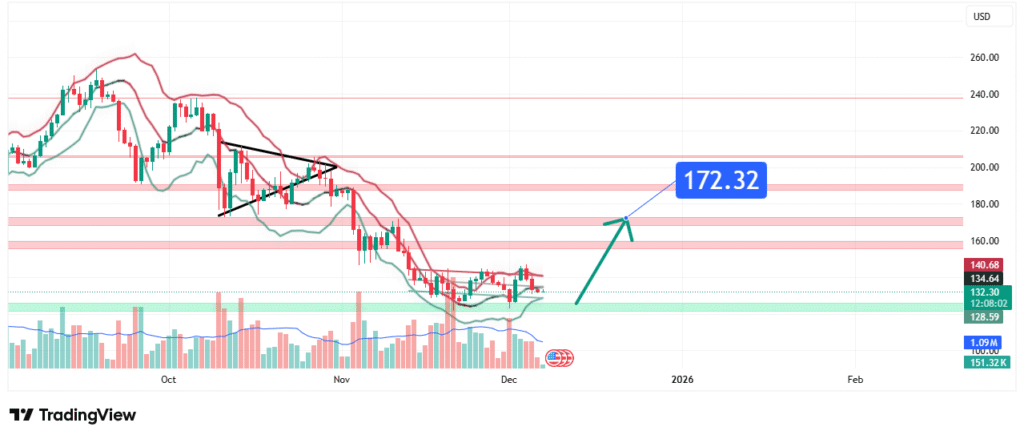

Solana Price Forecast Eyeing a Rally to $172.32 Resistance

Solana’s price has been consolidating in a bullish flag pattern after a significant rally from its yearly lows. This price action suggests a bullish continuation bias is forming. Our analysis projects a breakout towards a primary target of $172.32, which represents a key historical resistance level from early 2024. This prediction is based on a confluence of technical factors, including a strong support hold, bullish market structure, and the potential completion of a consolidation phase.

Current Market Structure and Price Action

The current market structure is bullish, characterized by a series of higher highs and higher lows. The price is currently interacting with a crucial support zone between $125 and $135. This area has acted as both resistance and support in recent months, and its current role as support is a positive sign. Recent price action has shown low volatility compression and tightening ranges, indicating that a volatility expansion and a potential breakout to the upside may be imminent as the asset builds energy.

Identification of the Key Support Zone

The most critical technical element is the Strong Support Zone between $125 and $135. The strength of this zone is derived from:

- Historical Significance: This zone was a major resistance area throughout Q1 2024. A successful flip from resistance to support is a classic bullish technical signal.

- Technical Confluence: The zone aligns with the 50-day Exponential Moving Average (EMA) and the 0.382 Fibonacci retracement level of the recent impulse wave, adding to its importance.

- Market Psychology: This round-number area represents a point where buyers have previously stepped in aggressively, creating a psychological floor for the asset.

This confluence makes it a high-probability level for a bullish reaction and the launchpad for the next leg up.

Technical Targets and Rationale

Our analysis identifies the following price target(s):

Primary Target: $172.32

This level represents a previous major swing high and a strong resistance zone from February 2024. It is the next logical ceiling for price discovery following a successful breakout from the current consolidation. A move to this target would represent a ~30% gain from current levels.

Secondary Target: $200+ (Psychological Level)

This is a more ambitious target, acting as the next key psychological barrier. A decisive break and close above $172.32 would open a clear path for a test of the $200 region.

Prediction: We forecast that the price will hold the $125-$135 support zone and break above the recent consolidation highs near $150, moving towards PT1 at $172.32.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish continuation thesis is invalidated if the price achieves a daily close below $120. This level represents a clear break of the higher low structure and the key support confluence zone, signaling a deeper correction is underway.

- Position Sizing: Any long positions taken should be sized so that a loss triggered at the invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Network Performance & Adoption: Solana’s consistently high throughput and low fees continue to attract developers and users, with sustained growth in DeFi TVL and NFT volumes providing a strong fundamental base.

- Overall Crypto Sentiment: The market is closely tracking Bitcoin ETF flows and macroeconomic trends. A positive shift in broader crypto sentiment would act as a strong tailwind for SOL’s predicted move.

- Institutional Interest: Continued development and partnerships within the Solana ecosystem are key drivers for long-term value and can fuel bullish momentum.

Conclusion

Solana is at a technical decision point within a bullish structure. The weight of evidence suggests a bullish resolution, targeting a move to $172.32. Traders should monitor for a confirmed breakout above the $150 consolidation high and manage risk diligently by respecting the key invalidation level at $120. The reaction at the $172.32 target zone will be crucial for determining whether the rally can extend towards $200.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.