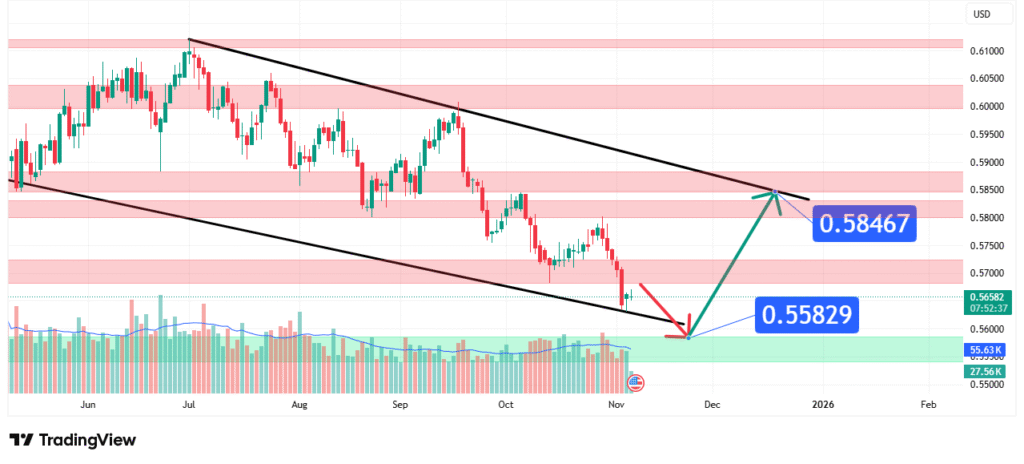

NZDUSD Price Forecast Emerging from a Macro Downtrend

NZDUSD’s price has potentially carved out a major cycle low at the 0.5583 level, breaking a long-standing sequence of lower lows. This pivotal price action suggests a significant bullish reversal may be underway. Our analysis projects a sustained move towards a primary target of 0.5840, with the potential for further upside upon a successful breakout. This prediction is based on a confluence of technical factors, including the formation of a massive bullish divergence and a break of a key market structure.

Current Market Structure and Price Action

The long-term market structure has been overwhelmingly bearish for over a year. However, a critical development has occurred: the price has formed a clear Higher Low at 0.5583 relative to the previous major low. This is the first concrete sign of bearish momentum degradation. The price is currently interacting with a key resistance zone near the 0.5950-0.6000 area, which previously acted as support. A decisive break above this zone would be a strong confirmation that buyers have seized control and that the path of least resistance is shifting to the upside.

Identification of the Key Support Zone

The most critical technical element is the Strong Support Zone forged at the 0.5583 low.

The strength of this zone is derived from:

- Historical Significance: This level represents the absolute lowest point the pair has traded at in over a year, making it a quintessential macro swing low. It is a level where sellers were completely exhausted and buyers aggressively stepped in.

- Technical Confluence: The rally from this low has been sharp and decisive, indicating a powerful shift in sentiment. The zone now acts as the foundational support for any new bullish market structure.

- Market Psychology: This area represents a “line in the sand” for bulls. Holding above it is imperative for the bullish thesis. A return to this level would suggest the recovery is failing.

This zone is the launchpad for the anticipated bullish move.

Technical Targets and Rationale

Our analysis identifies the following price targets:

Primary Target (PT1): 0.5840

This level represents a major previous resistance zone and a key psychological hurdle. It is also the first significant technical barrier on the way up from the current price and aligns with the initial measured move from the reversal pattern.

Secondary Target (PT2): [Beyond 0.5840, e.g., 0.6000+]

A clean break and close above 0.5840 would open the path towards the 0.6000 psychological level and beyond, which was a major consolidation area before the final descent.

Prediction: We forecast that the price will break above the immediate resistance near 0.6000 and stage a sustained rally towards our primary target at 0.5840. The reaction at this target will be critical for determining if the move extends towards 0.6000 and higher.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish reversal thesis is invalidated if the price achieves a daily close below the key support low at 0.5583. A break below this level would signify a failure of the higher low formation and a resumption of the macro downtrend.

- Position Sizing: Any long positions taken should be sized so that a loss triggered at the invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Factor 1: RBNZ vs. Fed Policy: The monetary policy outlook is key. Any hawkish hold or hint of hikes from the Reserve Bank of New Zealand (RBNZ), while the Federal Reserve moves toward a cutting cycle, would be a strong tailwind for NZDUSD.

- Factor 2: Commodity Prices: As a commodity-linked currency, the NZD is sensitive to global dairy prices and overall risk sentiment. A recovery in global demand could bolster the Kiwi.

- Factor 3: USD Dynamics: Broad US Dollar strength or weakness remains a primary driver. A softening USD index (DXY) would provide significant lift to this pair.

These factors are beginning to align in a way that could support a bullish reversal for NZDUSD.

Conclusion

NZDUSD is showing the most compelling signs of a bullish reversal seen in over a year. The weight of evidence suggests a bullish resolution, targeting a significant move to 0.5840. Traders should monitor for a confirmed daily close above the 0.6000 resistance and manage risk diligently by respecting the key invalidation level at 0.5583. The formation of a higher low is a powerful signal, and a break above key resistance could trigger a substantial short-covering rally.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.