What Is Bull Market and How to Earn Profit From It

A bull market is a sustained period of rising prices and investor optimism, typically marking a strong, healthy economy. It represents a time of opportunity where confidence is high, and the trend is your friend. Understanding how to navigate a bull market is crucial for capitalizing on growth and building long-term wealth.

For investors in the US, UK, Canada, and Australia, recognizing a bull market on major indices like the S&P 500, FTSE 100, or ASX 200 is the first step to participating in significant wealth creation.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A prolonged financial period characterized by rising asset prices and widespread investor optimism. |

| Also Known As | Bull Run, Market Uptrend, Rally |

| Main Used In | Stock Trading, Crypto Investing, Portfolio Management, Economic Analysis |

| Key Takeaway | The primary strategy is “buy low, sell high,” as the overall market trajectory is upward, but it’s crucial to have an exit strategy before the trend reverses. |

| Related Concepts |

What is a Bull Market

A bull market is a financial market circumstance where prices are increasing or are anticipated to grow. The term is most commonly applied to the stock market (e.g., the S&P 500 or NASDAQ) but can also refer to anything that is traded, such as bonds, real estate, cryptocurrencies, or commodities. The bull symbolizes an animal that attacks by thrusting its horns upward, representing the market’s upward momentum.

Think of it as a prolonged period of economic sunshine. Companies are generally profitable, unemployment is low, and consumer confidence is high. This creates a virtuous cycle: optimism leads to buying, which pushes prices up, which in turn creates more optimism. It’s a self-reinforcing loop of positive sentiment and rising valuations.

Key Takeaways

The Core Concept Explained

At its heart, a bull market measures collective greed and optimism versus fear. It’s driven by a simple economic principle: demand outstripping supply. As more investors want to buy an asset than sell it, the price is bid up. This trend is sustained by tangible factors like robust corporate earnings, low-interest rates from central banks like the US Federal Reserve, and strong GDP growth. A high or sustained bull run indicates a period of wealth creation and economic expansion. However, it’s crucial to remember that markets move in cycles. Even within a powerful bull market, there are always pullbacks and corrections (short-term declines of 10-20%); these are normal and often provide new entry points for investors.

How to Identify a Bull Market

Since there’s no single formula, a bull market is identified by analyzing a combination of price action, economic data, and market sentiment. The most common technical rule of thumb is a 20% or more rise in broad market indexes (like the S&P 500 or the Dow Jones Industrial Average) from their most recent low, following a previous decline of 20% or more.

Key Indicators of a Bull Market

- Sustained Price Appreciation: The most obvious sign. Look for a chart of a major index making a series of higher highs and higher lows.

- Strong Economic Fundamentals: Key metrics like GDP growth, employment rates, and consumer spending are healthy and improving. For instance, a falling unemployment rate in the US or UK is a strong tailwind.

- High Investor Confidence: This can be measured by sentiment surveys like the AAII Investor Sentiment Survey or the CNN Fear & Greed Index. In a bull market, optimism and greed are predominant.

- Robust Corporate Earnings: Companies listed on exchanges like the NYSE and NASDAQ are reporting strong and growing profits.

- Favorable Monetary Policy: Central banks (like the Federal Reserve, Bank of England, or Bank of Canada) are typically in an accommodative cycle, with low-interest rates that make borrowing cheaper and investing more attractive.

Why Bull Markets Matter to Traders and Investors

Bull markets are the primary engines of wealth generation in the financial world. Understanding their dynamics is not just academic; it’s critical for practical portfolio management.

- For Investors: A bull market is the ideal environment for long-term wealth accumulation through strategies like buy and hold. It allows retirement accounts (like 401(k)s in the US or ISAs in the UK) to compound significantly. Recognizing you are in a bull market encourages staying invested and resisting the urge to sell during minor dips.

- For Traders: Traders aim to capitalize on the prevailing upward trend. Strategies like buying the dip or trend following become highly effective. A bull market provides numerous opportunities across various sectors and asset classes.

- For Analysts: Analysts use the characteristics of a bull market to gauge economic health, assess sector rotations (where money moves from one industry to another), and identify which companies are best positioned to benefit from the economic expansion.

