Ethereum (ETH) Price Forecast Eyeing a Move to $3,100

Ethereum’s price

Current Market Structure and Price Action

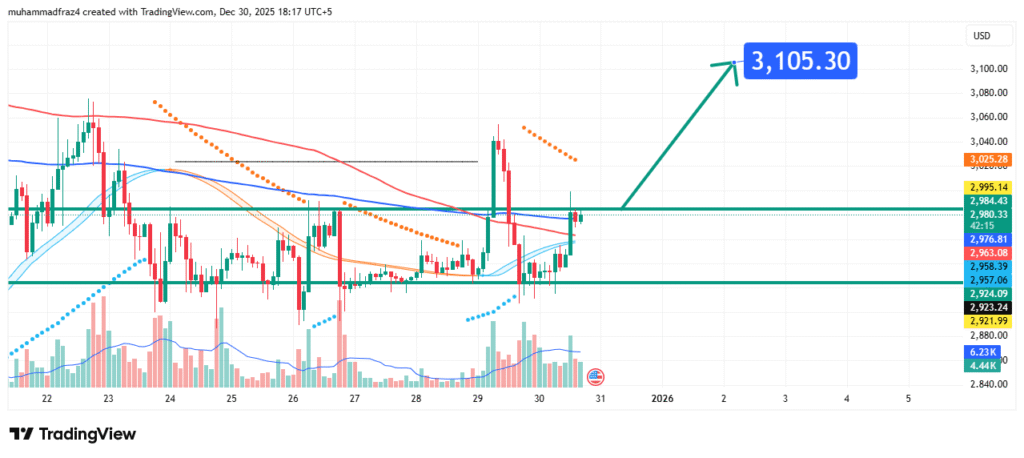

The current market structure for Ethereum has shifted to bullish, characterized by a clear series of higher highs and higher lows. The price is currently interacting with a significant resistance zone between $2,980 and $3,050. Recent price action has shown consistent buying pressure, with candles closing near their highs, indicating a lack of strong selling at this level. The move appears to be part of a breakout from a previous consolidation range, suggesting increased momentum.

Identification of the Key Resistance Zone

The most critical technical element is the Strong Resistance Zone between $2,980 and $3,050.

- Historical Significance: This zone has acted as a major swing high and area of consolidation on multiple occasions in the recent past, creating a clear supply wall.

- Technical Confluence: The upper bound of this zone ($3,050) aligns with a key psychological level. The lower bound ($2,980) is where current price action is being contested.

- Market Psychology: A sustained daily close above $3,050 would signify a major victory for bulls, likely triggering a wave of follow-through buying as shorts are squeezed and new momentum enters the market.

This confluence makes it a high-probability level for a significant price reaction upon a confirmed breakout.

Technical Target and Rationale

Our analysis identifies the following price target:

Primary Target (PT1): $3,100

Rationale: This target is a key psychological round number and aligns with the 1.272 Fibonacci extension level of the prior consolidation phase. It represents the next logical resistance area following a clean break above the $3,050 ceiling. A move to this level would confirm the strength of the new bullish impulse.

Prediction: We forecast that Ethereum will successfully achieve a daily close above the $3,050 resistance, using it as a springboard to propel price towards our primary target at $3,100. The move should be validated by increasing volume.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish breakout thesis is invalidated if the price fails to hold newfound support and achieves a sustained 4-hour close below $2,920. This level represents the recent breakout point and a failure to hold it would suggest the breakout was false, potentially leading to a retest of lower support near $2,850.

- Position Sizing: Any positions taken should be sized so that a loss triggered at the $2,920 invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is complemented by a constructive fundamental landscape:

- ETF Catalyst: The ongoing narrative and potential approval of U.S. Spot Ethereum ETFs remain a significant mid to long-term tailwind, attracting institutional interest.

- Network Activity: Sustained growth in Layer-2 transaction volumes and Total Value Locked (TVL) in DeFi protocols on Ethereum demonstrates robust underlying utility and demand.

- Regulatory Clarity: Progress towards a regulatory framework for cryptocurrencies, particularly with ETH’s classification, reduces systemic uncertainty.

These factors contribute to a bullish foundational sentiment, supporting the case for upward price movement.

Conclusion

Ethereum is at a pivotal technical moment, challenging a major resistance zone. The combination of improving market structure, bullish momentum, and supportive fundamentals suggests a bullish resolution, targeting a move to $3,100. Traders should monitor for a confirmed daily close above $3,050 and manage risk diligently by respecting the key invalidation level at $2,920. The price action at the $3,100 target will be critical for assessing the potential for an extended rally.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.