How to Open a Fidelity 401k A Simple Guide for Beginners

Want to build a secure financial future and take control of your retirement savings? Learning how to open and optimize your Fidelity 401k is the most powerful first step you can take. This guide will walk you through the entire process, from eligibility checks to selecting your first investments, so you can start growing your wealth with confidence.

For employees in the US, using a Fidelity 401k is one of the most tax-efficient ways to save for retirement, allowing your investments to grow tax-deferred while you potentially lower your current taxable income.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | To successfully open and initially fund a Fidelity 401k account. |

| Skill Level | Beginner |

| Time Required | 20-30 minutes |

| Tools Needed | Your Employer’s Plan Information, Social Security Number, Personal Banking Details, Computer/Smartphone. |

| Key Takeaway | A Fidelity 401k is a powerful tool for tax-advantaged retirement savings, often with an employer match that is essentially free money. |

Why Opening a Fidelity 401k is Crucial for Your Financial Future

A Fidelity 401k isn’t just a savings account; it’s a powerful, tax-advantaged investment vehicle designed to fund your retirement. For most Americans, it’s the cornerstone of their wealth-building strategy. The problem it solves is twofold: it forces disciplined, long-term saving and leverages the magic of compound growth in a way taxable accounts cannot.

By successfully opening and contributing to your Fidelity 401k, you are not just saving money; you are building a financial engine. You gain access to potential employer-matched contributions (free money), significant tax breaks, and a curated selection of investments, putting you on the path to a secure and independent retirement.

Key Takeaways

What You’ll Need Before You Start

Before you begin the enrollment process, having the following information on hand will make it quick and seamless.

Knowledge Prerequisites: Basic understanding of what a 401k is and a general idea of your retirement goals and risk tolerance.

Information & Documents Required:

- Your Social Security Number (SSN).

- Your employer’s name and your employee ID.

- Your bank account and routing numbers for setting up contributions.

- Your desired contribution percentage or dollar amount.

Tools & Platforms: A computer or smartphone with internet access to visit the Fidelity NetBenefits website or use the mobile app.

To make the investment selection process easier, you’ll need to understand basic asset classes. Many of the best online brokers for beginners, like E*TRADE or Charles Schwab, offer extensive educational resources that can help.

How to Open a Fidelity 401k: A Step-by-Step Walkthrough

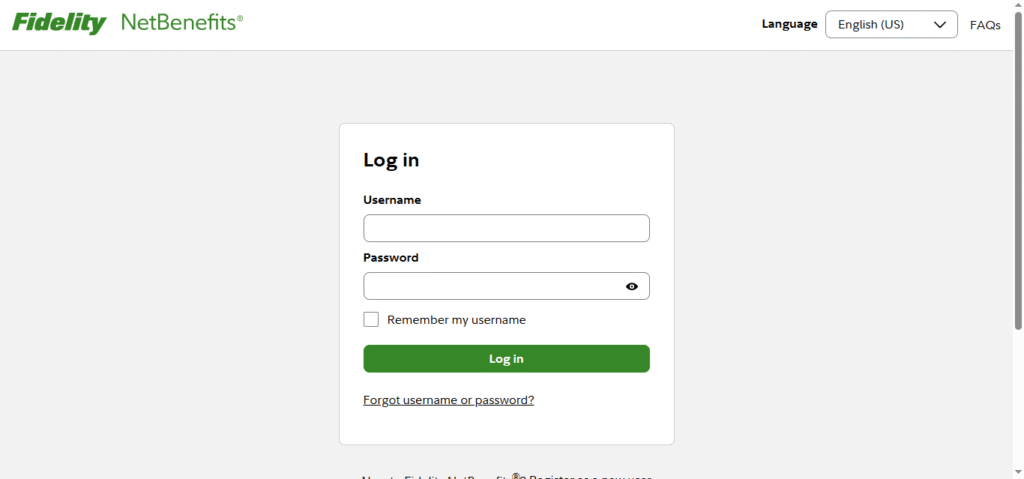

Step 1: Access Your Fidelity NetBenefits Portal

You cannot open a 401k directly on Fidelity’s public website. Your enrollment is managed through a dedicated portal for your company’s plan.

Go to the Fidelity NetBenefits website or open the app. You will typically receive a link and login credentials from your employer’s HR department shortly after you become eligible for the plan. If you can’t find it, contact HR.

Pro Tip: Bookmark the NetBenefits login page for easy future access. Ensure you are on the correct Fidelity site (check the URL) to avoid phishing scams.

