Markets are set to open after a volatile session driven by renewed AI skepticism and escalating US-Iran...

Muhammad Faraz

Faraz translates financial complexity into clarity. He delivers daily technical analysis on stocks, forex, commodities, and crypto, identifying key trends and trade setups through chart patterns and sentiment analysis. Simultaneously, he breaks down finance terms, personal finance strategies, and trading education, making sophisticated markets and money concepts accessible to all experience levels.

Markets are set to open after a flurry of corporate results and strategic announcements, from a major...

Markets are set to open after a powerful AI-led rally that saw Nvidia sign a major deal...

Markets are set to open after a session marked by sharp rallies in several soft commodities. My...

Markets are set to open after a news-heavy session featuring Warren Buffett's final 13F, a surge in...

Markets are set to open after a night of significant geopolitical posturing and sector-specific shake-ups. My analysis...

Markets are set to open after a long weekend with AI disruption fears intensifying across sectors. My...

Markets are set to open after a flurry of UK labor data, major corporate earnings, and significant...

Markets are set to open on a cautious note, grappling with AI disruption fears that have cooled...

Markets are set to open after a crucial US Consumer Price Index (CPI) report showed tame inflation....

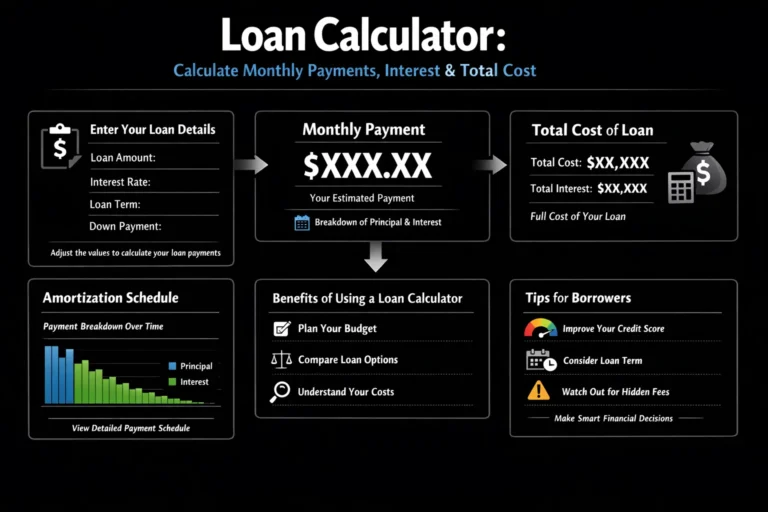

Calculate your monthly loan payments with our free online Loan Calculator tool. Input your loan amount, interest...

Markets are set to open after a long President's Day weekend, but the lingering effects of last...