Trading vs. Gambling How to Build a Disciplined Strategy

Feeling that adrenaline rush when a trade moves and wondering if it’s just luck? The line between trading and gambling is thinner than most think, but crossing it is the difference between long-term success and financial ruin. This guide will give you a clear, actionable framework to build a disciplined, evidence-based trading strategy that relies on skill, not chance.

For traders in the US, UK, and other developed markets, understanding this distinction is crucial for navigating volatile conditions and adhering to the principles taught by successful institutions and professional traders.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | To systematically differentiate trading from gambling and implement a professional, rule-based approach. |

| Skill Level | Beginner to Intermediate |

| Time Required | Ongoing, but core mindset shift can happen in days. |

| Tools Needed | Trading Journal, Brokerage Platform, Risk Calculator, Economic Calendar. |

| Key Takeaway | Trading is a business of probabilities and risk management, while gambling is a game of chance with a negative expected value. |

Why Learning to Distinguish Trading from Gambling is Crucial

Many new traders enter the markets with the same mindset as a casino visitor: hoping for a big score. This confusion is the single biggest reason most lose money. Understanding the critical differences isn’t an academic exercise; it’s the foundational skill that will determine your survival and profitability.

This guide solves the problem of inconsistent results, emotional decision-making, and blown-up accounts. It replaces hope with a structured process.

You will stop being a market gambler and start operating as a business owner, where your trading is a venture based on strategy, edge, and strict capital preservation.

Strategic Trading vs Gambling vs Long-Term Investing

| Feature | Strategic Trading | Gambling | Long-Term Investing |

|---|---|---|---|

| Foundation | Probabilities & Risk Management | Chance & Luck | Fundamental Value & Growth |

| Time Horizon | Short to Medium-Term | Instant (Spin of a wheel) | Long-Term (Years/Decades) |

| Primary Goal | Consistent Profits from Market Inefficiencies | Entertainment & a Big Win | Wealth Accumulation via Compounding |

| Emotional Driver | Discipline & Process | Hope & Greed | Patience & Conviction |

What You’ll Need Before You Start

To embark on this journey, you need more than just capital. You need the right intellectual toolkit.

Knowledge Prerequisites:

- A basic understanding of what moves the markets (e.g., economic data, earnings reports).

- Familiarity with basic chart reading and order types (market, limit, stop-loss).

Mindset Prerequisites:

- Humility: Accepting that losses are part of the business.

- Patience: Waiting for your specific setup, not trading for the sake of it.

- Objectivity: The ability to review your trades without ego.

You’ll need a reliable brokerage platform to execute your plan. Many of the best brokers for retail traders, like Interactive Brokers or TD Ameritrade, offer advanced charting tools and robust risk management features that are essential for strategic trading. For beginners, platforms like eToro or Plus500 offer user-friendly interfaces, but always ensure they are regulated by bodies like the FCA or SEC.

