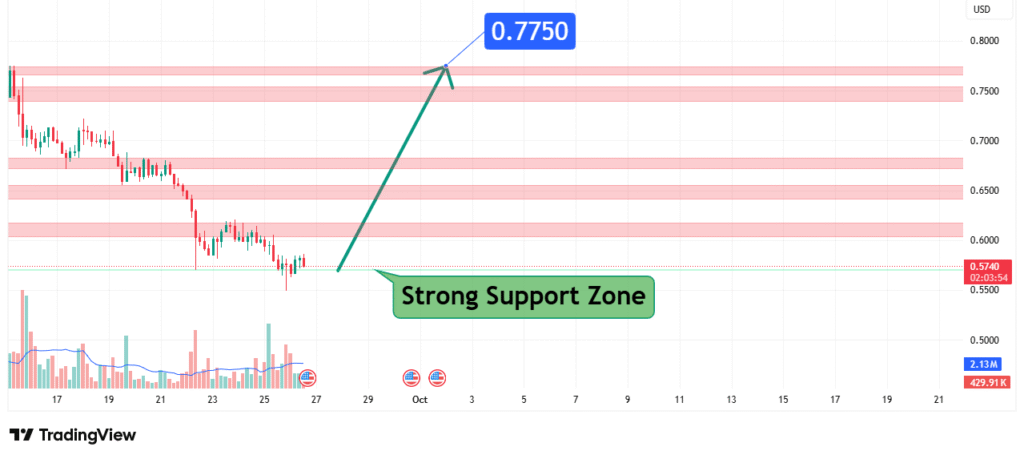

Ethena (ENA) Price Analysis Bullish Setup Targeting $0.775

Ethena (ENA) is currently trading around $0.574 after a prolonged downtrend. Price action has found a strong support zone, with volume confirming buyer interest at these levels. Our analysis suggests a potential bullish reversal with a primary target at $0.775, representing a significant short-term upside move.

This forecast is supported by the confluence of historical support, multiple resistance re-tests, and improving volume dynamics.

Current Market Structure and Price Action

The market has been under sustained selling pressure in recent sessions, pushing ENA to a multi-day low. However, the structure now shows signs of base formation at $0.574, indicating sellers may be exhausted.

Key observations:

- Downtrend exhaustion: Consecutive lower lows appear to have stalled at the highlighted support.

- Volume activity: Buying volume has increased near the support zone, suggesting accumulation.

- Potential reversal: If buyers hold this zone, a bullish rally could follow toward resistance levels.

Key Support & Resistance Zones

- Strong Support Zone: $0.550 – $0.574

- Historically defended by buyers, forming the basis of this bullish setup.

- Immediate Resistance Levels: $0.650, $0.700

- Target Resistance Zone: $0.775 (primary bullish target)

This alignment of technical levels strengthens the case for a potential breakout if momentum continues.

Technical Target & Rationale

- Primary Target (PT1): $0.775

- This aligns with a major resistance cluster seen in mid-September and coincides with a psychological round level.

- Secondary Target (PT2): $0.800+ (if breakout is sustained)

- This would mark a continuation of bullish momentum beyond the first target.

Prediction: Ethena (ENA) is likely to bounce from its current $0.574 support and move toward $0.775 in the upcoming sessions.

Risk Management Considerations

- Invalidation Level (Stop-Loss): Below $0.540

- A daily close below this level would invalidate the bullish setup, suggesting further downside.

- Position Sizing: Traders should risk only 1–2% of capital, as crypto volatility can trigger sharp moves.

Fundamental Backdrop

While this is a primarily technical analysis, some external factors can support or challenge the bullish thesis:

- Market Sentiment: Broader crypto market showing recovery signs after recent sell-offs.

- Macro Factors: Investor anticipation around U.S. Fed policy and liquidity conditions may influence altcoin performance.

- Project-Specific: Positive news on Ethena’s adoption or ecosystem upgrades could accelerate the move toward $0.775.

Conclusion

Ethena (ENA) is at a critical technical inflection point. With strong support at $0.574, increasing buying volume, and a well-defined resistance target, the evidence suggests a bullish breakout is likely in the coming days.

Our forecast sees ENA targeting $0.775, with traders advised to monitor the support zone closely and respect the invalidation level below $0.540 for effective risk management.

Chart Source: TradingView

This analysis is for educational and informational purposes only and does not constitute financial advice. Trading cryptocurrencies involves high risk, and you may lose your entire investment. Always conduct your own research (DYOR) and consult a licensed financial professional before making investment decisions.