What Are Bonds, A Complete Guide to Fixed Income Investing

Do you want to build a diversified portfolio, generate steady income, or add a stabilizing force to your investments? Understanding what bonds are and how they work is the key. This step-by-step guide will walk you through everything you need to know, from the basic mechanics to building a bond portfolio tailored to your financial goals.

For investors in the US and Canada, bonds offer significant tax benefits. The interest from municipal bonds is often exempt from federal (and sometimes state/provincial) income tax, while Treasury bonds are generally exempt from state and local taxes. Understanding these nuances can help you keep more of your investment returns.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | Understand what bonds are, how to invest in them, and how they can fit into your portfolio. |

| Skill Level | Beginner to Intermediate |

| Time Required | 15-20 minutes for basics; ongoing for portfolio management. |

| Tools Needed | Access to a brokerage account, understanding of your financial goals. |

| Key Takeaway | Bonds are loans you make to governments or companies, providing predictable income and portfolio stability, making them a crucial component for diversification. |

| Related Concepts |

Why Understanding Bonds is Crucial for Every Investor

Knowing how bonds work solves a fundamental problem for investors: how to balance the pursuit of growth with the need for stability and predictable income. Unlike stocks, which represent ownership in a company, bonds represent a loan you make to an issuer, such as a government or corporation. This foundational difference is why bonds are often called “fixed-income” securities; they typically provide regular, scheduled interest payments and the return of your principal at a set future date.

The core problem bonds solve is portfolio volatility. When stock markets swing wildly, bonds historically have shown less dramatic price movement, acting as a cushion. For investors approaching retirement or those with a lower risk tolerance, this stability is invaluable. Furthermore, bonds provide a reliable source of income through coupon payments, which can be essential for funding living expenses without having to sell assets at an inopportune time.

Ultimately, mastering bonds empowers you to build a resilient, diversified portfolio. You’ll be equipped to make strategic choices about how much risk to take, how to generate tax-efficient income, and how to protect your capital while still participating in the market’s growth potential.

Key Takeaways

What You’ll Need Before You Start

Before diving into bond investing, it’s helpful to have a few things in place. This will make your learning process smoother and your investment decisions more informed.

Knowledge Prerequisites:

- Basic Financial Goals: Clarify why you want to invest in bonds (e.g., for income, stability, or diversification).

- Understanding of Risk: A general sense of your personal risk tolerance.

- Familiarity with Investment Accounts: Knowing how a brokerage account works is essential for actually purchasing bonds or bond funds.

Data & Research Requirements:

- Issuer Credit Ratings: These are grades (like AAA or BB) given by agencies like Moody’s and S&P that assess the issuer’s ability to repay its debt. This is a key indicator of risk.

- Current Interest Rate Environment: A basic awareness of whether market interest rates are rising, falling, or stable, as this directly impacts bond prices.

- Yield Comparisons: Knowing how to find and compare yields like Yield to Maturity (YTM), which estimates your total return if you hold the bond until it matures.

Tools & Platforms:

- A Brokerage Account: This is your gateway to the bond market. You can buy individual bonds, bond mutual funds, or bond ETFs through most online brokers.

- Financial News & Data Websites: Sites like the U.S. Treasury’s TreasuryDirect for buying government bonds directly, or financial portals for researching bond prices and yields.

- A Simple Calculator or Spreadsheet: For comparing yields and understanding the math behind your potential returns.

To easily access the bond market and research credit ratings, you’ll need a reliable brokerage platform. Many of the best online brokers for investors, like Vanguard, Charles Schwab, or Fidelity, offer robust bond trading platforms, educational resources, and a wide selection of bond funds. Researching and choosing the right broker is a critical first step in your bond investing journey.

