Annual Report What Is It, How Is It Used, and What Are Its Limitations

Publicly traded corporations are required to publish a detailed annual report that summarizes their financial and operational results for the year. It serves as a corporate resume, providing shareholders and the public with a detailed account of the company’s health, strategy, and future outlook. Mastering the ability to read and analyze an annual report is a fundamental skill for any serious investor or analyst.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A comprehensive yearly publication that public companies must provide to shareholders to describe their operations and financial conditions. |

| Also Known As | 10-K (for the formal SEC filing), Yearly Report |

| Main Used In | Fundamental Analysis, Equity Research, Corporate Governance, Investment Decision-Making |

| Key Takeaway | It is the primary source of truth for a company’s financial health, management strategy, and potential risks, directly mandated by regulators. |

| Formula | N/A (It is a document containing many individual formulas and statements). |

| Related Concepts |

What is an Annual Report

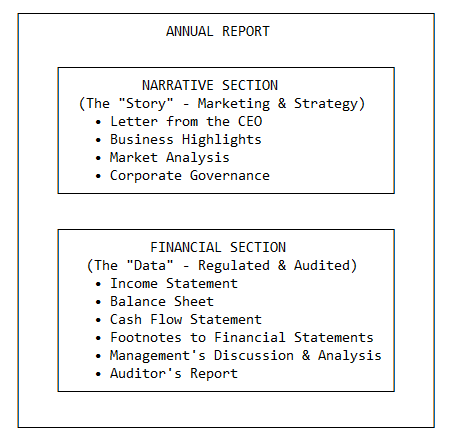

An annual report is more than just a booklet with glossy photos and CEO quotes. This publication serves as an official record of a corporation’s business endeavors and achievements over the previous fiscal year. Its primary purpose is to inform shareholders, the company’s owners, about the business’s performance and governance. While the front half is often a marketing tool, the back half contains the legally mandated, audited financial data that provides a transparent view of the company’s well-being.

Key Takeaways

The Core Concept Explained

Think of an annual report as a combination of a company’s medical chart and strategic plan. The financial statements (the medical chart) provide a quantitative diagnosis of fiscal health, showing profitability, debt levels, and cash flow. The narrative sections (the strategic plan) explain the company’s vision, the challenges it faces, and how management intends to steer the company forward. A high-quality report builds trust and transparency, while a vague or opaque one can be a major red flag for investors.

How an Annual Report is Compiled

An annual report is not “calculated” but is a meticulously compiled document. The process involves collaboration between corporate management, accountants, the legal team, and an independent external auditing firm. The creation follows a strict timeline after the fiscal year ends, involving data aggregation, financial statement preparation, drafting narrative sections, legal review, an external audit, and finally, filing with the SEC (as a 10-K) and distribution to shareholders.

Why the Annual Report Matters to Traders and Investors

For those practicing fundamental analysis, the annual report is arguably the most critical resource available.

- For Investors: It provides the essential data needed for valuation models (like DCF analysis). Investors use it to assess a company’s long-term profitability, financial stability (debt levels), and the quality and integrity of its management. It answers the critical question: “Is this a healthy, well-run business I want to own a piece of?”

