Bitcoin (BTC) Price Forecast Bullish Target at $90,336

Bitcoin’s price

Current Market Structure and Price Action

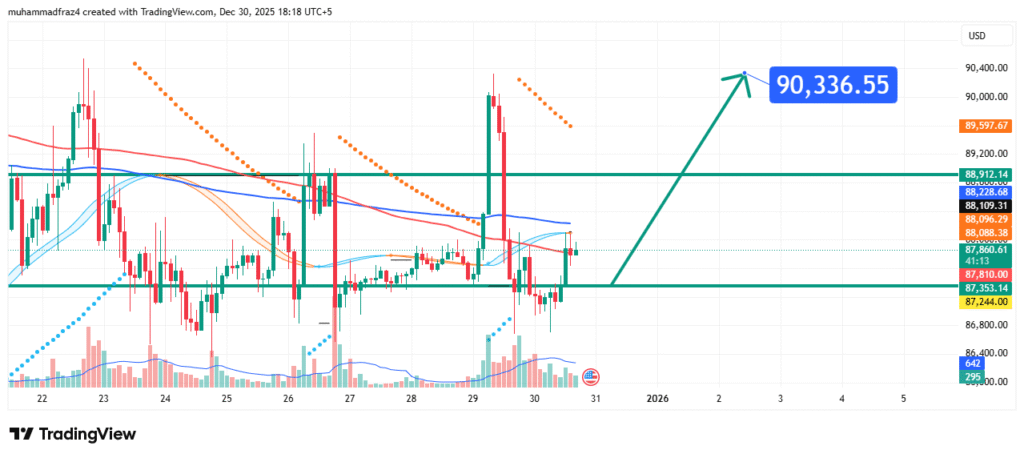

The overarching market structure for Bitcoin remains decisively bullish, characterized by a series of higher highs and higher lows. The price is currently interacting with the upper boundary of its short-term consolidation range and the 20-period Exponential Moving Average (EMA) on the 4-hour chart, which is acting as dynamic support. Recent price action has shown decreasing volatility and tightening ranges—a classic sign of compression often preceding a significant breakout. The ability to hold above the $86,500 support is a key bullish tell.

Identification of the Key Resistance Zone & Breakout Level

The immediate hurdle is the Resistance Zone between $88,800 and $89,200.

- Historical Significance: This zone has capped several recent rally attempts, creating a clear supply wall.

- Technical Confluence: It aligns with a minor Fibonacci extension level and represents the previous local high from which the current consolidation began.

- Market Psychology: A daily close above this zone would signify that sellers at this level have been exhausted, likely triggering a wave of momentum buying and short covering.

A confirmed breakout above $89,200 is the critical catalyst needed to activate the move towards our primary target.

Technical Target and Rationale

Our analysis identifies the following price target:

Primary Target (PT1): $90,336

This target is derived from a 1.618 Fibonacci extension of the recent consolidation wave (measuring from the swing low to high before the pause). Furthermore, $90,336 acts as a major psychological and round-number resistance level, likely to attract significant attention. A break above this could open the path towards $92,000.

Prediction: We forecast that Bitcoin will successfully break above the $88,800-$89,200 resistance zone and propel towards our primary target at $90,336. The move is expected to be supported by increasing volume.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish continuation thesis is invalidated if the price achieves a sustained 4-hour close below $86,500. This level represents the recent swing low of the consolidation and a break below it would suggest a deeper corrective pullback is underway, potentially towards $84,800.

- Position Sizing: Any positions aligned with this bullish outlook should be sized so that a loss triggered at the $86,500 invalidation level represents a small, pre-defined percentage of your total trading capital (strictly 1-3%).

Fundamental Backdrop

The technical setup is reinforced by a supportive fundamental landscape:

- Institutional Inflows: Sustained inflows into U.S. Spot Bitcoin ETFs indicate continued institutional demand, providing a strong underlying bid for BTC.

- Macro Tailwinds: Growing anticipation of a less restrictive monetary policy from the Federal Reserve is weakening the US Dollar (DXY), historically a positive catalyst for Bitcoin and risk assets.

- Halving Momentum: The market continues to trade in the post-halving period, where historical precedent and reduced new supply creation support long-term bullish narratives.

These factors collectively contribute to a bullish sentiment, providing a firm foundation for the technical breakout scenario.

Conclusion

Bitcoin is at a critical technical juncture, compressing energy for its next directional move. The confluence of bullish structure, supportive fundamentals, and a defined breakout level suggests a high-probability move towards $90,336. Traders should monitor for a confirmed breakout above $89,200 with accompanying volume and manage risk diligently by respecting the key invalidation level at $86,500. The reaction at the $90,336 target will be pivotal for assessing the strength of the next leg up.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.