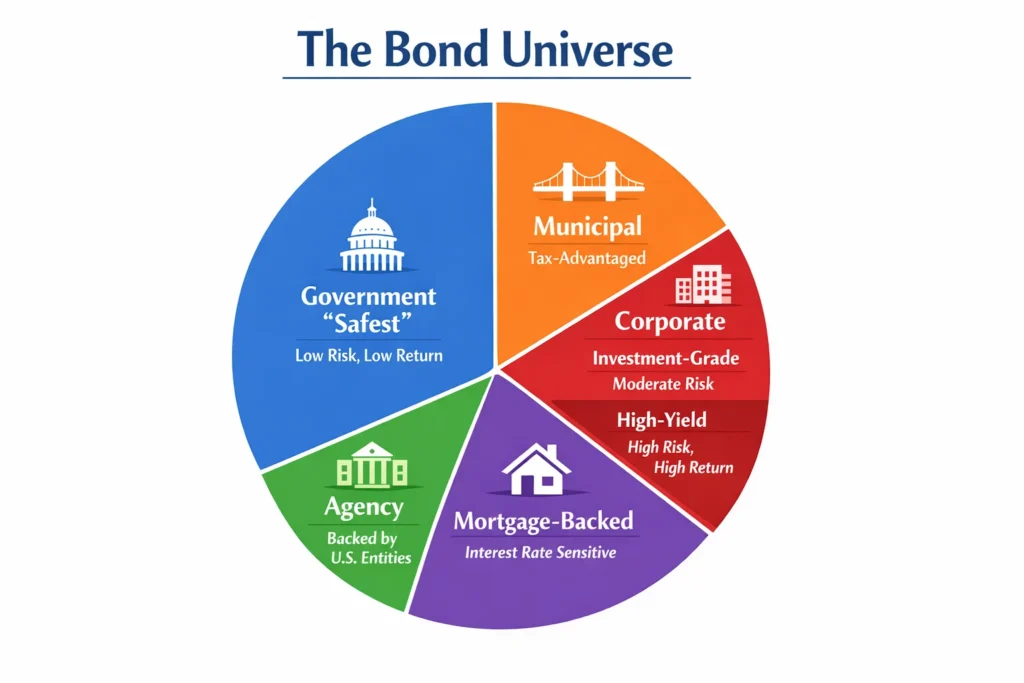

The 5 Major Types of Bonds and Who Should Buy Them

Bonds come in various forms, each with distinct characteristics, risks, and tax implications. Understanding the main categories is your first step to building a smart portfolio.

1. Government Bonds (Sovereign Debt)

These are issued by national governments and are considered among the safest bonds, especially those from stable countries.

- U.S. Treasury Bonds (T-Bonds, Notes, Bills): Backed by the “full faith and credit” of the U.S. government, they are viewed as virtually free of default risk. Interest is exempt from state and local taxes.

- Ideal For: Extremely risk-averse investors, those seeking a safe haven during market turmoil, or a core holding for portfolio stability.

2. Municipal Bonds (Munis)

These are issued by state and local governments to fund public projects like schools, highways, and airports.

- Key Feature: Interest is often exempt from federal income tax and, if you live in the issuing state, state and local taxes too.

- Ideal For: Investors in higher tax brackets seeking tax-efficient income. Always calculate the tax-equivalent yield to compare them fairly with taxable bonds.

3. Corporate Bonds

These are issued by companies to fund operations, expansion, or acquisitions. They offer a spectrum of risk and return.

- Investment-Grade: Issued by financially strong companies (rated BBB-/Baa3 or higher). Offer moderate yields with relatively low default risk.

- High-Yield (“Junk”) Bonds: Issued by companies with weaker finances (rated below BBB-/Baa3). Offer higher yields to compensate for significantly higher default risk.

- Ideal For: Investors seeking higher income than government bonds provide and who are comfortable with the additional risk. High-yield bonds should only be a small, well-understood portion of a portfolio.

4. Agency Bonds

These are issued by government-sponsored enterprises (GSEs) like Fannie Mae or Freddie Mac. They fund areas like mortgages.

- Not Directly Government-Backed: While perceived as low-risk, they are not explicitly guaranteed by the U.S. government like Treasuries.

- Ideal For: Investors looking for a yield pickup over Treasuries with a slight increase in risk.

5. Mortgage-Backed Securities (MBS)

These are bonds backed by a pool of mortgages. As homeowners make their mortgage payments, that cash flow is passed to MBS investors.

- Prepayment Risk: The main risk is that homeowners may refinance or sell their homes early, repaying the mortgage principal sooner than expected, which can disrupt your expected income stream.

- Ideal For: Sophisticated investors who understand the complex risks involved.

How Bonds Work: A Step-by-Step Walkthrough

Let’s break down the lifecycle of a bond, from the initial loan to the final repayment.

Step 1: The Bond is Issued

A government or corporation needs to raise money. Instead of getting a bank loan, they issue bonds to thousands of individual and institutional investors. Each bond has key terms set at issuance:

- Face Value (Par): The amount being borrowed, typically $1,000, which will be repaid at maturity.

- Coupon Rate: The fixed annual interest rate, expressed as a percentage of the face value.

- Maturity Date: The future date when the loan must be repaid in full.

Step 2: The Investor Receives Interest Payments

When you buy the bond at issuance, you pay the face value (e.g., $1,000). In return, the issuer makes regular coupon payments to you. These are usually paid semiannually. For example, a $1,000 bond with a 5% coupon pays $50 per year, or $25 every six months.

Common Mistake to Avoid: Don’t confuse the coupon rate (fixed at issuance) with the bond’s current yield. The yield changes if the bond’s market price changes, but your coupon payment amount does not.

