What Is Circuit Breaker, How It Can Save Your Portfolio

A circuit breaker is a mandatory trading halt triggered by severe market declines to prevent panic-selling and restore order. For traders and investors in the US, UK, Canada, and Australia, these mechanisms are vital safety nets on major exchanges like the NYSE and NASDAQ, designed to curb extreme volatility and protect market integrity.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A regulatory mechanism that temporarily halts trading on an exchange following a sharp, predefined price decline. |

| Also Known As | Trading Curb, Market-Wide Circuit Breaker |

| Main Used In | Stock Trading, Derivatives Markets, Cryptocurrency Exchanges |

| Key Takeaway | It acts as a “cooling-off” period to prevent panic and provide time for information dissemination during market crashes. |

| Formula | N/A (Triggered by percentage declines in a market index, e.g., S&P 500) |

| Related Concepts |

What is a Circuit Breaker

Think of a circuit breaker in your home: when there’s an electrical surge, it trips to prevent damage to your appliances and a potential fire. A market circuit breaker serves a similar purpose. When the financial markets experience a severe, rapid sell-off—an “emotional surge” of panic—the exchange automatically halts trading for a predetermined period. This pause is designed to stem the tide of fear, give market participants time to assess the situation, and prevent a disorderly, catastrophic crash like the one in 1987, which directly led to their implementation.

The Core Concept Explained

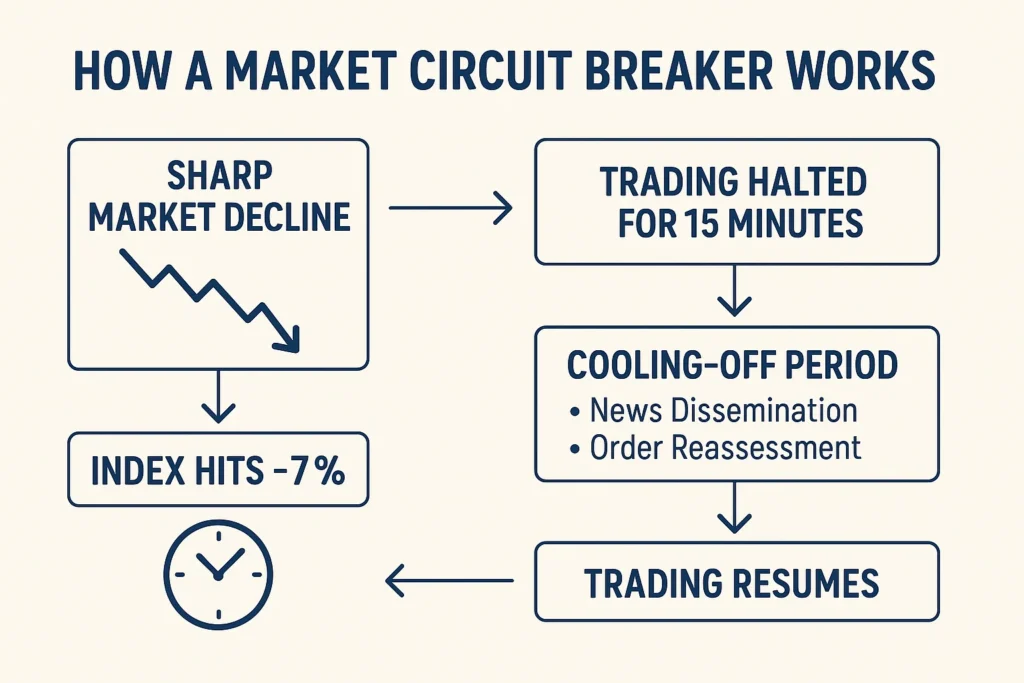

Circuit breakers are triggered by percentage declines in a major market index, such as the S&P 500 in the US. They are not based on individual stock prices. The key idea is that a temporary, coordinated halt can break the negative feedback loop where falling prices trigger more selling, which in turn triggers even more panic. During the halt, traders can reassess their strategies, news can be digested, and buy orders can be gathered, which can help stabilize prices when trading resumes. A key aspect of market liquidity drying up is temporarily addressed by forcing a stop to all activity.

Key Takeaways

How a Circuit Breaker is Triggered

While there is no “formula,” circuit breakers are activated by a clear, rules-based mechanism: a significant percentage drop in a benchmark index from its previous closing price. The rules are set by regulatory bodies like the SEC in the United States.