How to Trade and Not Gamble: A Step-by-Step Walkthrough

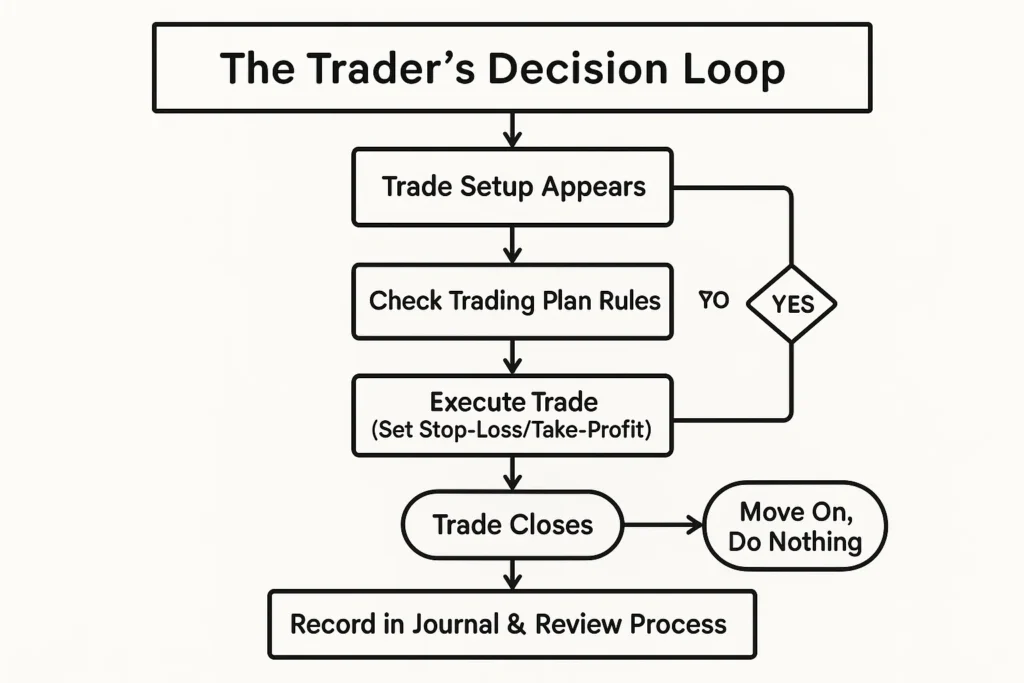

This process is about building habits and systems that enforce discipline.

Step 1: Define and Document Your Edge

A gambler has no edge; a trader must have one. Your edge is a quantifiable reason why a trade has a higher probability of success than failure.

This could be a technical pattern (e.g., a specific candlestick breakout with high volume), a fundamental discrepancy (e.g., a stock is undervalued based on your analysis), or a statistical arbitrage. The key is that it must be testable and repeatable.

Pro Tip: Start by backtesting your edge on historical data. If it wouldn’t have worked in the past, it likely won’t work in the future.

Step 2: Implement Rigorous Risk Management Before the Trade

Gamblers risk everything for a payout. Traders define their maximum loss before they even enter.

For every trade, determine your position size based on a fixed percentage of your capital you are willing to lose (e.g., 1-2%). Always use a stop-loss order to automate your exit.

Common Mistake to Avoid: Moving your stop-loss further away because you feel the trade will turn around. This is gambling behavior.

Step 3: Execute Your Plan with Disciplined Emotion Control

This is where theory meets reality. The market will test your resolve with random wins and losses.

Follow your plan exactly as written. A win on a trade that didn’t follow your rules is more dangerous than a loss that did. It teaches you that breaking rules can be profitable; a lesson that will destroy you in the long run. This is known as Random Reinforcement, a powerful psychological trap also found in gambling.

Formula for Success: Process > Outcome. Judge yourself on whether you followed your process, not whether you made money on a single trade.

Step 4: Analyze and Refine Through a Trading Journal

A gambler only looks at their final P&L. A trader conducts a forensic analysis of every trade.

Your trading journal is your most important tool. For every trade, record: the reason for entry, the chart setup, your emotional state, the outcome, and, most critically, what you learned.

The Hidden Trap: How Random Reinforcement Fuels Trading Addiction

You’ve learned the steps to be disciplined, but why is it so hard to stay disciplined? The answer lies in a powerful psychological principle called Random Reinforcement, and understanding it is your best defense against slipping into a gambler’s mindset.

What is Random Reinforcement?

It’s a conditioning schedule where rewards are given on an unpredictable basis. This is the most potent way to create a habit. A classic example is a slot machine: you pull the lever 100 times with no reward, but the 101st pull gives a jackpot. That unpredictable win wires your brain to keep pulling the lever, hoping for the next payout. The maybe next time hope is incredibly addictive.

How It Manifests in Trading

Imagine a new trader who doesn’t have a plan. They take an impulsive trade based on a social media tip and lose money. They do it again and lose again. Frustrated, they try a third time, and this time, the trade rockets up for a massive, unexpected win.

- The first two losses were mild punishments.

- The third, random win was a massive, unpredictable reward.

