What Are Cyclical Stocks, How to Trade, Are They Bad

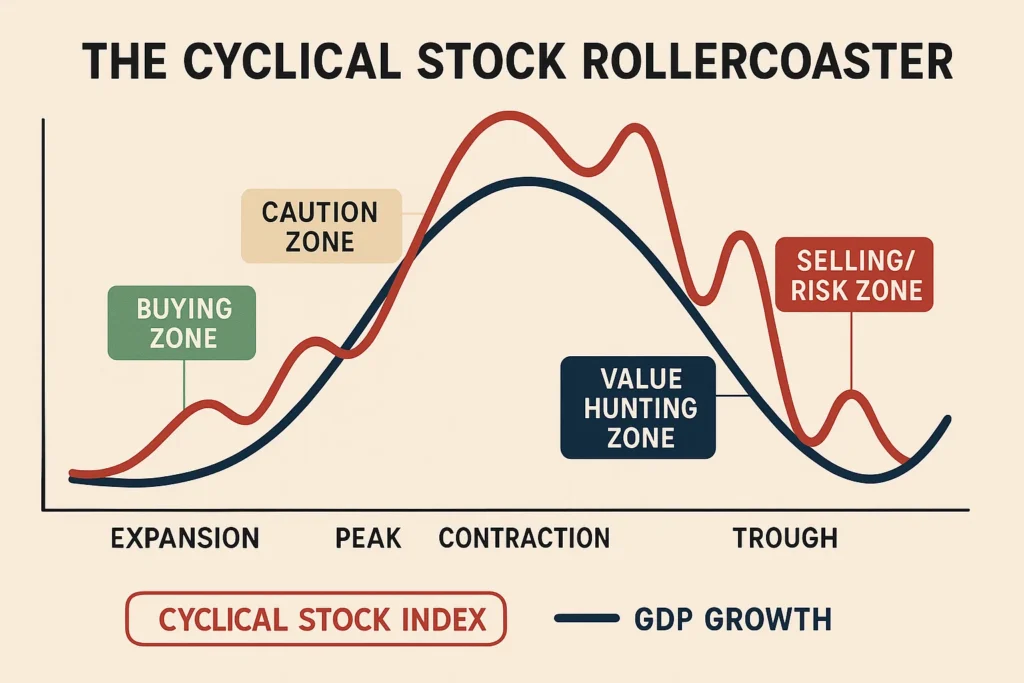

A cyclical stock represents a company whose performance and share price are heavily tied to the broader economic cycle. When the economy booms, these stocks soar; when it contracts, they often fall sharply. Understanding cyclical stocks is crucial for investors in the US, UK, Canada, and Australia aiming to time the market, manage portfolio risk, and capitalize on macroeconomic trends.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A stock of a company whose fortunes are closely tied to the ups and downs of the overall economy. |

| Also Known As | Economic Sensitive Stocks, Procyclical Stocks |

| Main Used In | Sector Rotation Strategies, Economic Timing, Tactical Asset Allocation |

| Key Takeaway | Timing is everything; successful investing in cyclical stocks requires anticipating economic turning points rather than reacting to them. |

| Formula | N/A (Identified by sector, financial metrics, and correlation with economic indicators) |

| Related Concepts |

What is a Cyclical Stock

A cyclical stock is an equity security of a company that sells discretionary goods or services, meaning consumer demand for them rises and falls with the overall health of the economy. These companies are in industries like manufacturing, travel, luxury goods, and construction. When the economy is strong, consumers and businesses have more disposable income and confidence, leading to increased spending on these non-essential items. Conversely, during recessions, these are the first expenses cut. Think of them as the “surfboards” of the stock market—they ride the big waves of economic expansion but can be wiped out when the wave crashes.

Key Takeaways

The Core Concept Explained

At its core, a cyclical stock measures a company’s direct dependency on discretionary spending. The key metric isn’t a single formula but a pattern of correlation. Analysts look for companies whose revenue, earnings, and stock price charts move in near-lockstep with leading economic indicators like GDP growth, industrial production, and consumer confidence indices. A high degree of correlation (e.g., >0.7) often confirms a stock’s cyclical nature. This means when the Federal Reserve or the Bank of England raises interest rates to cool inflation, these stocks are among the first to feel the pain as demand forecasts drop.

How to Identify a Cyclical Stock

Since there’s no single formula, identifying cyclical stocks involves a multi-factor screening process focusing on sector, financials, and statistical measures.

Step-by-Step Identification Guide

- Sector Analysis: Start with the industry. Classic cyclical sectors include:

- Consumer Discretionary: Automakers (Ford, General Motors), luxury brands (LVMH), hotels (Marriott), restaurants.

- Industrials: Aerospace (Boeing), machinery (Caterpillar), construction.

