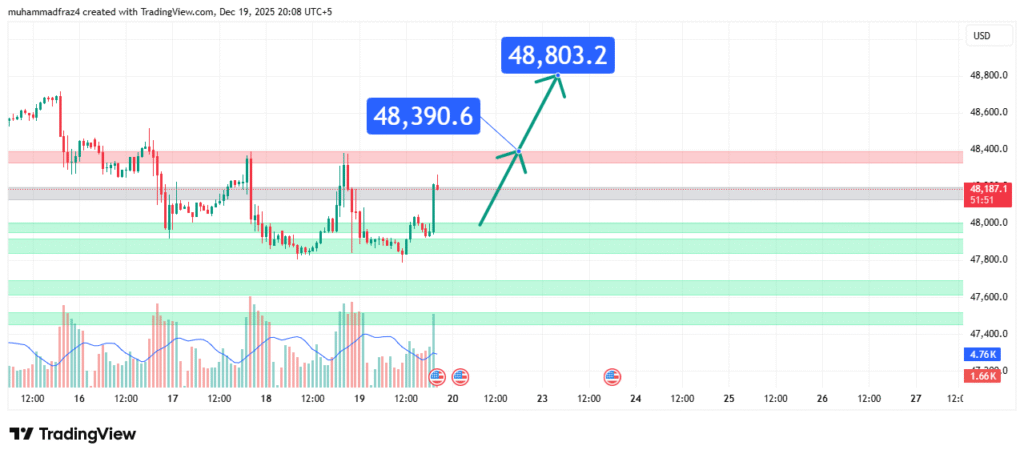

Dow Jones (DJIA) Price Forecast Key Breakout Toward 48,390

The Dow Jones Industrial Average (DJIA) has found significant buying interest and is consolidating above a crucial support zone near 48,100 USD. This price action, following a recent pullback, suggests a bullish bias is forming. Our analysis projects an initial move towards a target of 48,390 USD, with a primary bullish target at 48,803 USD. This prediction is based on a confluence of technical factors, including a strong support hold and a potential bullish reversal pattern evident on lower timeframes.

Current Market Structure and Price Action

The broader market structure remains bullish, defined by a series of higher highs and higher lows. The price is currently interacting with a robust support zone, which has catalyzed a bounce from recent lows. The price action on the chart shows a consolidation phase with a base forming around the 48,100-48,200 area, indicating seller exhaustion and a potential accumulation phase by buyers. A break above the immediate resistance near 48,400 would confirm the bullish momentum is resuming.

Identification of the Key Support Zone

The most critical technical element is the Strong Support Zone around 48,100 – 48,200 USD. The strength of this zone is derived from:

- Historical Significance: This level has acted as a major consolidation area and a previous swing high, now potentially acting as support (role reversal).

- Technical Confluence: The zone aligns with a key psychological round number (48,000) and the lows of the recent corrective move, adding to its importance as a “line in the sand” for bulls.

- Market Psychology: This area represents a point where sellers failed to push prices lower, and buyer conviction is being tested. Holding above it is crucial for maintaining the bullish intermediate trend.

This confluence makes it a high-probability level for a bullish reaction.

Technical Targets and Rationale

Our analysis identifies the following price targets:

Initial Target (IT): 48,390 USD

Rationale: This level represents the first significant resistance and the recent swing high that needs to be conquered to confirm the bullish structure’s resumption. It acts as a preliminary profit-taking zone.

Primary Target (PT1): 48,803 USD

Rationale: This is our main bullish objective, representing a test of the recent all-time highs and a key psychological level. A break above the 48,800 mark would open the path for a new leg higher in the trend.

Prediction: We forecast that the price will hold above the 48,100 support, break above the 48,400 resistance, and move towards IT at 48,390 USD. A sustained move beyond that would then open the clear path towards PT1 at 48,803 USD.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish thesis is invalidated if the price achieves a daily close below the 48,000 USD support. This level represents a clear break of the key support zone and the recent higher low structure, signaling a deeper correction is underway.

- Position Sizing: Any positions aligned with this bullish outlook should be sized so that a loss triggered at the 48,000 invalidation level represents a small, pre-defined percentage of your total trading capital (typically 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Corporate Earnings: The ongoing Q3 earnings season is driving individual stock volatility, with overall results supporting resilient corporate health.

- Monetary Policy Outlook: Market expectations for the timing of the Federal Reserve’s first rate cut continue to be the dominant macro driver for equity indices.

- Economic Data: Upcoming releases on inflation (PCE) and GDP will be critical in shaping near-term sentiment and volatility.

These factors currently contribute to a cautiously optimistic sentiment surrounding large-cap US equities, providing a conducive backdrop for the bullish technical setup.

Conclusion

The Dow Jones (DJIA) is at a technical inflection point just above major support. The weight of evidence from price action and key level confluence suggests a bullish resolution, targeting a move first to 48,390 and subsequently to 48,803 USD. Traders should monitor for a confirmed breakout above 48,400 and manage risk diligently by respecting the key invalidation level at 48,000 USD. The reaction at the 48,800 target zone will be crucial for determining the index’s next major directional move.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.