Step 3: Bonds Trade on the Secondary Market

You don’t have to hold a bond until maturity. Like stocks, bonds can be bought and sold between investors in the secondary market. This is where bond prices fluctuate daily based on two main factors:

- Changes in Market Interest Rates: This is the most important driver. If new bonds are issued with a 6% coupon, your older bond with a 5% coupon becomes less attractive. To sell it, you’d likely have to lower its price. Conversely, if new bonds pay only 4%, your 5% bond becomes more valuable, and its price would rise. This creates the inverse relationship between bond prices and interest rates.

- Changes in the Issuer’s Creditworthiness: If a company’s financial health deteriorates, the risk of it defaulting increases. Investors will demand a higher yield to compensate for that risk, which forces the bond’s price down.

Step 4: The Bond Matures

On the maturity date, the bond’s lifecycle ends. The issuer repays the full face value (the original $1,000) to the current bondholder, regardless of what price was paid for it on the secondary market. If you held the bond from issue to maturity, you received all scheduled interest payments and got your initial loan back.

How to Use Bonds in Your Investment Strategy

Understanding bonds is one thing; applying that knowledge strategically is another. Here’s how to integrate bonds into your portfolio based on common financial goals.

Scenario 1: Seeking Stability and Capital Preservation

If your primary goal is to protect your savings from stock market volatility—for instance, as you near retirement—focus on high-quality, short- to intermediate-term bonds. U.S. Treasuries and high-grade corporate bonds are ideal here. Their lower default risk and shorter maturities make them less sensitive to interest rate swings, providing a stable portfolio anchor.

Scenario 2: Generating Tax-Efficient Income

If you are in a higher tax bracket and need income, municipal bonds (“munis”) can be powerful tools. Their interest is often exempt from federal income tax (and sometimes state tax if you live in the issuing state). To compare a muni’s yield to a taxable bond, calculate its Tax-Equivalent Yield. A financial advisor or online calculator can help you determine if munis are right for your tax situation.

Scenario 3: Strategic Diversification for Growth

For a long-term growth portfolio, bonds provide crucial diversification. Historically, bonds and stocks have an inverse relationship; when stock prices fall, bond prices often hold steady or rise as investors seek safety. By holding a mix (e.g., 60% stocks/40% bonds), you can smooth out your portfolio’s returns over time. A simple strategy is a bond ladder, where you buy bonds with staggered maturity dates (e.g., 1, 2, 3, 4, and 5 years). As each bond matures, you reinvest the principal in a new 5-year bond, helping manage interest rate risk.

Decoding the Bond Fact Sheet

When you research an individual bond or a bond fund, you’ll encounter a “fact sheet” with key metrics. Let’s decode the four most critical ones.

1. Coupon vs. Current Yield vs. Yield to Maturity (YTM)

- Coupon: The fixed annual interest rate based on the bond’s original face value.

- Current Yield: The annual interest payment divided by the bond’s current market price. Shows your income return right now.

- Yield to Maturity (YTM): The most important metric. It estimates your total annualized return if you buy the bond at its current price and hold it until it matures, assuming all coupons are reinvested at the same rate. It accounts for the purchase price, coupon payments, time to maturity, and the face value you’ll get back.

2. Duration

- What it is: A measure (in years) of a bond’s sensitivity to changes in interest rates. It’s more complex than just “time to maturity.”

- How to use it: If a bond has a duration of 5 years, a 1% rise in interest rates will cause its price to fall by approximately 5%. Conversely, a 1% drop in rates will cause its price to rise by about 5%. Higher duration = higher interest rate risk.

3. Credit Rating

- What it is: A letter grade (AAA, AA, A, BBB, BB, B, CCC, etc.) assigned by agencies like Standard & Poor’s (S&P) and Moody’s.

- How to use it: It’s a direct indicator of default risk. Bonds rated BBB-/Baa3 and above are “investment-grade.” Bonds rated below that are “high-yield” or “junk.” Never invest in a bond without knowing its rating.

4. Call Feature

- What it is: A provision that allows the issuer to repay the bond before its maturity date, usually when interest rates fall.

- How to use it: This is a risk to you, the investor (call risk). If your bond is “called,” you get your principal back but lose future interest payments, forcing you to reinvest in a lower-rate environment. Bonds with call features typically offer a slightly higher yield to compensate for this risk.

Common Mistakes When Investing in Bonds

Even seasoned investors can stumble with bonds. Here are common pitfalls and how to avoid them.

Pitfall 1: Chasing the Highest Yield Without Assessing Risk.

The Mistake: Choosing a bond solely because it offers the highest interest rate, which often signals higher default risk (as with “junk” bonds).

The Fix: Always check the credit rating. Understand that yield and risk are directly related. Ensure the risk level aligns with your overall portfolio strategy, and never allocate a large portion of your portfolio to high-yield bonds for the wrong reasons.