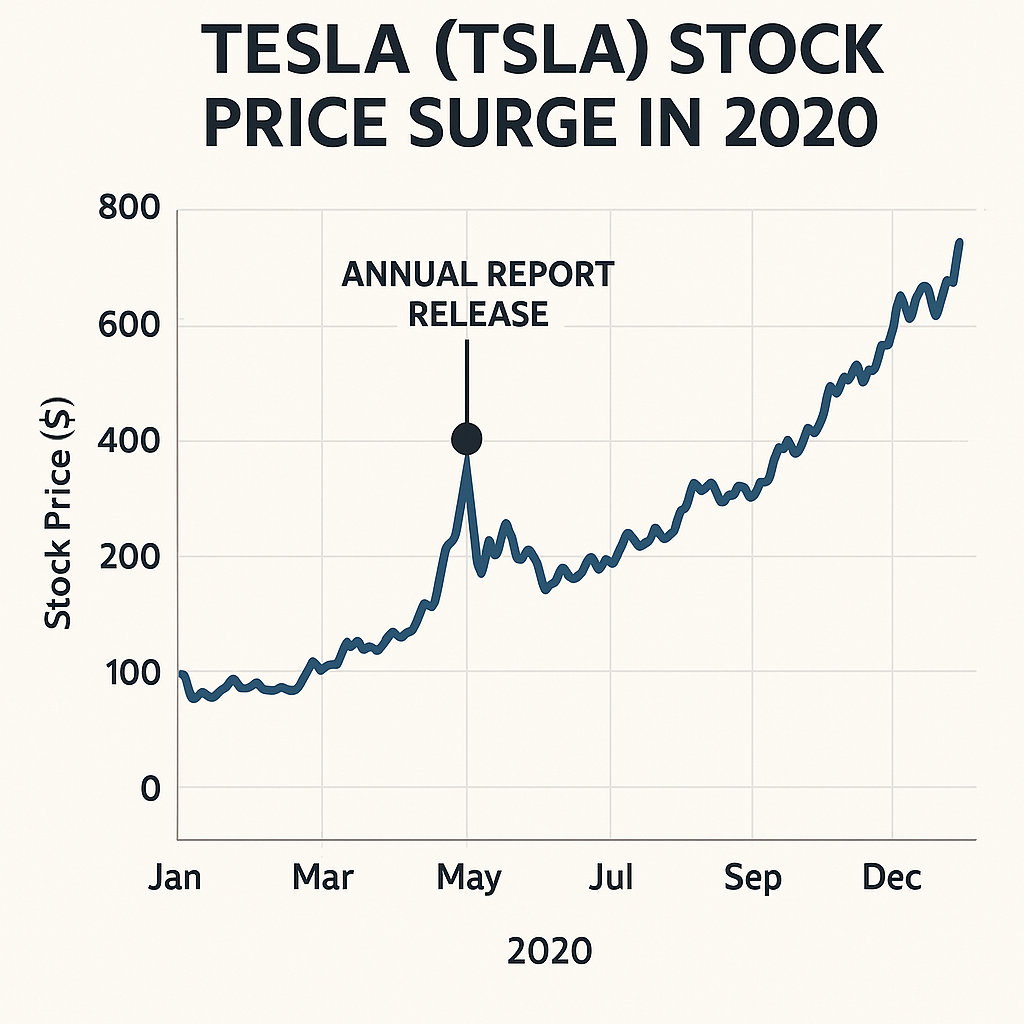

- For Traders: While traders often focus on technicals, major price movements can be triggered by the release of an annual report. It provides the “why” behind price action. Discrepancies between expectations and reported results can cause significant volatility, creating entry and exit opportunities.

- For Analysts: It is the foundational document for all equity research. Analysts dissect every section, from the financial footnotes to the MD&A, to build forecasts, assign ratings, and identify industry trends and risks.

How to Use an Annual Report in Your Analysis Strategy

Don’t read it cover-to-cover like a novel. Instead, approach it like a detective.

- Case 1: The CEO Letter & MD&A for Qualitative Insight: Read the CEO’s letter for tone and priorities. Then, cross-reference their optimism with the hard data in the Management’s Discussion & Analysis (MD&A). Does management explain poor performance convincingly? Are they transparent about risks?

- Case 2: The Footnotes for Hidden Details: The footnotes to the financial statements are where companies hide crucial information. Look for details on pending lawsuits, accounting method changes, debt obligations, and segment reporting. This is often where red flags are buried.

