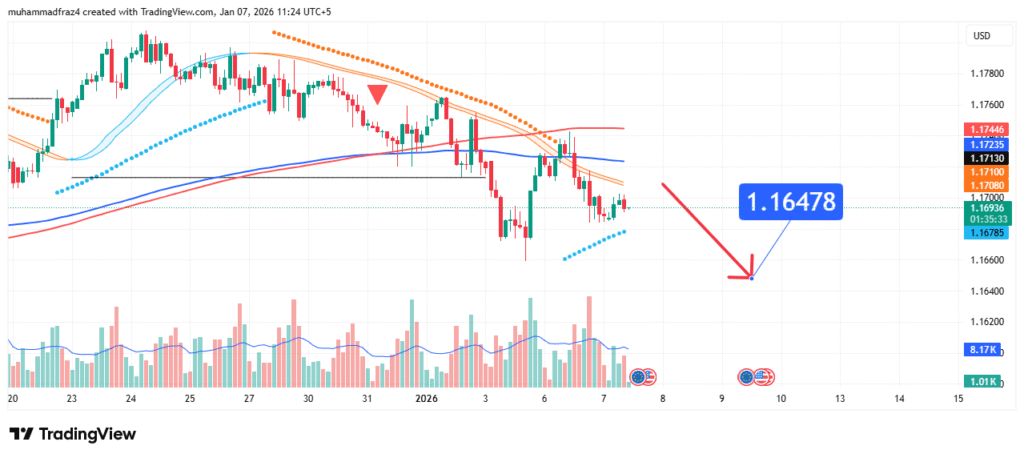

EURUSD Price Forecast Bearish Target at 1.16478

EUR/USD

Current Market Structure and Price Action

The current market structure appears bearish, with price failing to sustain above the 1.17000–1.17100 zone. The price is currently interacting with a critical support area near 1.16785. Recent price action indicates a lack of bullish conviction, suggesting that a breakdown toward lower supports is likely in the upcoming sessions.

Identification of the Key Resistance Zone

The most critical technical element is the strong resistance zone between 1.17100 and 1.17450. The strength of this zone is derived from:

- Historical Significance: This area has previously acted as both support and resistance, creating a consolidation barrier.

- Technical Confluence: The zone aligns with multiple recent highs and psychological levels.

- Market Psychology: This area represents a point where sellers have previously stepped in, creating overhead supply.

This confluence makes it a high-probability zone for bearish reversals or continuation of downward moves.

Technical Targets and Rationale

Our analysis identifies the following price target:

Primary Target (PT1): 1.16478

This level represents a key technical and psychological support, aligned with previous reaction points visible on the provided chart. A break below 1.16785 would likely accelerate the move toward this target.

Prediction: We forecast that the price will break below immediate support near 1.16785 and move towards PT1 at 1.16478.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The bearish thesis is invalidated if the price achieves a daily close above 1.17450. This level represents a clear break above the key resistance zone and would shift the structure bullish.

- Position Sizing: Any positions taken should be sized so that a loss triggered at the invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Central Bank Policies: Divergence between the ECB and Fed monetary policies continues to drive EUR/USD volatility.

- Economic Data: Upcoming inflation and employment data from both regions could impact the pair’s direction.

- Market Sentiment: Broader risk appetite and USD strength are key factors influencing the pair.

These factors contribute to the cautiously bearish sentiment surrounding the pair in the near term.

Conclusion

EUR/USD is at a technical inflection point. The weight of evidence suggests a bearish resolution, targeting a move to 1.16478. Traders should monitor for a confirmed breakdown below 1.16785 and manage risk diligently by respecting the key invalidation level at 1.17450. The reaction at the target zone will be crucial for determining the next major directional move.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.