven types of trading, you now have the foundational map to begin that journey with clarity and purpose, empowering you to build a sustainable and confident approach to the markets.

Frequently Asked Questions

Recommended Resources

- Investopedia: Day Trading – For foundational definitions.

- Babypips.com School – Excellent free resource for Forex and general trading education.

- SEC Guide on Day Trading – Critical reading on the risks and rules.

- QuantConnect – A platform for those interested in learning algorithmic trading.