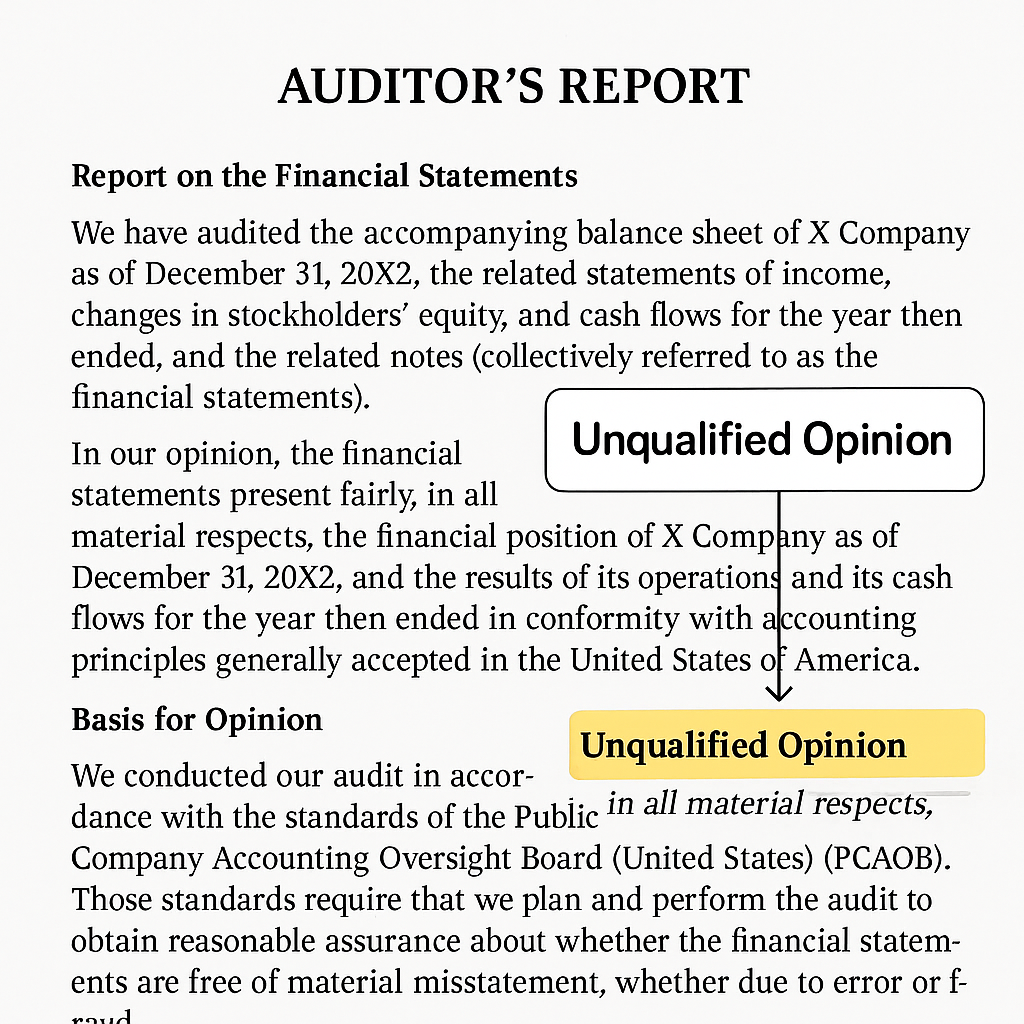

- Case 3: The Auditor’s Report for a Clean Bill of Health: The first thing to check is the auditor’s opinion. When an auditor issues an “unqualified opinion,” it signifies that the financial records are presented fairly and without material inaccuracies. A “qualified opinion” or worse is a massive red flag indicating potential accounting issues.

7. Pros and Cons of Annual Reports

- Comprehensive & Standardized: Provides a complete, standardized (via GAAP or IFRS) overview of the company in one place.

- Audited for Reliability: The financial data is verified by an independent third-party auditor, increasing its reliability.

- Forward-Looking Elements: Contains qualitative information on strategy and market outlook not found in pure financial data.

- Mandatory and Public: It is a regulatory requirement, ensuring consistent availability for all investors.

- Backward-Looking: It primarily reports on the past year, not the current moment. The information can be several months old by the time it’s published.

- Marketing Spin: The narrative sections can be overly optimistic and designed to put a positive spin on poor results.

- Complexity: Can be long, complex, and filled with jargon, making it difficult for novice investors to parse.

- Potential for “Creative Accounting”: While audited, management still has some discretion in how they present numbers, which can sometimes obscure the true economic reality.

Annual Report in the Real World: The Case of Tesla, Inc. (2020)

Tesla’s 2020 Annual Report was a landmark document. For the first full year in the company’s history, it reported a net profit under GAAP rules. Investors meticulously analyzed the document, seeking not only proof of profitability on the Income Statement but also insights into major capital expenditures for new facilities, which are detailed in the Cash Flow Statement and MD&A sections. The report provided the hard data to justify its soaring stock price at the time, showing that growth was translating into actual profitability. Conversely, any missed promises or hidden weaknesses in that report would have been heavily punished by the market.

How Annual Report Relates to Other Concepts

The most common point of confusion is between the Annual Report and the 10-K.

| Feature | Annual Report | 10-K Filing |

|---|---|---|

| What it is | A shareholder-friendly publication, often designed with graphics and photos. | The official, mandatory legal document filed with the SEC. No fluff. |

| Content | It encompass the complete 10-K filing, which is frequently introduced by a promotional overview designed for shareholders. | Pure, dense text and financial data. Contains all legally required disclosures. |

| Primary Use | Marketing to and informing general shareholders and the public. | Regulatory compliance and providing full disclosure to regulators and sophisticated investors. |

In essence: The 10-K is the formal legal filing. The Annual Report is a package that typically includes the 10-K inside it.

Conclusion

In the complex world of investing, the annual report stands as a beacon of transparency and a vital tool for due diligence. Moving beyond the polished marketing narrative to master the financial statements and footnotes is what separates casual readers from astute investors. By making the annual report a cornerstone of your research process, you empower yourself to make informed decisions, mitigate risks, and ultimately build a stronger, more resilient portfolio based on concrete data rather than market sentiment.

Related Terms:

- 10-Q Filing: This is a quarterly report that offers a condensed update on a company’s performance, serving as a frequent supplement to the annual 10-K.

- Balance Sheet: A fundamental financial statement that provides a snapshot of a firm’s assets, liabilities, and shareholders’ equity at a specific date.

- Income Statement: This essential report outlines a company’s revenues, expenses, and overall profitability across a defined period.

- Cash Flow Statement: The third core statement, detailing the inflows and outflows of cash, crucial for understanding liquidity.

Frequently Asked Questions

Recommended Resources

- SEC EDGAR Database: The primary source for all official filings (10-K, 10-Q).

- Investopedia – Annual Report: A great overview and breakdown of components.

- AICPA Guide: For understanding the auditing process and standards.

How did this post make you feel?

Thanks for your reaction!