Step 2: Initiate Enrollment and Set Your Contribution Rate

Once logged in, navigate to the “Benefits” or “Retirement” section and find the 401k enrollment option.

The system will guide you through the enrollment steps. The most critical decision here is setting your contribution rate. This is the percentage of your pre-tax salary that will be automatically deducted from each paycheck and invested into your 401k.

Common Mistake to Avoid: Contributing less than the amount required to get your employer’s full matching contribution. For example, if your employer matches 50% of your contributions up to 6% of your salary, you should contribute at least 6% to get the full 3% match (50% of 6%). Anything less is leaving free money on the table.

Step 3: Designate Your Beneficiaries

This is a crucial but often overlooked step.

You will be prompted to name one or more beneficiaries for your account. This determines who will receive the funds in your 401k if you pass away. You can typically name primary and contingent beneficiaries and specify percentages.

Pro Tip: Review and update your beneficiaries after major life events like marriage, divorce, or the birth of a child.

Step 4: Choose Your Investments

This is where your money will actually be put to work. Your contributions will typically go into a default money market fund until you direct them elsewhere.

You will be presented with a list of investment options, which usually include mutual funds, target-date funds, and sometimes company stock. Your choices will determine your portfolio’s risk and growth potential.

Formula for Beginners: If you’re unsure where to start, a Target-Date Fund is an excellent choice. Simply pick the fund closest to the year you plan to retire (e.g., Fidelity Freedom® 2055 Fund). These funds are professionally managed to automatically adjust their asset allocation, becoming more conservative as you approach retirement.

Step 5: Review and Submit

Carefully review all your selections: your contribution amount, beneficiaries, and investment elections.

Once you submit your enrollment, you will receive a confirmation. Your contributions will typically begin on the next available pay cycle. Congratulations, you’ve officially started your retirement investing journey!

Beyond Enrollment: Managing Your Fidelity 401k Like a Pro

Opening your account is just the beginning. Proactive management is key to maximizing your returns.

1. Rebalancing Your Portfolio:

Over time, your chosen investment allocation will drift as some assets grow faster than others. Rebalancing is the process of buying and selling assets to return to your original target allocation. This forces you to “buy low and sell high” and controls risk.

How-to: On NetBenefits, you can often set up automatic annual or quarterly rebalancing. Alternatively, you can manually review and rebalance once a year.

2. Performing an Annual 401k Check-up: Once a year, log in and review:

- Performance: How are your investments doing relative to their benchmarks?

- Fees: Are you in the lowest-cost share classes of the funds available?

- Contribution Rate: Can you afford to increase it by 1%?

- Life Changes: Have your risk tolerance or retirement goals changed? Adjust your investments accordingly.

How to Use Your Fidelity 401k in Your Overall Financial Strategy

Your 401k shouldn’t exist in a vacuum. It’s one piece of your financial puzzle.

Scenario 1: Early in Your Career: Your goal should be to consistently contribute at least enough to get the full employer match. Even if you start with just 5-6%, the power of compounding over decades is immense. As you get raises, increase your contribution percentage by 1% each year.

Scenario 2: Changing Jobs: When you leave an employer, you have several options for your old 401k. The most recommended is to initiate a rollover into your new employer’s 401k plan (if allowed) or into a Fidelity Rollover IRA. This keeps your retirement savings consolidated and growing tax-deferred.

Case Study: “Maria, a 28-year-old graphic designer, started her first job with a 401k. Her employer offered a 100% match on the first 3% of her salary. By enrolling immediately and contributing 5%, she not only got the full 3% match but also built a habit of saving. Ten years later, thanks to consistent contributions, the employer match, and market growth, her 401k balance is over $80,000, providing a strong foundation for her future.”

Considering a rollover? Managing multiple retirement accounts can be tricky. Opening a Fidelity Rollover IRA can simplify your finances and give you access to a wider range of investment options.

Common Mistakes When Opening a Fidelity 401k (And How to Fix Them)

Pitfall 1: Not enrolling at all. Life gets busy, and it’s easy to procrastinate.

Solution: Set a calendar reminder for your eligibility date. Treat enrollment as a mandatory HR task, not an optional one.

Pitfall 2: Leaving the employer match on the table. This is the most costly error.

Solution: During enrollment, find your plan’s “Summary Plan Description” document and confirm the matching formula. Set your contribution to at least meet the full match threshold.

