BNB Bullish Setup Key Support Holds, Eyes $1,145 and Beyond

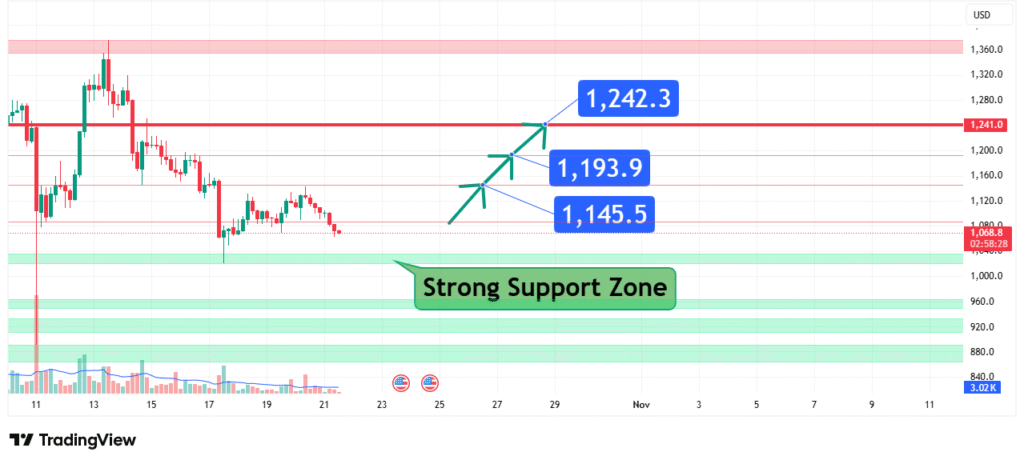

BNB’s price has experienced a significant decline but is now consolidating within a strong support zone between approximately $1,120 and $1,145. This price action suggests a bullish bias is forming as buyers are stepping in to defend this critical area. Our analysis projects a recovery wave towards a primary target of $1,242, with intermediate targets at $1,193 and $1,145. This prediction is based on a confluence of technical factors, primarily the presence of a multi-layered support zone that has historically prompted strong reactions.

Current Market Structure and Price Action

The broader market structure has been bearish, characterized by lower highs and lower lows. However, the price is now critically interacting with a strong support zone. The current consolidation and failure to break decisively lower suggest that seller momentum is exhausting and buyer accumulation is likely occurring. This indicates that a bullish reversal or a significant corrective bounce is imminent from these levels.

Identification of the Key Support Zone

The most critical technical element is the Strong Support Zone between $1,120 and $1,145, with a key focus on the $1,145.5 level. The strength of this zone is derived from:

- Historical Significance: The levels within this zone, particularly $1,145.5, have acted as significant support and resistance in the past, creating a robust price floor.

- Technical Confluence: The zone is reinforced by the psychological importance of the $1,100 and $1,120 levels, creating a band of support rather than a single, fragile line.

- Market Psychology: This area represents a point where long-term believers and value-based buyers find the asset attractive, leading to increased demand and a potential sentiment shift.

This multi-layered confluence makes it a high-probability level for a strong bullish reaction.

(Ad Placement Suggestion #2: Native ad or text link within the key level description)

Technical Target(s) and Rationale

Our analysis identifies a multi-tiered bullish target structure:

- Initial Target (PT1): $1,145 USD

Rationale: This is the upper boundary of the identified support zone. A bounce from current levels would first target a reclaim of this level to confirm bullish strength. - Intermediate Target (PT2): $1,193 USD

Rationale: This level represents a previous consolidation area and a significant swing level identified on the chart. It acts as the first major resistance on the path upward. - Primary Target (PT3): $1,242 USD

Rationale: This is our primary bullish objective, representing a strong historical resistance level. A break above PT2 would open a clear path for the price to move towards this key target.

Prediction: We forecast that the price will hold above the support zone and initiate a bullish reversal, first moving towards PT1 at $1,145. A sustained move above that would then target PT2 at $1,193, with the final primary objective at $1,242.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish thesis is invalidated if the price achieves a sustained daily close below the $1,040 level. This level is placed below the key support zone and the recent lows to account for false breakdowns and represents a clear break of the structure that justifies our prediction.

- Position Sizing: Any long positions taken should be sized so that a loss triggered at the invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

(Ad Placement Suggestion #3: Banner ad after the risk management section)

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Binance Ecosystem Health: The performance and adoption of the BNB Chain, including DeFi and dApp activity, directly influences BNB’s utility and value. Positive developments here can fuel a recovery.

- Broader Crypto Market Sentiment: As a major altcoin, BNB’s price is heavily correlated with Bitcoin’s movements. A bullish shift in overall crypto market sentiment is a crucial catalyst for this prediction.

- Exchange-Specific Developments: Any news regarding Binance’s regulatory standing, new product launches, or token-burn mechanisms can cause significant price volatility.

These factors contribute to a cautious-but-optimistic sentiment for a bullish reversal from the current support zone.

Conclusion

BNB is at a critical technical juncture, testing a historically significant support zone. The weight of evidence suggests a bullish resolution, targeting a recovery wave first to $1,145, then $1,193, and ultimately $1,242. Traders should monitor for a confirmed bounce from the $1,120-$1,145 area and manage risk diligently by respecting the key invalidation level at $1,040. The reaction at our intermediate targets will be crucial for gauging the strength of the upward move.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.