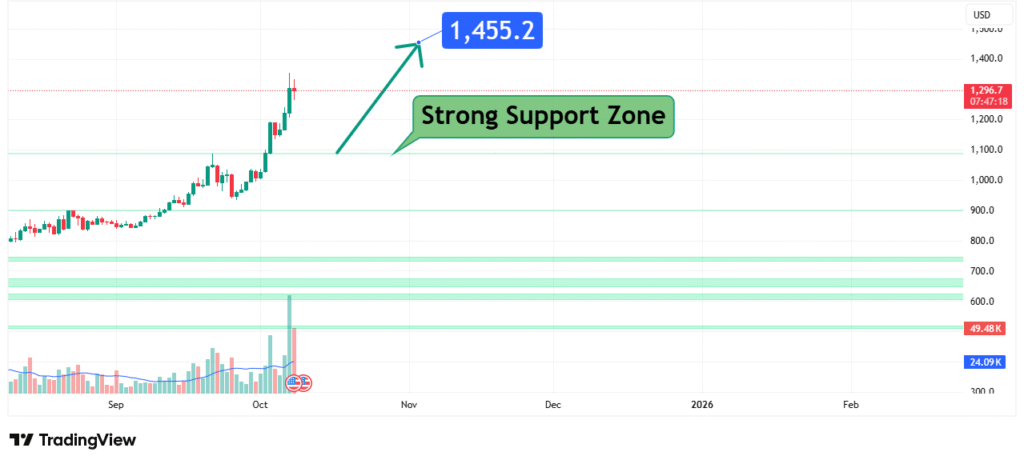

Binance Coin (BNB) Price Analysis Bullish Breakout Targets $1,455

BNB’s price has been consolidating and building energy above a well-defined strong support zone. This price action suggests a bullish bias is forming as buyers defend this critical area. Our analysis projects a move towards a primary target of $1,455, a level derived from the structure of the recent price action. This prediction is based on a confluence of technical factors, including the defense of a key support zone and the potential for a bullish breakout from the current consolidation phase.

Current Market Structure and Price Action

The current market structure for BNB is cautiously bullish, characterized by a series of higher lows that have established a solid support foundation. The price is currently interacting with and holding a crucial support zone, which has been tested multiple times from September through the current period. Recent price action shows a compression of volatility near this support, indicating that a decisive breakout to the upside may be imminent as the asset gathers momentum for its next leg.

Identification of the Key Support Zone

The most critical technical element on the chart is the Strong Support Zone ranging approximately from $1,250 to $1,300. The strength of this zone is derived from:

- Historical Significance: This level has acted as a major consolidation area and a springboard for previous rallies, as evidenced by the swing lows in September and October. Each successful test reinforces its importance.

- Technical Confluence: The zone aligns with a key psychological level ($1,300) and represents a prior resistance level that has now turned into support.

- Market Psychology: This area represents a point where sellers have been unable to push the price lower, and buyers consistently step in, indicating a shift in sentiment towards accumulation.

This confluence makes it a high-probability level for a bullish reaction and a potential launchpad for the next upward wave.

Technical Target and Rationale

Our analysis identifies the following price target:

Primary Target: $1,455

This target is identified as a previous major swing high and a significant resistance level. A break above the immediate consolidation resistance would likely propel the price towards this level, representing a clear measured move from the support base. The target also serves as a key psychological level that, if breached, could open the door for further gains.

Prediction: We forecast that BNB’s price will successfully hold the strong support zone, break above the local resistance, and initiate a rally towards our primary target at $1,455.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish thesis is invalidated if the price achieves a daily close below the Strong Support Zone, specifically below $1,240. This level should be chosen as it represents a clear break of the higher low structure and the critical support area that forms the foundation of this prediction.

- Position Sizing: Any long positions taken should be sized so that a loss triggered at the $1,240 invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Binance Ecosystem Growth: The health and adoption of the BNB Chain ecosystem, including DeFi and dApp activity, continues to be a core driver of BNB’s intrinsic value.

- Broader Market Sentiment: BNB’s price is heavily influenced by the overall direction of the cryptocurrency market, particularly Bitcoin’s momentum. A bullish macro environment would provide strong tailwinds for this prediction.

- Exchange Dynamics: As the native token of the world’s largest cryptocurrency exchange, Binance’s quarterly token burns and new product launches can directly impact supply and demand dynamics for BNB.

These factors currently contribute to a neutral-to-bullish sentiment surrounding the asset, providing a stable backdrop for this technical setup.

Conclusion

BNB is at a technical inflection point, coiling above a strong support base. The weight of evidence suggests a bullish resolution, targeting a move to $1,455. Traders should monitor for a confirmed breakout above the local resistance with increasing volume and manage risk diligently by respecting the key invalidation level at $1,240. The reaction at the $1,455 target zone will be crucial for determining the next major directional move.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.