Day Trading vs. Swing Trading Which is Right for You

Day trading and swing trading are two dominant styles of active trading, separated primarily by time. Day traders open and close all positions within a single day, seeking profit from small price movements, while swing traders hold positions for several days or weeks to capture larger price swings. Choosing the right path is critical, as it dictates your schedule, strategy, stress level, and potential for profit in fast-moving markets like the NYSE and NASDAQ.

For active traders in the US, UK, Canada, and Australia, understanding this distinction is the first step toward developing a disciplined approach, managing tax implications (like the IRS’s wash-sale rule or HMRC’s tax-free allowances), and selecting the right brokerage platform.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A comparison of two active trading styles defined by their holding periods: day trading (intraday) and swing trading (days to weeks). |

| Also Known As | Intraday Trading vs. Position Trading (short-term) |

| Main Used In | Stock Trading, Forex, Crypto, Futures, Options |

| Key Takeaway | Day trading is a high-intensity, full-time job focusing on technical analysis and speed, while swing trading offers more flexibility, using both technical and fundamental analysis to capture larger trends. |

| Related Concepts |

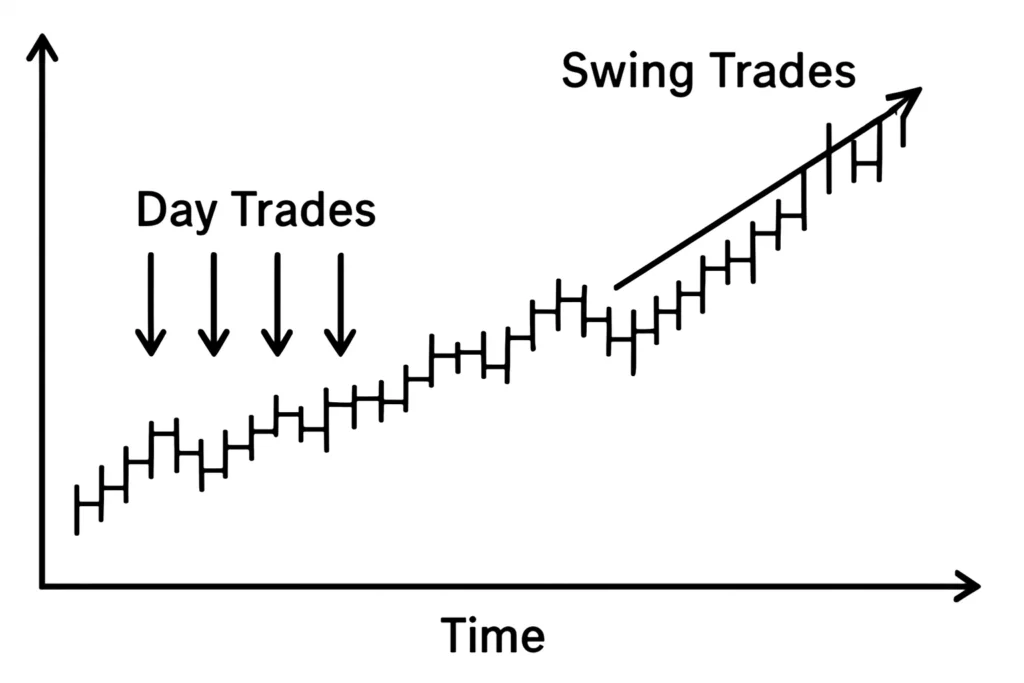

At its core, the difference between day trading and swing trading boils down to your holding period and, consequently, your entire lifestyle. Imagine a surfer: a day trader is catching dozens of small, fast waves, getting in and out of the water constantly. A swing trader waits for the perfect, larger wave, rides it for a longer duration, and captures a more significant move. Day trading is about profiting from intraday volatility, while swing trading is about capitalizing on short-term price momentum.

