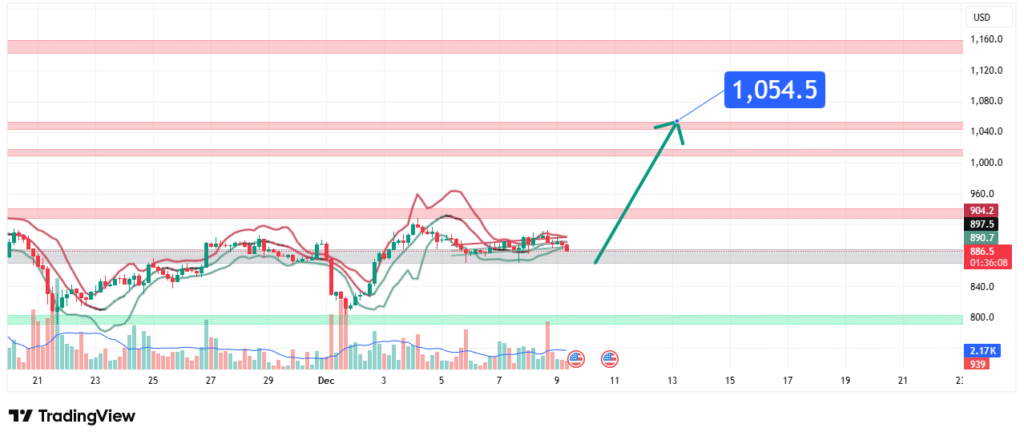

BNB Price Forecast Eyeing a +18% Move to $1,054

BNB’s price has been consolidating and showing signs of basing after a corrective decline from higher levels around $1,160. This price action suggests a bullish reversal bias is forming from a key demand zone. Our analysis projects a move towards a primary target of $1,054. This prediction is based on a confluence of technical factors, including a critical support hold, the structure of the potential reversal, and the identification of clear resistance levels overhead as recovery targets.

Current Market Structure and Price Action

The current market structure is corrective but potentially bottoming. The price has declined from a high near $1,160 and appears to be finding a floor in the $840-$900 region. The price is currently interacting with the upper bounds of this key support zone. Recent price action has shown a potential double or triple bottom formation around the $840-$880 level, coupled with a break above a minor downsloping resistance trendline, indicating that selling pressure may be exhausting and a bullish reversal could be underway.

Identification of the Key Support Zone

The most critical technical element for the bullish thesis is the Strong Support Zone around $840 – $900. The strength of this zone is derived from:

- Historical Significance: This area represents a major previous consolidation zone and swing low from earlier in the chart. It has been tested multiple times in the current decline, demonstrating its importance.

- Technical Confluence: The zone contains the 200-day moving average (approximate) and aligns with a major psychological level ($900). The repeated tests without a decisive breakdown show strong buyer presence.

- Market Psychology: This area represents a value zone where long-term holders and new buyers have consistently stepped in, viewing dips to this region as accumulation opportunities rather than exit signals.

This confluence makes it a high-probability level for a bullish reversal.

Technical Target and Rationale

Our analysis identifies the following bullish price target:

Primary Target (PT1): $1,054

This level represents the first major resistance and previous support zone encountered on the way down. In market psychology, former support often turns into new resistance. It also represents a key Fibonacci retracement level (likely the 0.618 or 0.786) of the recent downward move from $1,160 to ~$840, making it a classic technical target for a corrective rally.

Prediction: We forecast that BNB will sustain its footing above the $840 – $880 support base and initiate a bullish reversal. This move is projected to challenge the significant overhead supply and resistance concentrated at our primary target of $1,054.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish reversal thesis is invalidated if the price achieves a decisive daily close below $820. This level is below the crucial multi-touch support confluence around $840. A break here would signal a failure of the reversal pattern and likely lead to a deeper decline towards $750 or lower.

- Position Sizing: Any long positions taken should be sized so that a loss triggered at the invalidation level (~$820) represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Binance Ecosystem Strength: BNB’s price is intrinsically linked to the health and activity of the Binance ecosystem, including trading volume on the exchange, adoption of BNB Chain, and the success of launchpad projects.

- Regulatory Landscape: As the native token of the world’s largest exchange, BNB is sensitive to broader regulatory news concerning Binance and the crypto industry globally.

- Broad Crypto Market Direction: A sustained bullish turn in Bitcoin and the overall crypto market cap is a primary catalyst needed to fuel a significant BNB recovery towards our target.

Conclusion

BNB is at a technical inflection point, attempting to carve out a significant low after a correction. The weight of evidence suggests a bullish reversal is in its early stages, targeting a recovery move to $1,054. Traders should monitor for a confirmed break above the immediate resistance near $960 with increasing volume and manage risk diligently by respecting the key invalidation level at $820. The price reaction at the $1,054 target will be critical in determining if this is a full trend resumption or a larger corrective bounce.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.