The US Market Circuit Breaker Rules

The current market-wide circuit breakers for the NYSE and NASDAQ are based on the S&P 500 index. The rules are tiered and time-dependent.

| Decline Threshold | Time of Day | Trading Halt Duration |

| Level 1: -7% | Before 3:25 PM ET | 15 minutes |

| Level 2: -13% | Before 3:25 PM ET | 15 minutes |

| Level 3: -20% | Anytime during the day | Trading halts for the remainder of the day |

Example from March 2020: On March 16, 2020, the S&P 500 opened and quickly fell over 7% from the previous close. This triggered a Level 1 circuit breaker at 9:49 AM ET, halting trading for 15 minutes. This event, driven by COVID-19 panic, was a classic example of the mechanism in action, providing a brief but crucial pause in a day of extreme market volatility.

Why Circuit Breakers Matter to Traders and Investors

Circuit breakers are a cornerstone of modern market structure, impacting all participants.

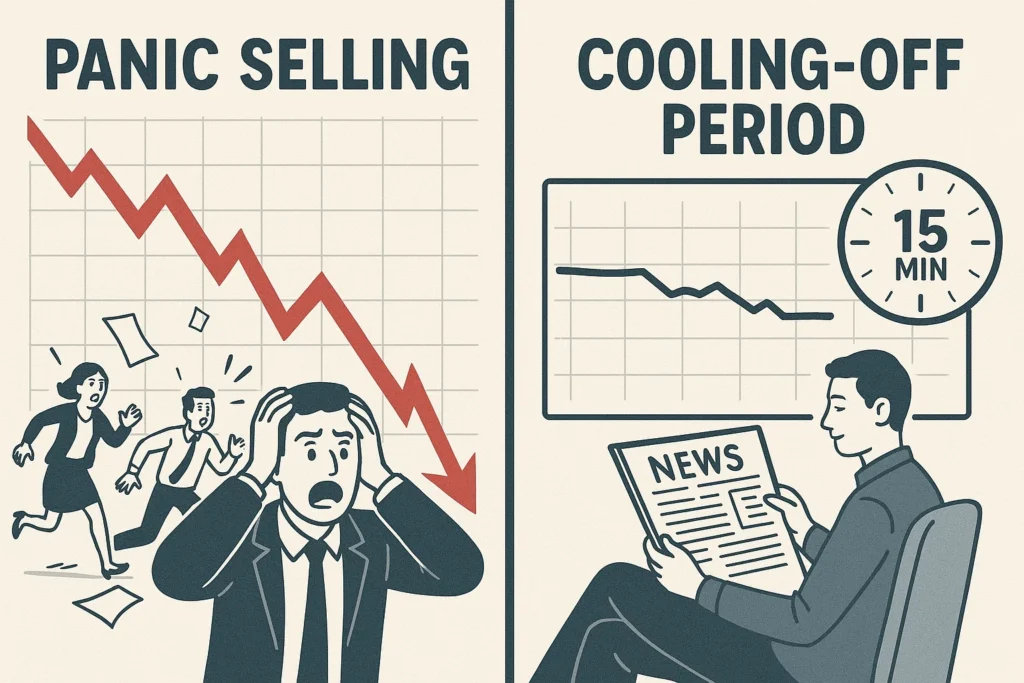

- For Retail Investors: They provide a crucial layer of protection against the kind of instantaneous, catastrophic losses seen in flash crashes. The halt prevents you from making panicked, emotional decisions and selling at the absolute bottom.

- For Institutional Traders and Hedge Funds: They force a pause in algorithmic and high-frequency trading strategies that can exacerbate a downturn. This allows quants and portfolio managers to reassess their risk models and liquidity needs.

- For the Market Overall: They maintain market stability and integrity. By preventing a total meltdown, they help preserve confidence in the financial system, which is essential for its long-term health. Understanding these rules is part of robust risk management.

The History and Evolution of Circuit Breakers

Circuit breakers are a direct response to market failure. The seminal event was Black Monday, October 19, 1987, when the Dow Jones Industrial Average plummeted 22.6% in a single day. The sheer speed and ferocity of the crash, exacerbated by “portfolio insurance” selling, overwhelmed the system. The Brady Commission report recommended the creation of “circuit breakers” to slow future declines.