- Financials: Banks (JPMorgan Chase, Barclays) – their profits are tied to loan demand and interest rates.

- Materials: Steel producers, mining companies (Rio Tinto).

- Technology (Semiconductors): Companies like NVIDIA and AMD, as chip demand fluctuates with consumer electronics and business investment.

- Financial Metric Check: Analyze the company’s income statement. Look for:

- High Operating Leverage: High fixed costs mean small changes in sales lead to large swings in profits.

- Volatile Earnings History: Year-over-year earnings that swing from deeply negative to highly positive are a strong sign.

- Statistical Correlation: Calculate or research the stock’s beta (β). A beta significantly above 1.0 (e.g., 1.3 to 2.0) indicates higher volatility than the market, a common trait of cyclicals. You can find this data on financial websites like Yahoo Finance or Bloomberg.

Example Identification:

- Company: A major US airline listed on the NYSE.

- Sector: Industrials (Airlines) – Highly sensitive to business travel, tourism, and fuel costs.

- Financials: Reported massive losses in 2020 (COVID-19 contraction), followed by record profits in 2022-2023 (travel rebound).

- Beta: Typically around 1.5.

- Interpretation: This is a textbook cyclical stock. Its fate is tied directly to economic activity and consumer/business confidence.

For investors in the US and UK, screening tools on platforms like Fidelity, Charles Schwab, or Hargreaves Lansdown are essential for this identification process. You can filter by sector and beta to build a watchlist.

Why Cyclical Stocks Matter to Traders and Investors

Cyclical stocks are not just a category; they are a powerful tool for expressing a macroeconomic view and managing portfolio dynamics.

- For Traders: They offer leveraged opportunities to profit from short-to-medium-term economic forecasts. A trader anticipating a strong retail holiday season might buy consumer discretionary ETFs before earnings announcements. They provide clear catalysts for momentum and swing trading strategies based on economic data releases.

- For Long-Term Investors: They are crucial for sector rotation, a strategy to enhance returns by overweighting sectors expected to outperform in the next phase of the economic cycle. Ignoring cyclicals can mean missing out on the most explosive growth phases of a market recovery. However, they also add volatility, requiring careful position sizing.

- For Analysts: Understanding a company’s cyclicality is fundamental to valuation. It dictates whether to use peak, trough, or normalized earnings in a Discounted Cash Flow (DCF) model. Misjudging this can lead to severe over or undervaluation.

How to Use Cyclical Stocks in Your Strategy

Use Case 1: The Sector Rotation Play

- Scenario: Leading indicators (e.g., rising PMI, falling unemployment claims) suggest an economy is moving from recession to early recovery.

- Action: Begin shifting portfolio allocation from defensive sectors (utilities, staples) into early-cycle cyclicals. These are often financials (as yield curves steepen) and consumer discretionary (as pent-up demand releases). This is a core tenet of the investment clock strategy used by many fund managers.

Use Case 2: The Contrarian “Deep Value” Hunt

- Scenario: A severe economic downturn has hammered cyclical stocks. Headlines are dire, and P/E ratios look high because earnings are near zero.

- Action: Value investors screen for high-quality cyclical companies with strong balance sheets (low debt) that can survive the downturn. They invest at the trough, often when the stock price is below book value, anticipating a multi-year recovery. This requires patience and a strong stomach for volatility.

Use Case 3: The P/E Ratio Trap Avoidance

- Scenario: A cyclical stock appears to have a “low” P/E ratio at the peak of the economic cycle.

- Action: An informed investor knows to use normalized or cycle-adjusted earnings (average earnings over a full cycle) instead of peak earnings. This often reveals the stock is actually expensive. This prevents buying at the top.

Executing these strategies requires a reliable brokerage with robust screening tools and low trading fees. Whether you’re in Canada using Questrade or in Australia using CommSec, choosing the right platform is the first step to implementing a cyclical strategy.

The Psychological Pitfalls of Trading Cyclical Stocks

Investing in cyclicals is as much a psychological challenge as an analytical one.

- The Fear of Missing Out (FOMO) at the Peak: When headlines are euphoric and a cyclical stock has already doubled, anchoring to past performance can lead to buying high. Antidote: Use trailing stop-loss orders and have predefined valuation ceilings.

- Panic Selling at the Trough: When news is relentlessly negative and losses mount, the urge to “sell before it goes to zero” is strong. Antidote: Pre-commit to a strategy based on fundamentals (e.g., “I will add if the price falls below book value, provided debt levels are stable”) rather than emotion.

- Confirmation Bias in Economic Views: Investors often seek information that confirms their bullish or bearish stance on the economy, ignoring contrary signals. Antidote: Actively follow a dashboard of contrary indicators and assign a “probability” to your economic outlook, adjusting it as new data arrives.

