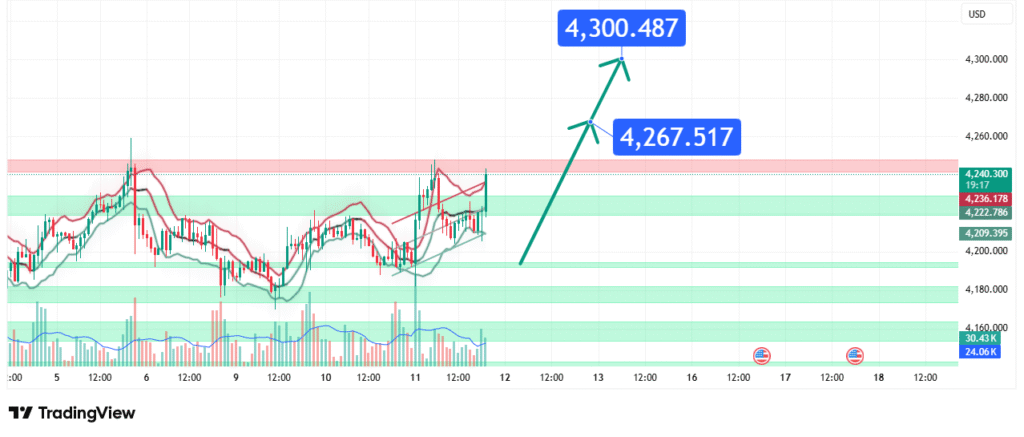

Gold Price Forecast New All-Time Highs in Sight at $4,300

Gold’s price has catapulted to unprecedented all-time highs, decisively breaking through the $4,200 psychological barrier with significant momentum. This explosive price action confirms a powerful bullish trend acceleration. Our analysis projects a continued ascent towards sequential targets at $4,267 and $4,300. This prediction is based on a confluence of technical factors, including a parabolic breakout from consolidation, strong bullish candlestick patterns, and a notable increase in buying volume during the ascent.

Current Market Structure and Price Action

The current market structure is extremely bullish and parabolic. The price is not merely in an uptrend but is in a phase of vertical expansion, indicating intense buying pressure and FOMO (Fear Of Missing Out) from institutional and retail traders alike. The price is currently consolidating its gains just above the previous all-time high resistance (now support) near $4,220 – $4,230. Recent price action has shown large, full-bodied bullish candles followed by shallow pullbacks, a classic signature of a strong trend where buyers aggressively absorb any selling. This structure suggests further upside is the path of least resistance.

Identification of the Key Support Zone (New Floor)

The most critical technical element is the New Support Zone between $4,220 and $4,230. The strength of this zone is derived from:

- Historical Significance: This area was the previous all-time high resistance. The principle of “resistance becomes support” is one of the most powerful in technical analysis, and a successful hold here would validate the breakout’s strength.

- Technical Confluence: The zone aligns with the breakout point and a key Fibonacci retracement level (often the 23.6% or 38.2% level of the latest impulsive wave). The chart also indicates significant volume activity here.

- Market Psychology: This level represents the “point of recognition” for the new bullish paradigm. Traders who missed the initial breakout will look to buy any dip to this level, creating a self-fulfilling support.

This confluence makes it the critical level to watch for maintaining the bullish thesis.

Technical Targets and Rationale

Our analysis identifies the following sequential price targets:

Primary Target (PT1): $4,267

This level represents the immediate measured move target based on the size of the recent consolidation pattern projected upward from the breakout point. It is a common initial objective following a parabolic thrust.

Secondary Target (PT2): $4,300

This is our key psychological and round-number target. The $4,300 level represents a major milestone and is a clear magnet for price action after such a powerful move. It also aligns with Fibonacci extension levels (e.g., 1.272 or 1.618) of the preceding correction.

Prediction: We forecast that the price will hold above the $4,220-$4,230 support zone and continue its ascent, first testing PT1 at $4,267 before making a run towards the major psychological target at PT2: $4,300.

Risk Management Considerations

Trading parabolic moves requires exceptionally strict risk management, as volatility and pullbacks can be severe.

- Invalidation Level (Stop-Loss): The entire bullish acceleration thesis would be severely damaged if the price achieves a daily close below $4,180. This level is below the new support zone and the previous local swing low. A break here would suggest the breakout may have been false or exhausted, potentially leading to a much deeper correction.

- Position Sizing: Due to elevated volatility, position sizes should be reduced compared to normal market conditions. Any long positions should be sized so that a loss represents a very small percentage of capital (e.g., 1% or less).

Fundamental Backdrop

The technical breakout is supported by a potent fundamental mix:

- Geopolitical Turmoil & Safe-Haven Demand: Ongoing global conflicts and uncertainty are driving massive capital into traditional safe-haven assets like gold.

- Central Bank Buying: Aggressive gold accumulation by central banks worldwide, particularly from emerging markets, provides a structural, non-speculative bid under the market.

- US Dollar and Rate Expectations: Any perceived weakness in the US Dollar or expectations that the Federal Reserve may slow its tightening cycle are profoundly bullish for gold, reducing the opportunity cost of holding the non-yielding asset.

Conclusion

Gold is in a historic bullish phase, trading in uncharted territory with immense momentum. The weight of evidence suggests the bullish trend will continue, targeting a move first to $4,267 and then the major psychological level at $4,300. Traders should monitor the $4,220-$4,230 zone for support and consider that in parabolic moves, the trend is your friend until it ends. Manage risk with extreme diligence by respecting the key invalidation level at $4,180.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. Trading commodities like gold involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.