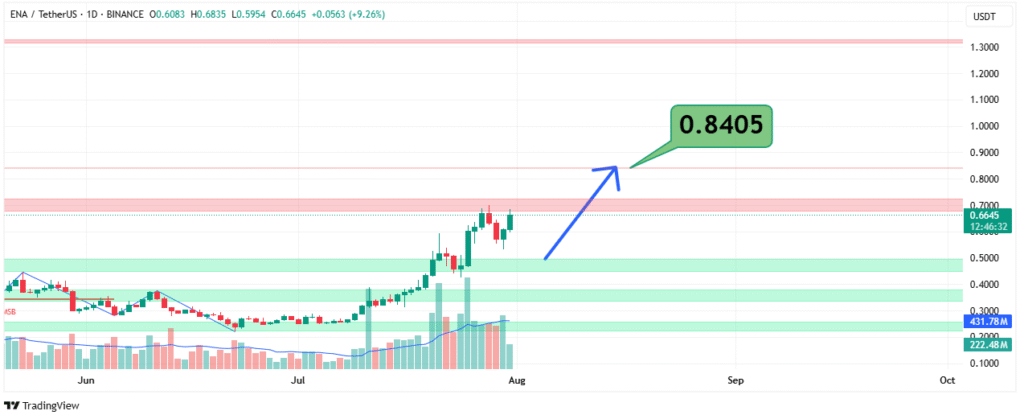

ENAUSDT is in a strong bullish momentum

ENA (Ethena) against USDT has demonstrated strong bullish momentum over the past several weeks, with the price surging from the $0.30 region in early July to over $0.66 by the end of the month. The daily chart shows a notable breakout above key support zones and is now approaching a significant resistance level. The next upside target, as highlighted, lies at $0.8405.

Recent Price Action

After weeks of consolidation around $0.30–$0.40, ENA/USDT broke out above multiple resistance zones, gaining over 100% in value within a month. The price is currently holding above the $0.60 level, which has turned into immediate support after a successful breakout.

Support and Resistance Levels

- Immediate Support: $0.60 – $0.62 (recent breakout zone)

- Next Support Zone: $0.40 – $0.45 (prior consolidation area)

- Immediate Resistance: $0.70 – $0.72 (current barrier)

- Next Major Target: $0.8405 (projected resistance and target zone)

- Extended Resistance: $1.30 (long-term key supply zone)

The chart highlights $0.8405 as the next significant level to watch, with strong bullish pressure potentially pushing prices toward that area in the short term.

Technical Indicators

- Trend: Strong bullish trend; higher highs and higher lows visible.

- Volume Profile: Rising volume supports upward momentum.

- Moving Averages: Price trading well above key moving averages, reinforcing bullish structure.

- Momentum: RSI and MACD (not shown on chart) likely indicating strong upward momentum but may enter overbought territory near $0.84.

Short-Term Outlook

If bullish momentum continues and the price breaks above the $0.70 resistance, ENA could rally toward the $0.8405 level in the coming days or weeks. However, traders should watch for potential profit-taking near resistance zones, which may lead to temporary pullbacks toward $0.62–$0.60.

Long-Term Scenario

A successful close above $0.8405 would open the path toward the $1.30 area, which represents the next major supply zone. Failure to hold above $0.60 support, however, could lead to a retest of lower levels around $0.40–$0.45.

Conclusion

ENA/USDT is currently in a strong uptrend, with bulls eyeing the $0.8405 target. The breakout above $0.60 is a significant technical development, supported by increasing volume and market momentum. Traders should watch for confirmation of a move above $0.70 to validate further upside potential toward $0.84 and possibly $1.30.