This random win powerfully reinforces all the bad behavior that led to it: the lack of planning, the impulsive entry, the reliance on tips. The brain learns, If I just keep doing this, I might get another huge payoff. This is far more seductive than the steady, moderate dopamine hit from a trade that goes as planned.

How to Break the Cycle

- Acknowledge the Trap: Recognize that any win achieved outside your trading plan is dangerous, not lucky. It’s the psychological equivalent of a slot machine jackpot.

- Focus on Process-Based Rewards: Shift your source of satisfaction. Reward yourself for perfectly executing a trade according to your plan; even if it results in a small loss. The win is in the discipline.

- Journal the Why: In your trading journal, explicitly mark trades that were outside your plan. Analyze the lucky wins with more scrutiny than your planned losses. Ask, Would this be repeatable 100 times?

How to Use This Framework in Your Trading Strategy

Let’s translate this mindset into concrete actions for different scenarios.

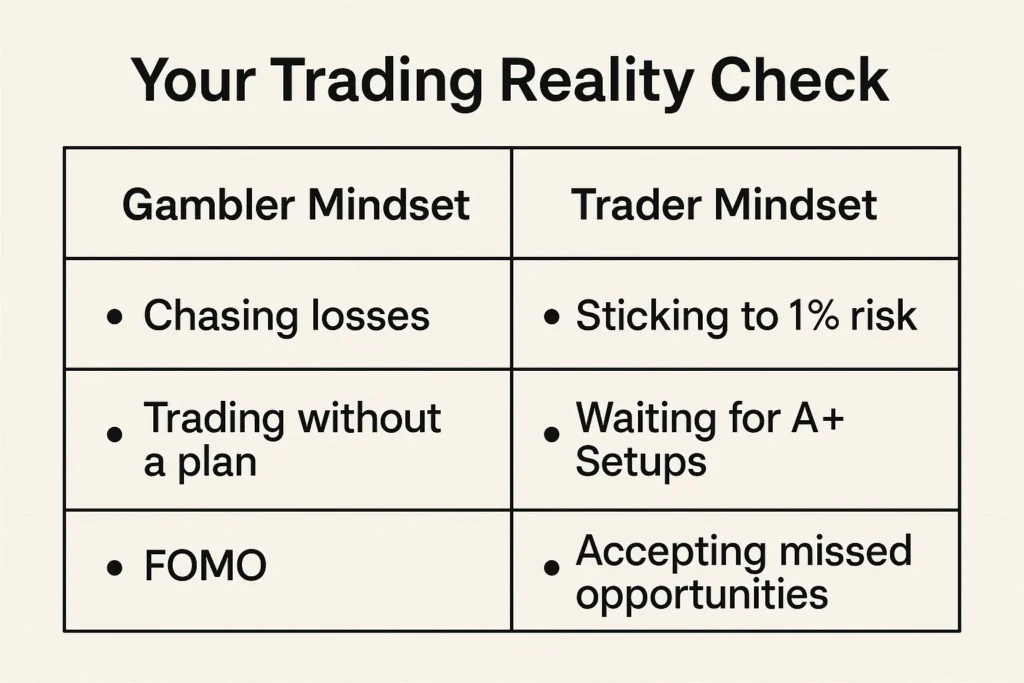

Scenario 1: A String of Losses

- Gambler’s Reaction: I’m due for a win! (Gambler’s Fallacy). Increases bet size to recoup losses quickly.

- Trader’s Reaction: Reviews the journal. Were the losses due to the strategy being ineffective in current market conditions, or due to poor execution? If the former, reduces position size or stops trading until the edge returns. If the latter, focuses on discipline.

Scenario 2: A Big, Unexpected Win

- Gambler’s Reaction: Attributes it to skill, becomes overconfident, and takes on more risk.

- Trader’s Reaction: Journals the trade. If the win was outside the planned strategy, it’s marked as a dangerous lucky break. The profit is banked, not used as an excuse to deviate from the plan.

