CADJPY at Make-or-Break Levels 105 Resistance Test

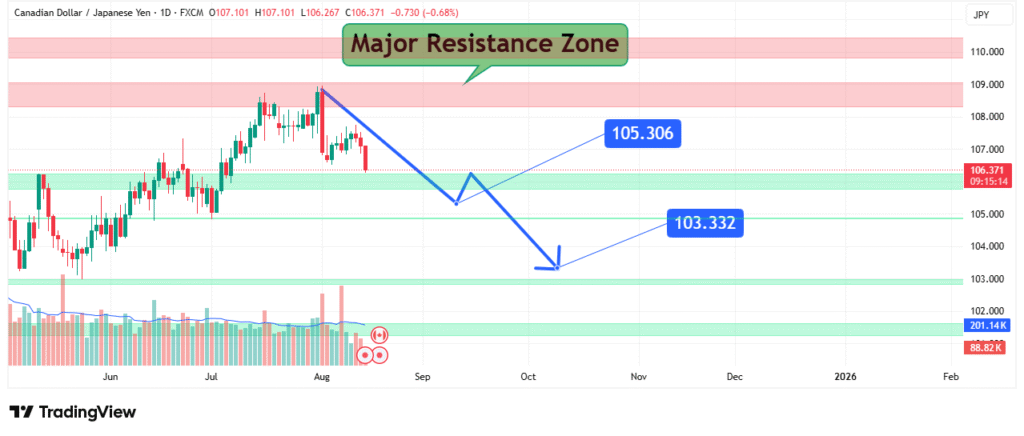

The CAD/JPY currency pair is currently testing major resistance levels, presenting traders with a high-probability technical setup. This analysis examines the key price levels that will determine whether the pair can break through resistance or reverse toward lower targets. With clear resistance at 105.306 and 103.332, we outline the potential scenarios and trading strategies for this important forex cross.

Current Market Structure

The daily chart reveals several crucial technical elements:

- Major Resistance Zone: Between 103.332 and 105.306

- Current Price Action: Testing upper bounds of resistance

- Historical Context: Previous rejections at these levels

- Timeframe Alignment: Multi-month consolidation pattern

The pair has shown consistent respect for these resistance levels throughout 2025, making them particularly significant for future price direction.

Critical Price Levels

Resistance Structure:

- Upper Resistance: 105.306 (year-to-date high)

- Lower Resistance: 103.332 (swing high)

- Psychological Barrier: 105.00 round number

Support Framework:

- Initial Support: 102.00 (recent swing low)

- Strong Support: 100.50 (psychological level)

- Major Floor: 99.00 (2025 lows)

Potential Price Scenarios

Bullish Breakout Scenario:

- Confirmation: Daily close above 105.306

- Target: 107.50 (measured move)

- Invalidation: Rejection at current levels

Bearish Reversal Scenario:

- Rejection Signal: Bearish pinbar at resistance

- Initial Target: 103.332 (partial profit)

- Final Target: 102.00 support

- Extension Potential: 100.50 if momentum continues

Technical Indicators

- Volume Analysis: Monitor for breakout confirmation

- Momentum Indicators: RSI showing potential divergence

- Moving Averages: Price relative to 50/200 DMA

- Order Flow: Watch for absorption at resistance

Trading Strategies

For Breakout Traders:

- Entry: On close above 105.306

- Stop: Below 104.50

- Targets: 107.50, then 110.00

For Reversal Traders:

- Entry: On rejection at 105.00-105.306

- Stop: Above 105.50

- Targets: 103.332, then 102.00

Key Fundamental Factors

- Bank of Japan Policy: Yield curve control adjustments

- Oil Prices: Impact on Canadian dollar strength

- Risk Sentiment: JPY’s safe-haven properties

- Interest Rate Differentials: CAD vs JPY yields

Risk Management Considerations

- Position Sizing: Account for JPY volatility

- Stop Placement: Outside key technical levels

- Timeframe Alignment: Confirm on daily/weekly charts

- News Risk: Central bank speech calendar

Conclusion: Waiting for Confirmation

CAD/JPY presents a clear technical setup with well-defined risk/reward parameters. Traders should wait for either:

- A confirmed breakout above 105.306 with follow-through, or

- A clear rejection at resistance with bearish momentum

The coming sessions will be crucial in determining the pair’s next significant move.