Since then, the rules have been updated several times:

- 1990s: Initially based on point declines in the Dow.

- 2012: Updated to be based on percentage declines in the S&P 500, a broader and more representative index.

- 2013: The Limit Up-Limit Down (LULD) rule was implemented to address single-stock volatility, a lesson from the 2010 Flash Crash.

This history shows that market safeguards are constantly evolving in response to new types of risks and trading technologies.

How to Navigate a Circuit Breaker in Your Strategy

You can’t trade during a halt, but you can prepare your strategy for when one occurs.

- Case 1: Having a Plan for the Halt: Don’t be caught off-guard. If you see the market down 5-6% rapidly, a circuit breaker is a real possibility. Use the 15-minute halt not to panic, but to check reliable news sources (like Bloomberg or Reuters) and reassess your portfolio’s fundamentals. Was the sell-off justified, or is it an overreaction?

- Case 2: Avoid Market Orders at the Open: After a significant overnight drop, avoid using market orders at the opening bell. The volatility could be extreme, and your order could fill at a terrible price just moments before a circuit breaker is triggered. Use limit orders to maintain control.

- Case 3: Recognizing a Potential Rebound: Historically, the first trading halt (Level 1) does not always mean the selling is over. However, it can sometimes create a short-term bottom as buyers step in during the pause. Watch the order book and volume when trading resumes for signs of stabilization.

Navigating volatile markets requires a reliable brokerage platform with robust tools and fast execution. To find the best platform for your needs, check out our in-depth guide to the Best Online Brokers for Active Traders.

- Prevents Panic: Halts disorderly markets and prevents a catastrophic downward spiral.

- Information Dissemination: Allows all participants to access news and data, creating a fairer playing field.

- Restores Order: Helps gather liquidity and can lead to a more stable market reopening.

- Protects Market Integrity: Maintains overall confidence in the financial system.

- Liquidity Traps: Halts all trading, potentially creating a flood of pent-up orders when the market reopens.

- Delays the Inevitable: May only pause a decline driven by fundamental bad news, not stop it.

- Index Concentration: Relying on one index (like the S&P 500) may miss sector-specific crashes.

- After-Hours Volatility: Selling pressure may shift to futures markets, causing a lower open the next day.

Circuit Breaker in the Real World: The COVID-19 Crash of March 2020

The most dramatic recent example of circuit breakers in action occurred during the onset of the COVID-19 pandemic. Fear of global economic shutdowns triggered historic volatility.

- March 9, 2020: The S&P 500 plunged 7% shortly after the open, triggering a Level 1 circuit breaker. Trading halted for 15 minutes.

- March 12, 2020: Just three days later, it happened again. The market fell 7% in the first few minutes, leading to another 15-minute halt. This was the first time since 1997 that circuit breakers were triggered twice in one week.

- March 16, 2020: The S&P 500 fell 8% at the open, triggering a Level 1 halt for the third time in two weeks.

These events showcased the mechanism’s critical role. While they didn’t stop the bear market, they provided repeated, crucial pauses that prevented a total meltdown and allowed for a more measured, albeit painful, price discovery process. The VIX index, a key measure of market fear, spiked to its highest level in history during this period.