In 2021, many traders made huge profits on meme stocks like GameStop. A gambler saw this as a new, easy way to make money. A strategic trader who participated would have recognized it as a unique, high-risk event, allocated a tiny, speculative portion of their capital, and banked the profits without changing their core, proven strategy.

Common Mistakes When Building a Trader’s Mindset

Pitfall 1: Overconfidence After a Win Streak.

Solution: Remember that even a broken clock is right twice a day. Stick to your pre-defined position sizing. Never assume you can’t lose.

Pitfall 2: The It’s Only a Loss When I Sell Fallacy.

Solution: This is denial. A loss is a loss once your stop-loss level is hit. Holding a losing trade hoping it will break even is gambling. Use hard stops.

Pitfall 3: Trading When Bored or For Action.

Solution: The market isn’t always offering opportunities. If there are no valid setups per your plan, the correct trade is no trade. Find a hobby outside of trading to satisfy the need for action.

Are You a Trader or a Gambler? A 10-Question Reality Check

It’s easy to self-identify as a trader, but your actions tell the real story. This checklist, inspired by diagnostic tools used in behavioral finance, helps you confront your own tendencies. Be brutally honest; this is for your eyes only.

For each question, answer Always, Often, Sometimes, or Never.

- I enter a trade with a pre-defined point where I will admit I’m wrong and exit (a stop-loss).

- I know the exact percentage of my total capital I am risking before I enter a trade.

- After a loss, my first instinct is to review my journal to see if I followed my plan, not to immediately place a new trade.

- I feel bored or fear of missing out (FOMO) when I’m not in a trade.

- I have moved my stop-loss further away from the price because I was convinced the trade would reverse in my favor.

- I increase my position size after a loss to make my money back faster.

- My trades are primarily based on a tested strategy/edge, not a gut feeling or a tip from social media.

- I can clearly articulate the logical reason for my current trade based on my written plan.

- I judge my daily success based on whether I followed my process, not on whether I made or lost money.

- I have a clear, written rule for when I will take profits (a take-profit target).

Scoring & Interpretation

- For Questions 1, 2, 3, 7, 8, 9, 10: Give yourself 3 points for Always, 2 for Often, 1 for Sometimes, and 0 for Never.

- For Questions 4, 5, 6: Give yourself 0 points for Always, 1 for Often, 2 for Sometimes, and 3 for Never.

Your Trader Profile:

- 25-30 Points (The Strategic Trader): You have a strong, process-oriented mindset. You treat trading as a business. Your focus should be on refining your edge and managing psychology during extended drawdowns.

- 15-24 Points (The Transitional Trader): You understand the concepts but struggle with consistent execution. You are in the danger zone where random reinforcement can easily derail you. Focus intensely on creating and adhering to a written trading plan.

- 0-14 Points (The Market Gambler): Your approach is dominated by emotion and chance. You are likely experiencing high stress and inconsistent results. Stop live trading immediately. Move to a demo account and focus 100% on building and practicing a rules-based system before risking another dollar.

- Sustainable Results: Shifts the focus from short-term luck to long-term, repeatable profitability.

- Emotional Resilience: A clear plan reduces fear and greed, the two biggest enemies of a trader.

- Capital Preservation: Rigorous risk management ensures you live to trade another day, even during a drawdown.

- Continuous Improvement: The journaling process turns every trade, win or lose, into a learning opportunity.

- Requires Significant Discipline: It’s mentally demanding and not as exciting as gambling-style trading.

- Can Be Slow: Patience is required, and you will miss moves that don’t fit your plan.

- No Guarantees: An edge only provides a probability of success, not a certainty. Drawdowns are inevitable.

- Time-Consuming: The research, journaling, and review process is a real time investment.

Your Trading Business Plan Template

A strategic mindset is useless without a framework for action. This template transforms abstract concepts into a concrete, operational document; your Trading Business Plan. Treat this with the same seriousness as a entrepreneur’s business plan.

1. Executive Summary & Mission Statement

- Purpose: Define your why. This is your guiding light.