Pitfall 3: Being too conservative in your investments. Young investors who choose only low-yield bonds or money markets miss out on long-term growth.

Solution: Understand your time horizon. If you’re decades from retirement, your portfolio should be heavily weighted toward stocks for growth. A target-date fund handles this automatically.

Pitfall 4: Taking early withdrawals. Withdrawing funds before age 59½ typically results in a 10% early withdrawal penalty plus income taxes, severely hampering your growth.

Solution: View your 401k as untouchable for anything but retirement. Build a separate emergency fund for unexpected expenses.

- Tax Advantages Contributions lower your current taxable income and grow tax-deferred.

- Employer Match Get an instant return on your investment with “free money” from your company.

- Automatic Savings Payroll deductions make disciplined, consistent investing effortless.

- High Contribution Limits Save more per year than with IRAs, accelerating your retirement goals.

- Creditor Protection Your retirement savings are generally safe from bankruptcy proceedings.

- Limited Choices You can only invest in the specific funds offered by your employer’s plan.

- Early Withdrawal Penalties Accessing funds before age 59½ incurs a 10% penalty plus taxes.

- Required Distributions You must start taking money out at age 73, which may not align with your needs.

- Fees Plan and fund fees can reduce your net returns if you’re not vigilant.

- Portability Managing the account after changing jobs requires active decision-making.

Understanding Fidelity’s Fund Offerings: A Primer

Your plan’s investment menu can be overwhelming. Here’s a breakdown of common fund types you’ll find.

- Target-Date Funds (e.g., Fidelity Freedom® Index Funds): As discussed, these are all-in-one funds tied to a retirement year. They are the ultimate “set-it-and-forget-it” option.

- Index Funds (e.g., Fidelity 500 Index Fund – FXAIX): These funds track a specific market index, like the S&P 500. They are typically low-cost and are a great building block for a portfolio.

- Actively Managed Funds: These are funds where a manager tries to beat the market by picking stocks. They often have higher fees, and most fail to beat their benchmark index over the long term.

- Bond Funds (e.g., Fidelity U.S. Bond Index Fund – FXNAX): These provide income and stability to your portfolio. The proportion of stocks to bonds is the primary driver of your portfolio’s risk level.

Pro Tip: For most investors, a simple portfolio built around a target-date fund or a mix of a few low-cost stock and bond index funds is the most reliable path to success.

Taking Your Fidelity 401k to the Next Level

For readers who have mastered the basics and want to optimize further.

Maximizing Tax Efficiency with a Roth 401k: Many Fidelity 401k plans now offer a Roth option. With a Roth 401k, you contribute post-tax money. This means you don’t get a tax break today, but your qualified withdrawals in retirement are completely tax-free. This can be a huge advantage if you expect to be in a higher tax bracket in retirement.

Mega Backdoor Roth Strategy: For high earners looking to save more than the standard contribution limit, some Fidelity 401k plans allow for after-tax contributions (different from Roth) which can be converted in-plan to a Roth 401k or Roth IRA. This is a complex but powerful strategy to shelter over $60,000 per year from taxes.

Fidelity 401k vs Fidelity IRA

It’s crucial to understand how a 401k fits among other common retirement accounts.

| Feature | Fidelity 401k | Fidelity IRA |

|---|---|---|

| Contribution Limit | $23,000 ($30,500 if 50+) | $7,000 ($8,000 if 50+) |

| Employer Match | Yes, common | No |

| Investment Choices | Limited to employer’s plan | Virtually unlimited (stocks, bonds, ETFs, etc.) |

| Income Limits | None for contributions | Yes, for deducting Traditional IRA and contributing to Roth IRA |

| Best For | Primary retirement saving, especially with an employer match. | Supplemental retirement saving, rollovers, or self-directed investing. |

Conclusion

You now possess the knowledge to take one of the most important steps for your financial future. By following the steps to open your Fidelity 401k, you are moving from passive saver to active investor. Remember to prioritize the employer match, choose appropriate investments, and avoid the common pitfalls of procrastination and early withdrawals.

Your action plan is simple: Enroll today. Log in to NetBenefits, set your contribution to at least the full match percentage, select a target-date fund if you’re unsure, and name your beneficiaries. The single best day to start was yesterday; the second-best day is today.

To make tracking your overall net worth easier, consider using a free portfolio tracker like Personal Capital. And if you’re looking for a platform to manage other investment goals, check out our reviews of the best investment platforms for beginners.