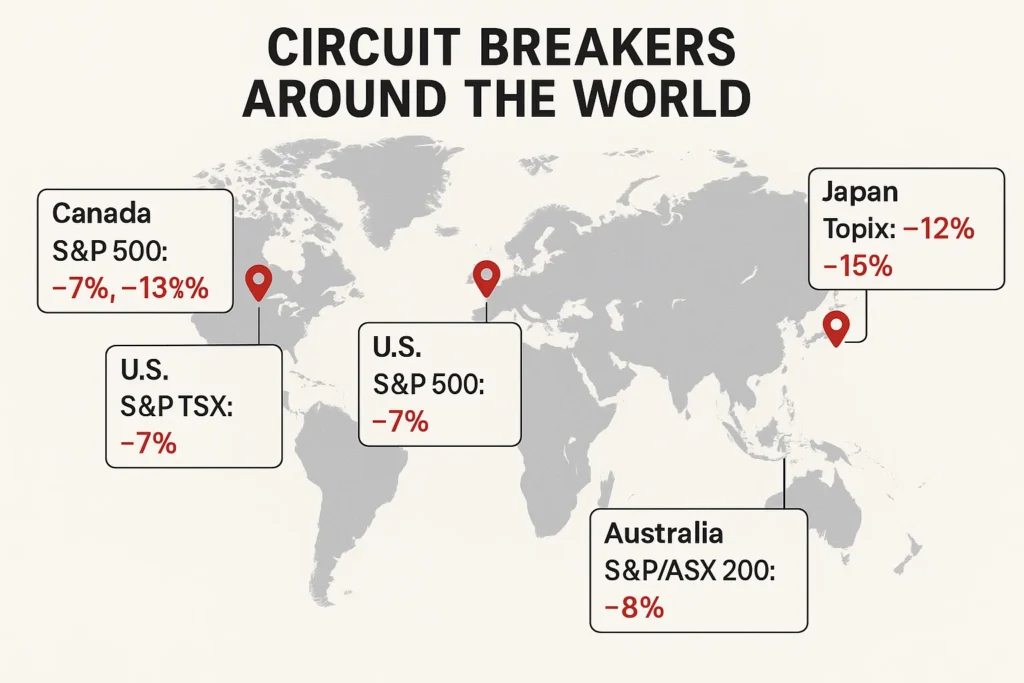

Circuit Breakers Around the World

The US system is just one example. Major financial centers worldwide have their own versions, tailored to their markets. Understanding these can be crucial for international investors or those trading foreign ETFs.

- United Kingdom (London Stock Exchange): The LSE does not have a fixed percentage-based circuit breaker. Instead, it uses a dynamic volatility monitoring mechanism that can halt a stock if its price moves too far from the market’s consensus, a system focused more on individual securities.

- Japan (Tokyo Stock Exchange): The TSE has a market-wide circuit breaker that halts trading in cash equities if the Topix index falls by a specific percentage (e.g., -12%, -15%, etc.) depending on the time of day. They also have price limits on futures contracts.

- Canada (TMX Group): Canadian rules involve single-stock circuit breakers similar to the LULD rule in the US, pausing a stock if its price moves too drastically in a short period.

- Australia (ASX): The ASX has a market-wide circuit breaker that triggers a halt if the S&P/ASX 200 index falls 5.5% from the previous close. A second halt occurs at a 9.5% drop, and a third at 13.5%.

Circuit Breaker (Market-Wide) vs Limit Up-Limit Down (LULD)

It’s easy to confuse market-wide circuit breakers with other volatility control mechanisms.

| Feature | Circuit Breaker (Market-Wide) | Limit Up-Limit Down (LULD) |

|---|---|---|

| What it measures | Broad market index decline (S&P 500) | Individual stock price movement outside a “band” |

| Scope | Halts trading for the entire market | Pauses trading only for the specific stock |

| Duration | 15 minutes or for the rest of the day | 15 seconds to 5 minutes, typically |

| Primary Use | Prevent market crashes | Prevent flash crashes in single stocks |

Conclusion

Ultimately, understanding circuit breakers is less about active strategy and more about risk management and emotional preparedness. They are a fundamental part of the market’s plumbing, designed to protect your capital from its own worst instincts during periods of extreme fear. While not a perfect solution, as we’ve seen they can prevent disorderly crashes and provide a vital window to reassess. By knowing the rules—the 7%, 13%, and 20% thresholds—you can avoid panic and make more rational decisions when volatility inevitably strikes. The next time you see a “Trading Halted” headline, you’ll understand it’s the system working as intended.

Ready to build a portfolio that can weather market storms? The foundation is a solid, long-term strategy. We’ve analyzed and compared the top investment platforms to help you get started. Explore our curated list of the Best Investing Apps for Long-Term Investors

Related Terms

- Volatility: Circuit breakers are a direct response to high market volatility.

- Flash Crash: The 2010 Flash Crash was a key event that led to the refinement of volatility controls like LULD and reinforced the importance of circuit breakers.

- Trading Halt: A circuit breaker is a specific type of regulatory trading halt.

Frequently Asked Questions

Recommended Resources

- SEC Investor Bulletin: Market Volatility – An authoritative source explaining how regulators view and manage volatility.

- NYSE: Circuit Breakers and Trading Curbs – Go straight to the source for the official rules on the NYSE website.

- Investopedia: A History of Circuit Breakers – A deeper dive into the history and evolution of these rules.