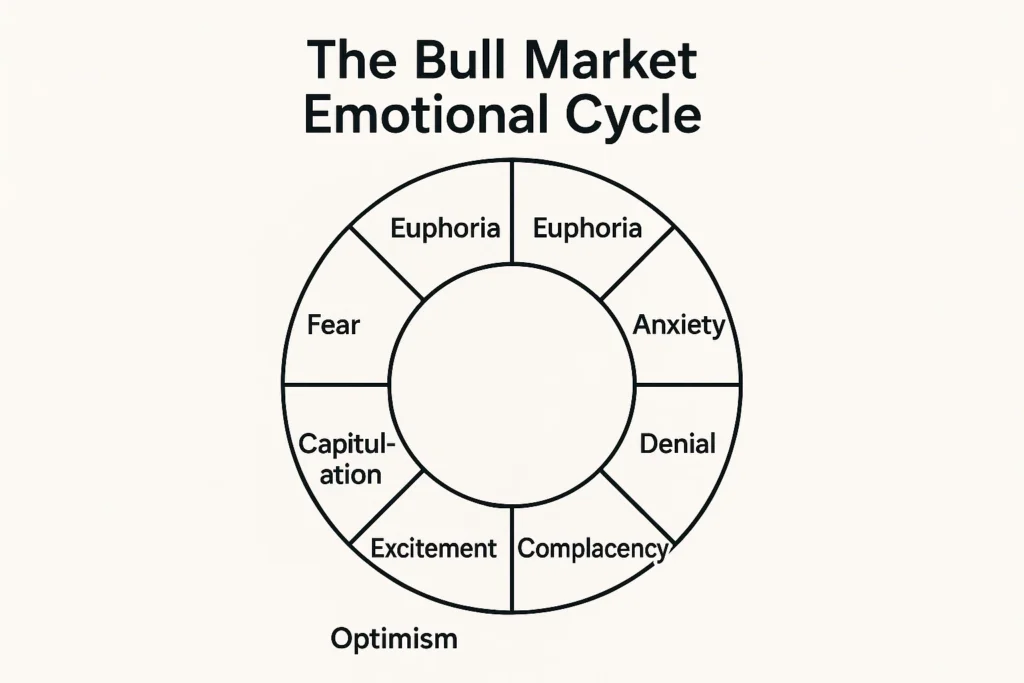

The Psychology of a Bull Market: Navigating the Emotional Cycle

Understanding the psychological underpinnings is as crucial as understanding the economics. A bull market follows a predictable emotional cycle that can cloud judgment if you’re not aware of it.

- Stage 1: Disbelief & Accumulation: The rally begins, but investors are shell-shocked from the previous bear market. They dismiss the rise as a dead cat bounce. Smart money and institutional investors start accumulating positions quietly.

- Stage 2: Optimism & Growth: The media starts reporting the recovery. Economic data improves. The wall of worry is climbed as more investors gain confidence and enter the market.

- Stage 3: Excitement & Greed: This is where the most significant price appreciation often occurs. Everyone is talking about stocks. Stories of easy money abound. FOMO (Fear Of Missing Out) drives new, often inexperienced, investors to throw money at any trending asset.

- Stage 4: Euphoria & Complacency: The peak. Valuation is ignored based on new paradigms. Leverage increases. The consensus is that the market can only go up. This is the most dangerous phase, where the greatest risk is taken.

How to Use a Bull Market in Your Strategy

Navigating a bull market requires a blend of optimism and caution. Here are actionable strategies:

- Case 1: The Long-Term Investor’s Approach: Focus on a core portfolio of high-quality stocks or low-cost index funds (like an S&P 500 ETF). The key is consistent investing (dollar-cost averaging) and patience. Avoid the temptation to frequently trade in and out, as this can lead to missing the best days of the rally, which often cluster together.

- Case 2: The Buy the Dip Strategy: In a healthy bull run, short-term pullbacks of 5-10% are common. These can be opportunities to add to positions in strong companies at a slightly lower price. Setting limit orders to buy at specific support levels can automate this process.

- Case 3: Sector Rotation: As the bull market matures, leadership often changes. Early on, cyclical sectors like technology and consumer discretionary tend to lead. Later, more defensive sectors or those that benefit from rising interest rates may take over. Monitoring economic data from sources like the U.S. Bureau of Labor Statistics can provide clues.

To start implementing these strategies, you need a reliable brokerage platform. We’ve reviewed the best online brokers for both new and experienced investors to help you get started.

- Wealth Creation The most significant pro is the potential for substantial portfolio growth and wealth accumulation for investors.

- Positive Sentiment Boosts consumer and business confidence, leading to increased spending and investment, which further fuels economic growth.

- Access to Capital Companies can raise money more easily through IPOs or secondary offerings, funding innovation and expansion.

- Easier Gains A rising tide lifts (almost) all boats, making it easier for novice investors to see positive returns.

- Job Growth A strong market often correlates with a strong economy, leading to lower unemployment and higher wages.

- Complacency & Overconfidence Investors may take on excessive risk, forgetting that markets can fall, leading to significant losses when the trend reverses.