Key Takeaways

Day Trading vs. Swing Trading vs. Investing

| Feature | Day Trading | Swing Trading | Long-Term Investing |

|---|---|---|---|

| Holding Period | Seconds to Hours | Days to Weeks | Years to Decades |

| Primary Analysis | Technical (Intraday) | Technical & Fundamental | Fundamental |

| Time Commitment | Very High (Full-Time) | Moderate (Part-Time) | Low (Occasional) |

| Activity Level | High Frequency | Moderate Frequency | Low Frequency |

| Goal | Profit from small intraday moves | Profit from short-term trends | Wealth accumulation |

The Core Concept Explained

The core concept is the trade-off between frequency and magnitude. Day traders make frequent, small bets, aiming for a high win rate and compounding small gains. Their goal is to have no overnight exposure, thus avoiding the risk of news events causing a stock to gap significantly against their position at the open. Swing traders, on the other hand, make fewer trades but aim for a higher risk-reward ratio on each trade, accepting overnight risk in pursuit of larger chunks of a price trend.

The Hybrid Approach: Combining Day and Swing Trading

Some traders don’t choose one exclusively; they blend the styles. This “multi-timeframe” approach can be highly effective.

How it Works: You primarily identify a swing trade setup based on daily charts. This is your “core” position. Then, you use intraday charts to:

Improve Your Entry: Instead of entering the swing trade at market, you wait for an intraday pullback to a key support level on a 1-hour or 15-minute chart to get a better price.

Trade Around the Core Position: If the stock becomes overbought on an intraday basis, you might sell a portion of your position to lock in some profit, planning to buy it back on a dip. This actively manages your cost basis.

This method leverages the big-picture context of swing trading with the tactical precision of day trading.

How to Identify Your Trading Style

Since there is no formula, you identify your fit by assessing specific criteria. Your choice is less of a calculation and more of a personal and strategic alignment.

Step-by-Step Identification Guide

Ask yourself these questions to determine which style suits you:

- Time Availability: Can you sit in front of a screen from market open to close (9:30 AM – 4:00 PM ET), or do you have a day job?

- Yes, full attention: Day Trading is possible.

- No, limited time: Swing Trading is better.

- Starting Capital: What is the size of your trading account?

- <$25,000: You are restricted by the PDT rule in the US, making traditional day trading difficult. Swing trading is your primary option.

- >$25,000: Both styles are available to you from a regulatory standpoint.

- Personality & Psychology: Are you impatient and decisive, or patient and methodical?

- Impatient/Decisive: You might thrive in the fast-paced day trading environment.

- Patient/Methodical: You may be better suited for the waiting game of swing trading.

- Risk Tolerance: How do you feel about overnight risk?

- Uncomfortable with overnight risk: Day trading aligns with this preference.

- Accepting of overnight risk: Swing trading is a fit.

For a trader in the UK or Australia using a platform like IG or Interactive Brokers, the PDT rule does not apply, but broker-specific margin and leverage rules will still impact capital requirements.

Why Choosing Between Day and Swing Trading Matters

Choosing incorrectly is a primary reason new traders fail. This decision impacts every facet of your trading journey.

- For the Aspiring Trader: It dictates the skills you need to learn. A day trader must master scalping techniques and order execution speed, while a swing trader needs to excel at identifying trend continuations and managing positions over time.

- For Your Lifestyle: Day trading is a high-stress, all-consuming job. Swing trading can be a side hustle. Your choice must align with the life you want to live.

- For Risk & Capital: The PDT rule makes day trading inaccessible for many beginners. Understanding this upfront prevents frustration and allows you to focus on a viable path, like swing trading, to build your capital.