- Outsized Returns: Potential for gains that far exceed the broader market during economic upswings.

- Macro-Driven Clarity: Clear catalysts from widely-reported economic data (GDP, employment).

- Strategic Flexibility: Ideal for active strategies like sector rotation and tactical allocation.

- Clear Value Signals: Extreme pessimism at cycle lows can present classic margin-of-safety buying opportunities.

- Extreme Volatility: Devastating downside risk during recessions; potential for permanent capital loss.

- Difficult Timing: Consistently calling economic turning points is notoriously difficult, even for professionals.

- Earnings Instability: Unreliable dividends, as payouts are often cut to preserve cash in downturns.

- Lagging Indicator Trap: Prices move before economic data, making reactive investing a losing strategy.

Cyclical Stocks in the Real World: The 2008-2013 Auto Industry Case Study

The Global Financial Crisis (GFC) and its aftermath provide a perfect case study. General Motors (GM) and Ford (F), classic US cyclical stocks, were decimated in 2008-2009 as credit froze and consumer demand evaporated. GM filed for bankruptcy. Investors who recognized the extreme cyclical trough—fueled by government intervention (Troubled Asset Relief Program) and pent-up demand—could have bought Ford shares below $2 in late 2008. As the US economy embarked on a long recovery, driven by low interest rates from the Federal Reserve, auto sales rebounded. Ford’s stock price increased over tenfold from its lows by 2013, dramatically outperforming the S&P 500. This cycle repeated, though less severely, during the COVID-19 pandemic, highlighting the recurring pattern of boom and bust for these companies.

Cyclical Stocks in a Portfolio: Allocation Strategies

How much of your portfolio should be in cyclical stocks? There’s no one answer, but here are structured approaches:

- The Strategic (Passive) Weight: Mirror the market. If cyclicals make up 35% of the S&P 500, that’s your neutral, long-term holding.

- The Tactical Tilt (Active): Based on your economic view, you can over- or under-weight by 5-15%. For example, moving from 35% to 45% allocation in early recovery.

- The Barbell Approach (for Risk Management): Pair a concentrated position in a few high-conviction cyclical stocks with a larger, stable allocation to bonds and defensive stocks. This limits downside while maintaining upside exposure.

- Using ETFs for Sector Exposure: Instead of picking individual stocks, consider ETFs like the Consumer Discretionary Select Sector SPDR Fund (XLY) or the Industrial Select Sector SPDR Fund (XLI) to get broad, diversified exposure to cyclical sectors, reducing company-specific risk.

Cyclical Stocks vs Defensive Stocks

The most crucial distinction is between Cyclical and Defensive (or Non-Cyclical) stocks.

| Feature | Cyclical Stock | Defensive Stock |

|---|---|---|

| Primary Driver | Overall economic health and discretionary spending. | Basic, consistent consumer needs (utilities, healthcare, staples). |

| Performance During Recession | Typically underperforms significantly. | Typically holds up better or even outperforms. |

| Beta (Volatility) | Generally high (>1.0). | Generally low (<1.0). |

| Dividend Profile | Often less reliable, can be cut. | Generally stable and reliable. |

| Investor Goal | Capital appreciation through economic timing. | Capital preservation and steady income. |

Conclusion

Ultimately, understanding cyclical stocks provides a critical framework for aligning your portfolio with the macroeconomic winds. They are powerful engines for growth but come with significant volatility and timing risk. As we’ve seen, they are best used proactively within a disciplined strategy like sector rotation or contrarian value investing, not reactively. By incorporating an awareness of economic cycles and stock sensitivity into your research, you can make more informed, strategic decisions—whether that means harnessing their power for growth or avoiding their pitfalls for stability.

Related Terms:

- Beta (β): Measures a stock’s volatility relative to the market. Cyclicals usually have high beta.

- Sector Rotation: The active strategy of moving investments between sectors (like cyclicals and defensives) based on the economic cycle.

- Economic Cycle: The natural fluctuation of the economy between expansion and contraction. The fundamental driver of cyclical stocks.

- Value Investing: A strategy where cyclical stocks at their trough are often prime candidates, appearing “cheap” on metrics like Price-to-Book.

- Consumer Discretionary Sector: The ETF sector (ticker: XLY) that contains many classic cyclical stocks.

Frequently Asked Questions About Cyclical Stocks

Recommended Resources

- The Investopedia page on Cyclical Stocks offers a solid foundational reference.

- For tracking the drivers, follow the U.S. Bureau of Economic Analysis (BEA) for GDP reports and the Federal Reserve Economic Data (FRED) portal.

- Research papers on “sector rotation” and “business cycle investing” available on SSRN can provide deeper strategic frameworks.