- Example: The mission of this trading business is to achieve consistent, risk-adjusted returns by systematically swing trading S&P 500 sector ETFs. The primary goal is capital preservation, with a secondary goal of outperforming the risk-free rate by an average of 10% annually, while never risking more than 1% of capital on any single trade.

2. Markets & Instruments

- Purpose: Define what you will trade to avoid distraction.

- Example: This business will only trade major US indices and sector ETFs (e.g., SPY, QQQ, XLF). It will NOT trade individual stocks, forex, or cryptocurrencies due to their higher, unmodeled volatility.

3. The Trading Strategy (Your Edge)

- Purpose: Document your repeatable, testable method.

- Entry Criteria: A valid long entry requires: (a) Price above the 200-day moving average, (b) RSI(14) crossing above 50 from below, and (c) A breakout above the previous session’s high with above-average volume.

- Exit Criteria: Exit for a loss if price closes below [specific level]. Exit for a profit when price reaches a 2:1 reward-to-risk ratio relative to the initial stop, OR if the 20-day moving average flattens and turns down.

4. Risk Management Protocol

- Purpose: Your survival manual. This is non-negotiable.

- Capital Allocation: Maximum risk per trade is 1% of the total account equity.

- Position Sizing: Position size = (Account Equity * 0.01) / (Entry Price – Stop-Loss Price).

- Maximum Drawdown: If the account draws down 10% from its peak equity, all trading will cease for one week for a mandatory strategy review.

- Daily Loss Limit: No new trades will be entered if daily losses exceed 3% of account equity.

5. Operations & Tools

- Purpose: Your business infrastructure.

- Trading Hours: Active monitoring from 9:45 AM ET to 11:30 AM ET. Orders are set before the open and reviewed at the close.

- Tools: Primary Broker: [Broker Name]. Charting Platform: TradingView. Journal: TraderVue.

- Data Sources: Reliance on [Specific Data Source, e.g., Finviz for screening, Fed’s FRED database for context].

6. Recording & Review (The CEO’s Report)

- Purpose: Continuous improvement.

- Journaling: Every trade, including ‘missed’ setups, will be recorded in TraderVue within 1 hour of market close.

- Performance Review: A full review of the business plan, trade log, and psychological state will be conducted on the first Sunday of every month.

Taking It to the Next Level

Once you’ve mastered the core disciplined mindset, you can enhance your business further.

- Understand Expectancy: Move beyond win-rate. Learn to calculate your trading system’s expectancy: (Win % * Average Win) – (Loss % * Average Loss). A positive expectancy is the true definition of an edge. Investopedia has a great resource on this concept.

- Correlation Analysis: Ensure your trades are not all dependent on the same market factor. Diversifying your strategies can smooth your equity curve.

- Automate Where Possible: Use trading platforms that allow you to pre-set your entry, stop-loss, and take-profit levels. This removes emotion from the execution phase.

Conclusion

You now possess the mental framework to escape the casino and build a real trading business. Remember, the goal is not to be right on every trade, but to be profitable over hundreds of trades by leveraging your edge and managing your risk.

Your action plan is simple but powerful:

- Write Your Trading Plan Today: Define your edge, your risk-per-trade, and your journaling process.

- Practice with a Demo Account: Test your plan without risking real money until you can execute it flawlessly.

- Embrace the Process: Judge yourself on your discipline, not your daily P&L.

To start your journey on the right foot, using a professional-grade brokerage is key. Compare our in-depth reviews of the best trading platforms for disciplined traders to find one that suits your strategy.

Frequently Asked Questions

Recommended Resources

- Investopedia – Random Reinforcement: A definitive explanation of this psychological concept.

- SEC.gov – Investor.gov: For official resources on responsible investing and understanding risks.

- FCA (FCA.org.uk) – Warning List: To check for unregulated brokers, adding credibility to your warnings.

- Babypips School of Pipsology (Free Forex Course): A renowned free resource for beginners to learn the basics systematically.

- TradingView: For charting and backtesting tools.

- Wall Street Mojo – Jensen’s Alpha: For a deeper dive into advanced performance metrics.