- Overvaluation Prices can detach from underlying fundamentals, creating asset bubbles that are prone to a sharp and painful burst.

- FOMO (Fear Of Missing Out) Can drive irrational investment decisions, causing people to buy at the peak without proper research.

- Inevitable End No bull market lasts forever. The transition to a bear market can be swift and erase a large portion of gains.

- False Sense of Security It can mask poor investment choices, as even low-quality assets may rise in a broad-based rally.

Advanced Bull Market Strategies for Different Investor Profiles

Go beyond buy and hold with tailored approaches.

- For the Risk-Averse Investor:

- Strategy: Systematic Profit-Taking. Decide in advance to sell a fixed percentage (e.g., 10%) of your winning positions every time your portfolio hits a new high. This systematically locks in gains and reduces exposure as the market becomes more expensive.

- Tool: Use a simple spreadsheet or your broker’s alert system to track all-time highs.

- For the Active Trader:

- Strategy: Momentum & Breakout Trading. Focus on stocks that are breaking out to new 52-week highs on high volume. In a strong bull market, momentum tends to persist. Use technical indicators like the Relative Strength Index (RSI) to time entries on pullbacks within the broader uptrend.

- Tool: A platform with advanced charting and scanning capabilities, like TradingView or Thinkorswim.

- For the Strategic Allocator:

- Strategy: Dynamic Asset Rebalancing. Set a strategic asset allocation (e.g., 60% stocks, 40% bonds). As the bull market pushes your stock allocation to, say, 70%, rebalance by selling stocks and buying bonds to return to your 60/40 split. This forces you to sell high and maintain your target risk level automatically.

- Tool: Many robo-advisors like Betterment or Wealthfront automate this process.

