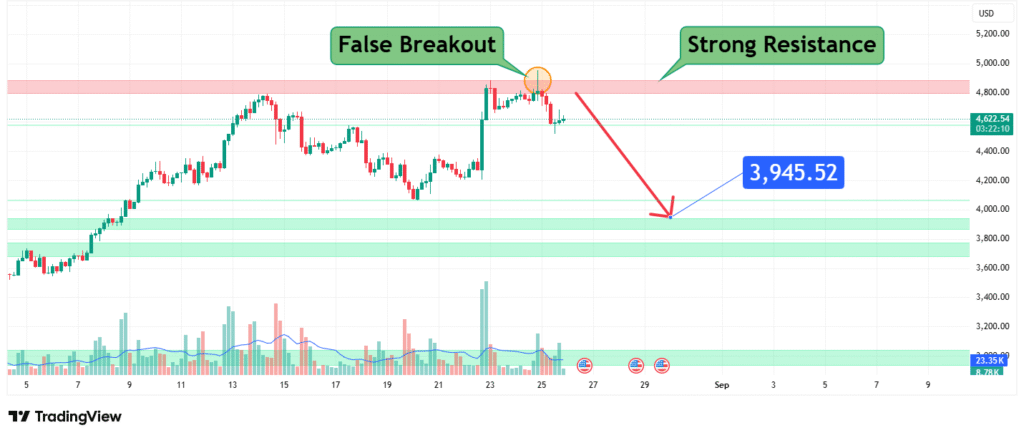

Ethereum's False Breakout A Bearish Reversal Targeting $3,945

The provided chart for Ethereum (ETH/USD) illustrates one of the most consequential and bearish patterns in technical analysis: the False Breakout, often referred to as a “bull trap.” This scenario occurs when the price of an asset briefly moves above a known resistance level, enticing bullish traders to enter new positions, only to reverse sharply and move lower, trapping these buyers at a loss. This pattern is a potent signal of distribution, indicating that smart money used the liquidity of the breakout to offload positions onto retail traders. The subsequent rejection confirms that buying power at higher levels is exhausted, setting the stage for a significant corrective move. The chart clearly labels this event, highlighting a critical failure for the bulls at a “Strong Resistance” zone.

The Formidable Strong Resistance Zone

The strength of a resistance zone is defined by the number of times price has tested and failed to break it, as well as the significance of the price levels within it. The zone annotated on the chart, containing levels like $4,800.00, $5,200.00, and $4,000.00, represents a formidable barrier. This is not a single price point but a region where historical selling pressure has consistently emerged. The recent false breakout above a portion of this zone (likely near the $4,000 area) was the final act of this struggle. The violent rejection back into the range confirms the zone’s integrity and demonstrates that sellers remain in absolute control at these elevated prices. This creates a clear ceiling for any future rally attempts in the near to medium term.

Bearish Price Projection and the $3,945 Target

Following a confirmed false breakout and rejection from a major resistance area, the typical technical expectation is for price to retreat toward the next significant level of support. The most immediate projected target for this decline is $3,945.52 USD. This level is strategically significant for several reasons; it may represent:

- The neckline of a potential bearish reversal pattern (like a Head and Shoulders top formed during the consolidation below resistance).

- A previous major swing high that has now switched roles to become support.

- A key psychological level where buyers previously stepped in.

A breach below $3,945 would signal that the bearish momentum is accelerating, likely opening the path toward deeper support levels near $3,400.00 or even $3,000.00.

Key Levels and Risk Management: The Bullish Invalidation

For this bearish thesis to remain valid, Ethereum must remain capped by the strong resistance zone. A sustained break below the $3,945 target would confirm the downtrend is underway. However, it is crucial to define the conditions that would invalidate this outlook. The bearish scenario is nullified if Ethereum can achieve a strong, sustained daily close above the entire resistance zone, particularly above the $4,800 level. Such a move would indicate that the false breakout was merely a stop run (a liquidity grab) before a genuine, powerful upside continuation. Until that occurs, the weight of evidence suggests lower prices are ahead.

Conclusion: Navigating the Impending Downturn

In conclusion, the technical picture for Ethereum has turned bearish following the confirmed false breakout. The rejection from strong resistance indicates that the path of least resistance is now downward, with an initial target set at $3,945. Traders should consider this a warning to protect profits on long positions, raise stop-losses, or evaluate short-side setups. Investors may view any bounce toward the resistance zone as an opportunity to reduce exposure. Prudent risk management is essential, as breaks from major technical levels often lead to moves characterized by increased volatility and momentum. The market has presented a clear signal, and the wise course is to respect it.

Chart Source: TradingView

Disclaimer: This analysis is based on technical patterns and is for informational purposes only. It is not financial advice. Trading cryptocurrencies involves extreme risk and volatility. Always conduct your own research and manage your risk accordingly.

How did this post make you feel?

Thanks for your reaction!