APR Calculator, Calculate the True Cost of Your Loan

APR Calculator

Calculate the true cost of borrowing with our Annual Percentage Rate calculator. Understand how fees and loan terms affect your actual interest rate for better financial decisions.

Your APR Results

Payment breakdown visualization will appear here

How to Apply These Results to Your Financial Strategy

When APR is Higher Than Expected: If your calculated APR is significantly higher than the nominal rate, this indicates substantial fees are impacting your loan cost. Consider:

- Negotiating with lenders to reduce or eliminate certain fees

- Shopping around for loans with lower origination or application fees

- Evaluating whether a slightly higher interest rate with lower fees might be better

Using APR for Loan Comparisons:

- Always compare APRs, not just interest rates, when evaluating loan offers

- A loan with a lower interest rate but high fees may have a higher APR than a loan with a slightly higher rate but no fees

- Use our calculator to standardize comparisons across different loan structures

Debt Management Strategies:

- If your APR exceeds 10%, prioritize paying down this debt quickly

- Consider debt consolidation if you have multiple high-APR loans

- Use the payment breakdown to understand where your money is going

Common Mistakes to Avoid:

- Don’t focus solely on monthly payment amounts

- Don’t ignore “small” fees that significantly impact APR over time

- Don’t forget to account for all fees, not just the obvious ones

Advanced Calculation Scenarios

Credit Card APR Calculations: Credit cards often have different APRs for purchases, cash advances, and balance transfers. Our calculator can help you understand:

- How penalty APRs affect your overall borrowing costs

- The true cost of cash advances with upfront fees

- How balance transfer fees impact the effectiveness of debt moving strategies

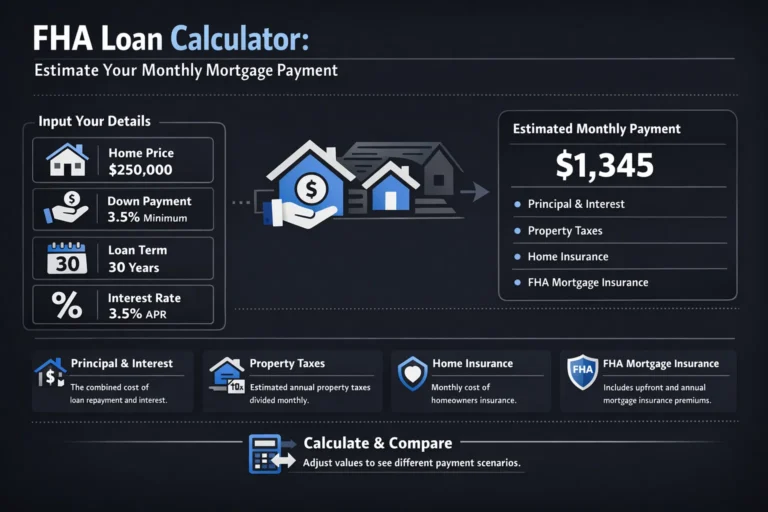

Mortgage APR Complexities: For mortgage loans, APR includes:

- Origination fees and points

- Mortgage insurance premiums

- Certain closing costs

- However, it excludes some costs like appraisal fees and title insurance

Auto Loan Considerations:

- Manufacturer incentives can artificially lower APRs

- Dealer fees significantly impact auto loan APRs

- Consider the total cost of ownership, not just the loan APR

Student Loan APR Analysis:

- Federal student loans have fixed APRs set by Congress

- Private student loan APRs vary based on creditworthiness

- Understand how deferment periods affect the true cost of student loans

Important Considerations

What the Calculator Doesn’t Account For:

- Variable interest rates that change over time

- Prepayment penalties or early payoff fees

- Changes in payment amounts over the loan term

- Tax implications of certain types of loan interest

Assumptions Made:

- Consistent payment amounts throughout the loan term

- No additional fees beyond those entered initially

- Interest compounds according to standard formulas

- Payments are made exactly on schedule with no delays

When to Consult a Financial Professional:

- For loans over $100,000

- When considering complex loan structures

- If you have multiple debt obligations to consolidate

- When planning major financial decisions like home purchases

Regulatory Variations:

- US: Truth in Lending Act requires APR disclosure

- UK: Consumer Credit Act governs APR calculations

- Canada: Cost of Borrowing regulations apply

- Australia: National Credit Code regulates APR disclosures

Frequently Asked Questions

Key Financial Terms

- Annual Percentage Rate (APR): The total yearly cost of a loan expressed as a percentage, including interest and fees. APR provides a standardized way to compare loan offers.

- Nominal Interest Rate: The stated interest rate on a loan before accounting for fees or compounding periods. This is the “headline” rate lenders advertise.

- Principal: The original amount of money borrowed, before interest or fees are added.

- Loan Term: The length of time over which a loan must be repaid, typically expressed in months or years.

- Origination Fee: A fee charged by lenders for processing a new loan application, usually calculated as a percentage of the loan amount.

- Amortization: The process of paying off a loan through regular payments that cover both principal and interest.

- Debt-to-Income Ratio (DTI): A personal finance measure that compares an individual’s monthly debt payments to their monthly gross income.

- Compound Interest: Interest calculated on the initial principal and also on the accumulated interest from previous periods.

Other Financial Calculators You Might Find Useful

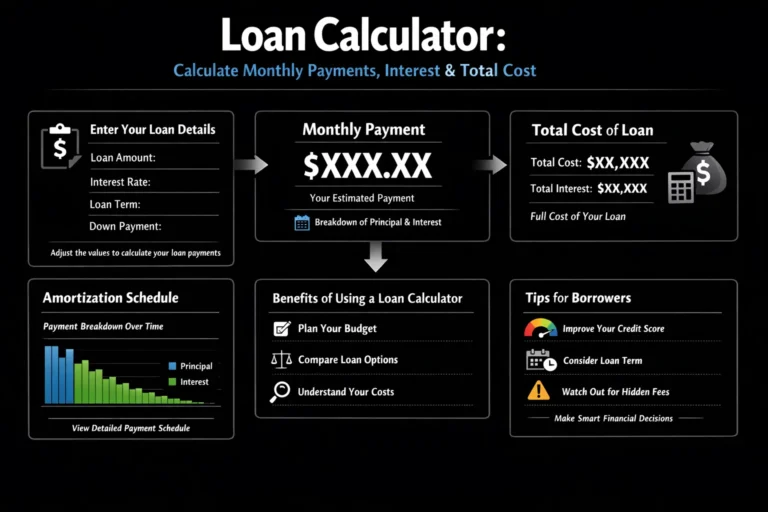

- Loan Amortization Calculator: Understand how your payments are split between principal and interest over time. Perfect for seeing how extra payments can reduce your loan term.

- Mortgage Affordability Calculator: Determine how much house you can realistically afford based on your income, debts, and down payment.

- Debt Payoff Calculator: Create a strategic plan to pay off multiple debts efficiently using either the avalanche or snowball method.

- Compound Interest Calculator: See how your savings or investments can grow over time with the power of compounding.

- Credit Card Payoff Calculator: Plan your strategy to eliminate credit card debt and understand how interest charges accumulate.