Debt-to-Income Ratio Calculator Measure Your Loan Eligibility

Debt-to-Income Ratio Calculator

Calculate how much of your monthly income goes toward debt payments. See if you meet lender requirements for loans and credit.

Your Debt-to-Income Results

How to Use the Debt-to-Income Ratio Calculator

Step-by-step instructions:

- Enter your monthly gross income – This is your total pre-tax income from all sources (salary, bonuses, investments, etc.)

- Input all monthly debt payments – Include mortgage/rent, auto loans, credit card minimum payments, student loans, and other obligations

- Review your results – See your front-end and back-end DTI ratios instantly

- Adjust inputs – Experiment with different scenarios to see how changes affect your ratio

Input Field Explanations:

- Monthly Gross Income: Your total income before taxes and deductions

- Monthly Housing Payment: Includes mortgage/rent, property taxes, insurance, and HOA fees

- Auto Loan Payments: All vehicle-related loan and lease payments

- Credit Card Payments: Minimum payments required on all credit cards

- Student Loan Payments: Payments for all education-related loans

- Other Debts: Any additional monthly debt obligations

Interpretation of Results:

- Front-End Ratio: Percentage of income going to housing costs (ideal: ≤28%)

- Back-End Ratio: Percentage of income going to all debt payments (ideal: ≤36%)

- Total Monthly Income & Debt: Shows your financial snapshot

- Visual Scale: Illustrates where you fall compared to lender benchmarks

How Debt-to-Income Ratio is Calculated

The debt-to-income ratio is calculated using a simple formula:

DTI Ratio = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

Two Types of DTI Ratios:

- Front-End Ratio (Housing Ratio):textFront-End DTI = (Monthly Housing Costs ÷ Gross Monthly Income) × 100

- Back-End Ratio (Total Debt Ratio):textBack-End DTI = (All Monthly Debt Payments ÷ Gross Monthly Income) × 100

Example Calculation:

If your monthly gross income is $5,000 and your total monthly debt payments are $1,800:

- Front-End Ratio (if housing is $1,200): ($1,200 ÷ $5,000) × 100 = 24%

- Back-End Ratio: ($1,800 ÷ $5,000) × 100 = 36%

What Counts as Debt Payments:

- Mortgage or rent payments

- Auto loans and leases

- Credit card minimum payments

- Student loans

- Personal loans

- Alimony or child support

- Other installment debts

How to Apply These Results to Your Financial Strategy

Actionable Advice Based on Results:

If Your DTI is Below 36%:

- You’re in a strong position for new credit applications

- Consider refinancing high-interest debts

- Focus on building emergency savings

- Continue responsible credit management

If Your DTI is Between 36-43%:

- Limit new credit applications

- Focus on paying down high-interest debt first

- Consider debt consolidation options

- Build a stricter budget to reduce expenses

If Your DTI is Above 43%:

- Prioritize debt reduction above all else

- Avoid new credit applications

- Consider credit counseling services

- Explore income-increasing opportunities

How to Improve Your DTI Ratio:

- Increase Income: Seek raises, side hustles, or additional income streams

- Reduce Debt: Focus on high-interest debt first, consider balance transfers

- Avoid New Debt: Postpone major purchases requiring financing

- Extend Loan Terms: Refinance to lower monthly payments (caution: may increase total interest)

Common Mistakes to Avoid:

- Underestimating true monthly debt obligations

- Forgetting irregular debts (quarterly or annual payments)

- Not including all income sources

- Ignoring the impact of co-signed loans

Advanced DTI Calculation Scenarios

Complex Use Cases:

1. Self-Employed or Variable Income:

- Use your lowest monthly income from the past 24 months

- Consider using a 2-year average

- Document all income sources thoroughly

2. Rental Property Owners:

- Include mortgage payments as debt

- May deduct rental income (typically 75% of gross rents)

- Consult tax professional for specific scenarios

3. Co-Signed Loans:

- Include payments if you’re primarily responsible

- Consider impact even if someone else makes payments

- Lenders view co-signed debt as your obligation

4. Student Loan Considerations:

- Use actual payment amount, not deferred or income-based

- If payments are $0 but will increase, estimate future payments

- Include all educational loans in your name

Impact of Different Financial Decisions:

| Decision | Effect on DTI | Long-term Impact |

|---|---|---|

| Pay off $5,000 credit card debt | Immediate 3-5% reduction | Save on interest, improve credit score |

| Take on $300/month car payment | Immediate 6% increase (on $5k income) | Adds to fixed expenses for 3-7 years |

| Refinance mortgage (lower payment) | Immediate reduction | May extend loan term, reduce interest |

| Income increase of $1,000/month | 5-10% reduction in ratio | Improves borrowing capacity significantly |

Important Considerations for DTI Calculations

What This Calculator Doesn’t Account For:

- Future income changes or job stability

- Emergency expenses or unexpected costs

- Changes in interest rates on variable debt

- Non-debt living expenses (utilities, food, etc.)