How to Use Day Trading and Swing Trading in Your Strategy

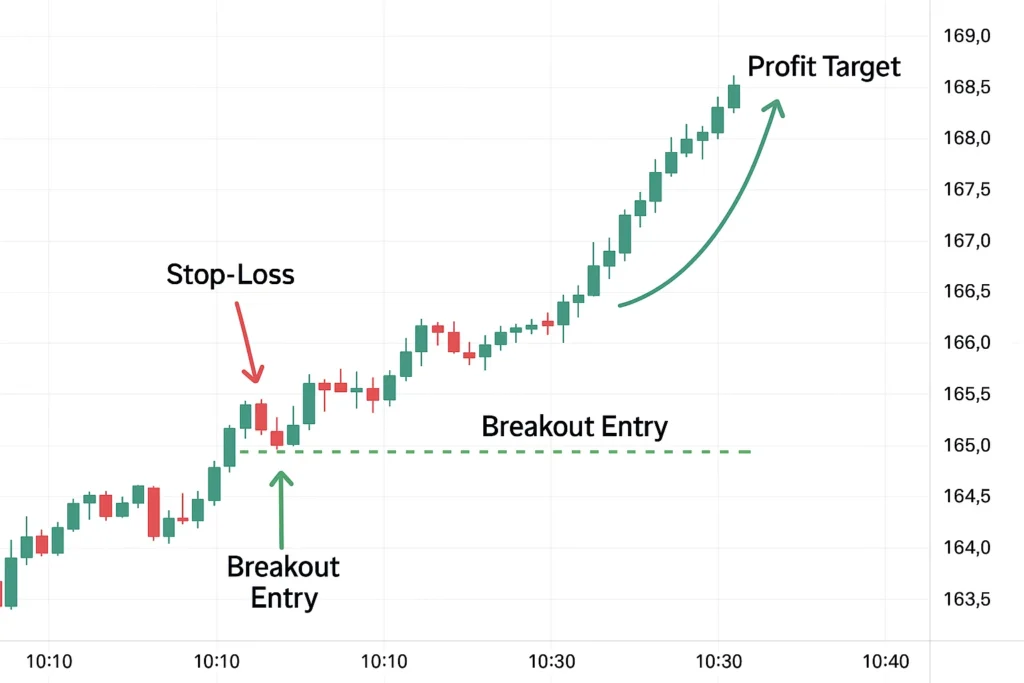

Use Case 1: Day Trading with Scalping

A day trader notices high volume in Apple (AAPL) in the first hour. Using a 1-minute chart, they enter a long position when the price breaks above the overnight high with strong volume, aiming for a $0.50 profit per share and placing a tight stop-loss $0.25 below their entry. They exit the position before 10:30 AM, regardless of outcome.

