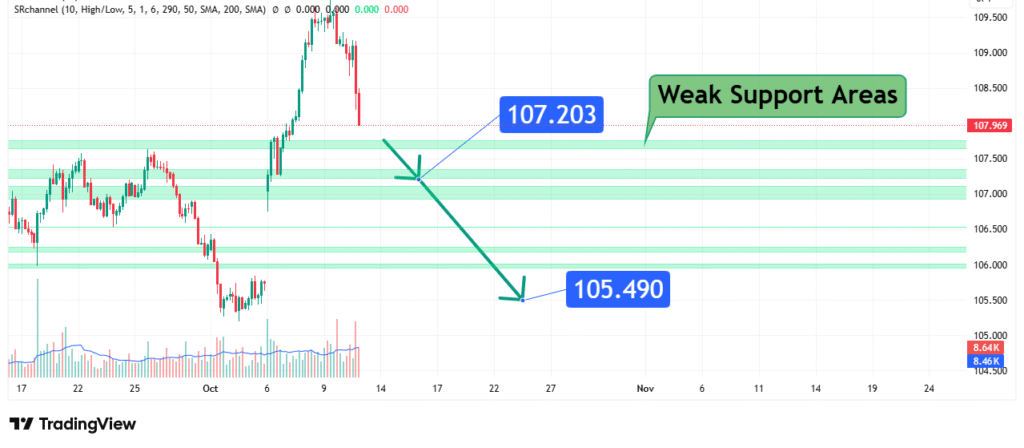

CADJPY Breakdown Bearish Wave Towards 105.4 and 107.2

CADJPY’s price has decisively broken below its recent trading range, accelerating through identified “Weak Support Areas.” This price action confirms a potent bearish bias is in control. Our analysis projects a continued decline towards an initial target of 107.20, with a primary target at 105.40. This prediction is based on the established downtrend, the lack of robust support, and strong underlying selling pressure.

Current Market Structure and Price Action

The current market structure is unequivocally bearish. The pair has established a clear sequence of lower highs and lower lows. The price has sliced through multiple support levels with ease, as indicated by the “Weak Support Areas” on the chart, and is currently trading near the lows of its recent range. The sharp, sustained downward move indicates significant selling momentum with little in the way of buyer defense.

Identification of Key Support and Resistance

The most critical technical elements are the lack of strong support and the newly established resistance above.

- Weak Support Areas: The chart explicitly labels the zones between 107.500 and 104.500 as “Weak Support Areas.” This suggests these levels may offer only temporary pauses or minor bounces rather than a significant trend reversal. The first notable level within this zone is 107.20, which now acts as a minor support and our initial target.

- New Resistance (Previous Support): The breakdown has turned the previous consolidation zone, roughly between 108.50 and 109.50, into a new strong resistance area. Any pullback into this zone is likely to be met with fresh selling interest.

Technical Target(s) and Rationale

Our analysis identifies the following price targets:

- Initial Target (IT): 107.20

- Rationale: This is the first technically significant level within the weak support band. It represents a minor historical pause and a logical initial profit-taking zone for short positions.

- Primary Target (PT1): 105.40

- Rationale: This is a more substantial technical target, aligning with the lower boundary of the identified support zone and a key psychological level. A move to this level would represent a total decline of approximately 2.3% from the current price, capturing the bulk of the bearish impulse.

Prediction: We forecast that the bearish momentum will persist, driving the price first towards the initial target at 107.20. Following a potential consolidation or minor bounce at that level, we expect a further decline to reach our primary target at 105.40.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bearish thesis is invalidated if the price achieves a decisive daily close above the key resistance zone at 109.00. This level represents a break back into the prior consolidation range and would signal a false breakdown, potentially leading to a short squeeze and a move higher.

- Position Sizing: Any short positions taken should be sized so that a loss triggered at the 109.00 invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Bank of Japan (BoJ) Policy Scrutiny: Any hawkish shift in policy from the ultra-dovish BoJ, or even speculation of one, strengthens the JPY (Yen) across the board, fueling pairs like CADJPY lower.

- Crude Oil Volatility: The Canadian Dollar (CAD) is highly correlated with the price of crude oil. Sustained weakness in oil prices undermines the CAD, contributing to the pair’s decline. The current bearish move suggests CAD weakness is overpowering any potential JPY weakness.

- Risk Sentiment: CADJPY often acts as a barometer for risk sentiment. A shift towards a “risk-off” environment in global markets typically benefits the safe-haven JPY, adding further downward pressure on the pair.

Conclusion

CADJPY is in a pronounced downtrend, characterized by strong momentum and a lack of meaningful support. The weight of evidence suggests a continued bearish trajectory, targeting a move first to 107.20 and ultimately to 105.40. Traders should be cautious of trying to catch falling knives; rallies are likely to be sold into. Risk must be managed diligently by respecting the key invalidation level above 109.00. The reaction at the 105.40 target will be critical for determining if the bearish trend will extend further.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.