Pitfall 2: Ignoring Interest Rate Risk and Duration.

The Mistake: Buying long-term bonds without considering what happens if interest rates rise. Long-term bonds lose more value when rates go up than short-term bonds do.

The Fix: Understand duration, a measure (in years) of a bond’s sensitivity to interest rate changes. A bond with a duration of 5 years will lose about 5% of its value if interest rates rise by 1%. Match the bond’s duration to your investment time horizon.

Pitfall 3: Overlooking the True Cost with “Zero Coupon” Bonds.

The Mistake: Buying zero-coupon bonds (which pay no periodic interest) in a taxable account without understanding the tax implications.

The Fix: Know that with zero-coupon bonds, you are still liable for taxes on the “imputed interest” you accrue each year, even though you don’t receive the cash until maturity. These bonds are generally best held in tax-advantaged accounts like IRAs or 401(k)s.

- Predictable Income: Provide regular, scheduled interest payments, which is valuable for budgeting and retirement income.

- Capital Preservation: High-quality bonds, especially if held to maturity, offer a high degree of principal safety.

- Portfolio Diversification: Their performance is often uncorrelated with stocks, reducing overall portfolio volatility.

- Tax Advantages: Certain bonds (Municipal, Treasury) offer tax-exempt interest at the federal, state, or local level.

- Seniority in Default: If a company goes bankrupt, bondholders are paid before stockholders, offering a layer of protection.

- Interest Rate Risk: When market interest rates rise, the market value of existing bonds falls.

- Credit/Default Risk: The issuer may fail to make interest payments or repay the principal.

- Inflation Risk: The fixed interest payments may lose purchasing power if inflation outpaces the bond’s yield.

- Reinvestment Risk: When a bond matures or is called, you may have to reinvest the proceeds at a lower interest rate.

- Lower Return Potential: Historically, bonds offer lower long-term returns compared to stocks.

Taking It to the Next Level

Once you’ve mastered the basics, you can explore more sophisticated bond strategies and concepts to further optimize your portfolio.

- Understanding the Yield Curve: The yield curve plots the yields of bonds (like U.S. Treasuries) across different maturity dates. A “normal” upward-sloping curve suggests a healthy, growing economy. An “inverted” curve (where short-term yields are higher than long-term) is often seen as a potential recession warning. Monitoring the yield curve can inform whether you should lean toward short-term or long-term bonds.

- Exploring Bond Funds (ETFs & Mutual Funds): Instead of picking individual bonds, you can invest in a bond fund, which holds a diversified portfolio of bonds managed by professionals. Bond ETFs (Exchange-Traded Funds) trade like stocks and offer low-cost, transparent exposure to various bond sectors. A key metric for funds is the SEC Yield, a standardized measure of a fund’s income yield.

- Building a Bond Ladder: This is a hands-on strategy to manage interest rate risk. You purchase bonds that mature in successive years (e.g., 2025, 2026, 2027, etc.). Each year, a bond matures, providing cash you can reinvest at current rates, smoothing out the effects of rate fluctuations over time.

To put these strategies into practice with ease, consider exploring low-cost bond ETFs from providers like Vanguard, iShares, or Schwab. They offer instant diversification and professional management. For a deeper dive into portfolio construction, our guide on “How to Build a Resilient Bond Ladder” can walk you through the specific steps.

Bonds vs Stocks

Understanding how bonds differ from stocks is fundamental to building a balanced portfolio. This comparison table highlights the key distinctions.

| Feature | Bonds | Stocks |

|---|---|---|

| What You Own | A loan/debt (you are a creditor). | A share of ownership/equity (you are a part-owner). |

| Primary Income Source | Fixed, regular interest payments (coupons). | Potential dividends and capital gains (selling for a profit). |

| Risk & Volatility | Generally lower risk and less price volatility. | Generally higher risk and greater price volatility. |

| Potential Returns | Limited to the stated interest and return of principal; historically lower. | Unlimited upside potential; historically higher over long periods. |

| Priority in Bankruptcy | Bondholders are paid before stockholders. | Stockholders are paid last, if anything remains. |

Conclusion

You now possess a fundamental understanding of one of the most important asset classes in finance. You know that a bond is essentially a loan, you understand the crucial inverse relationship between price and yield, and you’ve seen how different types of bonds—from safe Treasuries to higher-yielding corporates and tax-advantaged municipals—can serve specific roles in your portfolio.

Remember, bonds are not just for conservative investors. They are a versatile tool for generating income, preserving capital, and, most importantly, diversifying your portfolio to manage overall risk. Start applying this knowledge today. Review your current investment mix, consider your financial goals and risk tolerance, and think about how bonds can help you build a more resilient financial future. Your first step could be as simple as researching a broad-market bond ETF or speaking with a financial advisor about fitting bonds into your plan.