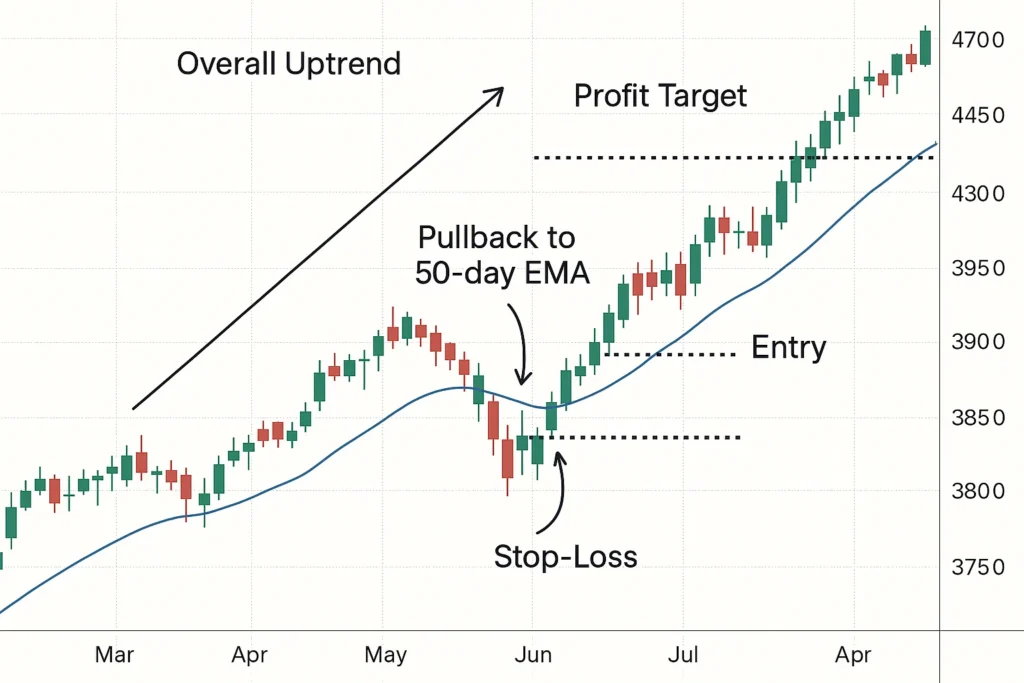

Use Case 2: Swing Trading a Pullback

A swing trader identifies an uptrend in Microsoft (MSFT) on a daily chart. They wait for the price to pull back to a key moving average (e.g., the 50-day EMA) with declining volume. They enter a long position, placing a stop-loss below a recent swing low. Their profit target is the previous high, offering a 3:1 risk-to-reward ratio. They hold the trade for 10 days until the target is hit.

Backtesting: The Data-Driven Path to Choosing Your Style

Don’t guess which style suits you; let the data decide. Backtesting involves applying a trading strategy to historical data to see how it would have performed.

- For Day Trading Strategies: You would need tick-level or 1-minute historical data. This is data-intensive and requires specialized software. It tests your ability to react quickly to simulated live conditions.

- For Swing Trading Strategies: This is easier for beginners. You can use free tools like TradingView’s “Bar Replay” or even manually scroll through daily charts to test your strategy on years of data in a short time.

By backtesting both a day trading and a swing trading strategy, you can objectively compare their hypothetical win rates, profit factors, and maximum drawdowns. You might find your personality prefers the slow-and-steady equity curve of swing trading over the volatile curve of day trading, or vice versa, before you ever risk a single dollar.

- No Overnight Risk All positions are closed by market close, protecting you from after-hours news gaps.

- Quick Feedback Rapid iteration allows for fast learning and strategy refinement.

- Use of High Leverage The ability to use margin intensively can amplify gains on small moves.

- Compounding Small Gains Many small wins can add up to significant monthly returns.

- Pattern Day Trader (PDT) Rule The $25,000 minimum equity requirement in the US is a major barrier to entry.

- Extremely High Stress The fast-paced environment leads to quick decision fatigue and emotional burnout.

- Significant Time Commitment Requires undivided attention during all market hours.

- High Transaction Costs Commissions and fees (even if small) can eat into profits due to high trade frequency.

- Flexibility Does not require monitoring the markets all day; can be done with a full-time job.

- Lower Capital Requirements No PDT rule restrictions; you can start with a much smaller account.

- Pursuit of Larger Gains Aims to capture the majority of a price swing, leading to higher profit-per-trade potential.

- More Time for Analysis Allows for thorough research and planning outside of market hours.

- Overnight and Weekend Gap Risk Your position is exposed to news and events that can cause the price to open significantly against you.

- Requires Patience Trades can take days or weeks to develop, which can be frustrating.

- Opportunity Cost Capital is tied up in open positions, potentially missing other setups.

- Less “Hands-On” Experience Fewer trades mean a slower learning curve in terms of execution.

Key Differences

Day trading and swing trading represent two distinct approaches to active trading, each with its own set of advantages and challenges:

- Time Commitment: Day trading requires full attention during market hours, while swing trading offers more flexibility.

- Risk Profile: Day trading eliminates overnight risk but involves high-frequency decision making, while swing trading exposes traders to overnight gaps but allows for more deliberate analysis.

- Capital Requirements: Day trading in the US requires a minimum of $25,000 due to PDT rules, while swing trading has no such restrictions.

- Learning Curve: Day trading provides rapid feedback but higher stress, while swing trading offers a gentler learning curve but requires more patience.

The choice between these approaches ultimately depends on your personality, available time, risk tolerance, and trading capital.