- Tax implications of debt payments

Assumptions Made:

- Monthly income is stable and predictable

- Debt payments remain constant

- All debts are included in calculations

- No major life changes anticipated

When to Consult a Financial Professional:

- DTI ratio consistently above 50%

- Considering bankruptcy or debt settlement

- Complex income structures (multiple businesses, investments)

- Planning major life changes (marriage, children, retirement)

Additional Factors Lenders Consider:

- Credit Score: Often weighted equally with DTI

- Employment History: Stability and industry

- Assets and Savings: Reserves for emergencies

- Loan-to-Value Ratio: For secured loans

- Payment History: Track record of on-time payments

Frequently Asked Questions About DTI Ratio

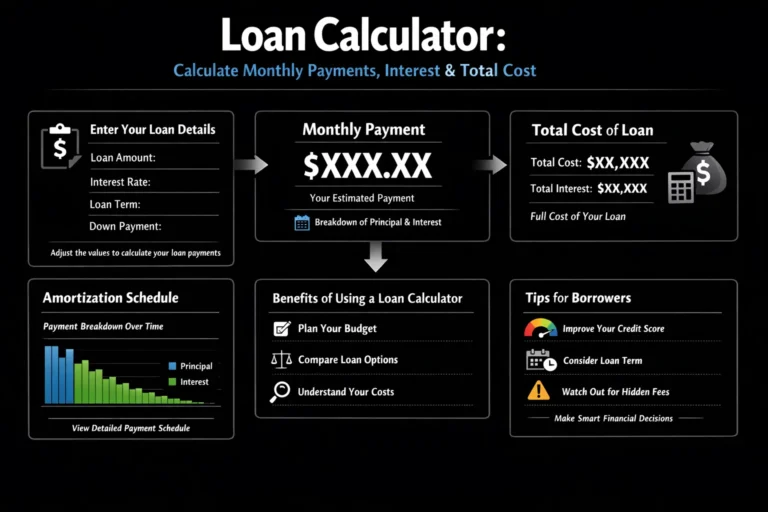

Other Financial Calculators You Might Find Useful

- Mortgage Affordability Calculator – Determine how much house you can afford based on your income, debts, and down payment

- Debt Payoff Calculator – Create a customized plan to eliminate your debt, showing how different strategies affect your payoff timeline

- Loan Amortization Calculator – Visualize how your loan payments are applied to principal and interest over time

- Credit Card Payoff Calculator – Calculate how long it will take to pay off credit card debt and how much interest you’ll pay

- Personal Loan Calculator – Compare loan offers and understand monthly payments for personal loans

DTI Ratios Through History

Historical Trends:

- 1980s: Average DTI ratios were significantly lower (25-30%) due to stricter lending standards

- 2000s: Ratios crept upward, contributing to the 2008 financial crisis

- Post-2008: Regulations tightened, with most lenders returning to traditional 28/36 standards

- 2020s: Increased flexibility for qualified borrowers, but fundamentals remain important

Current Benchmarks by Country:

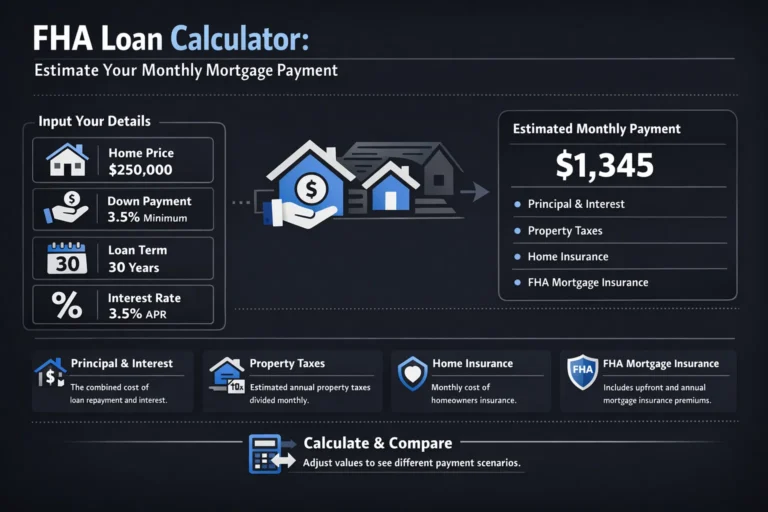

- USA: Conventional loans: 28/36, FHA: 31/43

- UK: Typically 35-45% for mortgage affordability assessments

- Canada: Mortgage stress test requires qualification at higher rates

- Australia: Most lenders prefer below 40%, with some allowing up to 50%

DTI Regulations and Guidelines

United States:

- CFPB Guidelines: Recommend back-end DTI below 43% for Qualified Mortgages

- Fannie Mae/Freddie Mac: Generally follow 28/36 but allow exceptions

- FHA Loans: Maximum 31/43 with compensating factors

United Kingdom:

- Financial Conduct Authority (FCA): Mortgage lenders must assess affordability

- Bank of England: Stress testing requirements for high DTIs

Canada:

- OSFI Guidelines: Stress test at higher interest rates

- CMHC: Maximum gross debt service ratio of 39%

Australia:

- APRA Guidelines: Lenders must assess living expenses thoroughly

- Serviceability Buffers: Assessment at higher interest rates

Real-World DTI Scenarios

Case Study 1: Improving DTI for Mortgage Approval

Sarah, 32, wanted to buy her first home but had a DTI of 48%. Over 18 months, she:

- Paid off $8,000 in credit card debt (reduced monthly payments by $250)

- Increased income through a promotion ($500/month raise)

- Refinanced student loans (saved $150/month)

- Result: DTI dropped to 35%, qualified for conventional mortgage

Case Study 2: Managing DTI After Job Loss

*Mark, 45, experienced income reduction from $7,000 to $4,500/month:*

- Contacted all creditors for hardship programs

- Temporially suspended retirement contributions

- Refinanced auto loan to lower payment

- Result: Maintained DTI below 40% during transition period

Key Financial Terms

- Debt-to-Income Ratio (DTI): The percentage of your gross monthly income that goes toward debt payments

- Front-End Ratio: Also called housing ratio, includes only housing-related debts

- Back-End Ratio: Includes all recurring monthly debt obligations

- Gross Monthly Income: Total income before taxes and deductions

- Recurring Debt: Regular monthly payments that are legally obligated

- Compensating Factors: Positive financial attributes that may offset higher DTI ratios