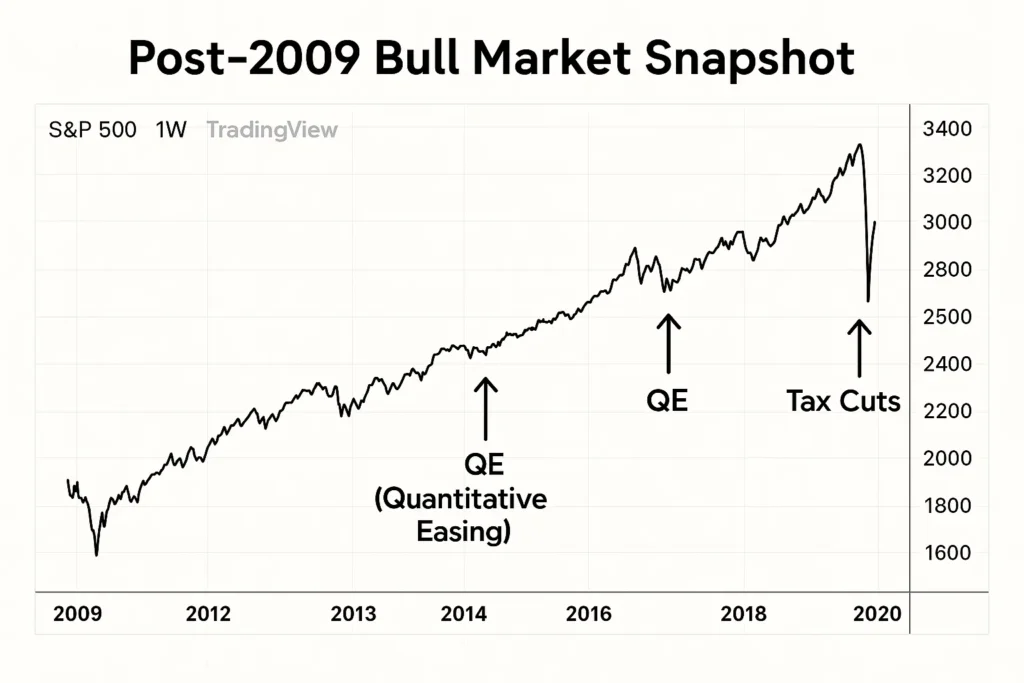

Bull Market in the Real World: The Post-2009 Recovery

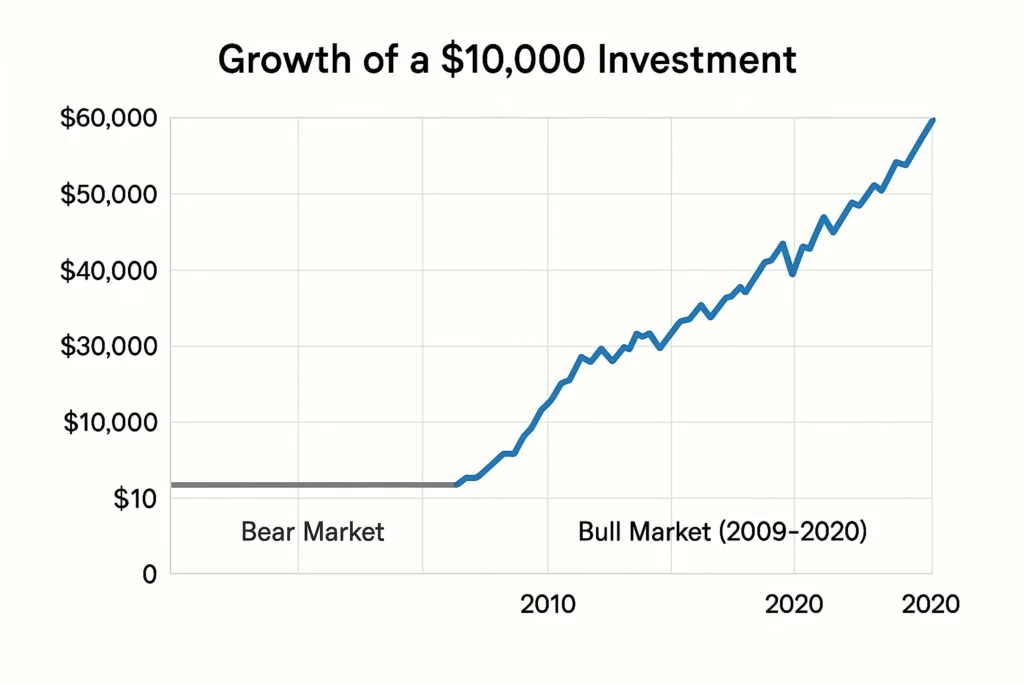

The bull market that followed the 2008 Global Financial Crisis is one of the most powerful and prolonged in history. Starting in March 2009, the S&P 500 embarked on an unprecedented rally that lasted over a decade, fueled by historically low-interest rates from the Federal Reserve, strong corporate earnings, and technological innovation.

This historic run, primarily driven by US markets, saw the S&P 500 soar from a low of around 666 points to over 3,700 points by the end of 2020, a gain of over 450%. Investors who stayed the course and continued investing in index funds tracking the S&P 500 saw their portfolios multiply, a prime example of the wealth-creating power of a long-term secular bull market.

Bull Market vs Bear Market

| Feature | Bull Market | Bear Market |

|---|---|---|

| Market Trend | Sustained upward price movement (≥20% rise). | Sustained downward price movement (≥20% decline). |

| Investor Sentiment | Optimism, Confidence, Greed. | Pessimism, Fear, Panic. |

| Economic Backdrop | Strong GDP, low unemployment, high profits. | Weak or contracting GDP, rising unemployment, falling profits. |

| Primary Strategy | “Buy and Hold” or “Buy the Dip.” | “Sell and Wait,” Short-Selling, or Defensive Investing. |

Conclusion

Understanding a bull market provides the confidence to participate in periods of significant economic growth and wealth creation. While it offers powerful tailwinds for your portfolio, as we’ve seen, it’s not without risks like overvaluation and investor complacency. By incorporating a disciplined strategy, whether it’s long-term holding, tactical buying on dips, or prudent sector rotation, you can harness the power of a bull run while managing its inherent dangers. Remember, the goal is not just to profit during the good times but to protect those profits for the long haul. Start by analyzing the current market trends on your own charts and economic dashboards.

Ready to put these concepts into action? The right tools are essential. We’ve meticulously reviewed and ranked the best online brokers for both stock trading and long-term investing to help you get started.

Related Terms

- Market Correction: A short-term decline of 10-20% within a bull market. It is a healthy pause that does not reverse the overall upward trend.

- Secular Bull Market: A long-term bull market that can last for 10-20 years, often containing several shorter-term bear markets within it. The 1982-2000 period is a classic example.

- Investor Sentiment: The overall attitude of investors toward a particular market, which is a key driver of both bull and bear markets.

- Asset Bubble: A situation where prices rise dramatically and detach from intrinsic value, often occurring in the late stages of a powerful bull market.

Frequently Asked Questions

Recommended Resources

- For Foundational Knowledge: U.S. SEC: Investor.gov Glossary provides clear, authoritative definitions.

- For Market Data & Charts: TradingView is an excellent platform for analyzing market trends and identifying bull market patterns.

- For Economic Indicators: Follow the official websites of the U.S. Federal Reserve and the Bureau of Labor Statistics for crucial data on interest rates and employment.