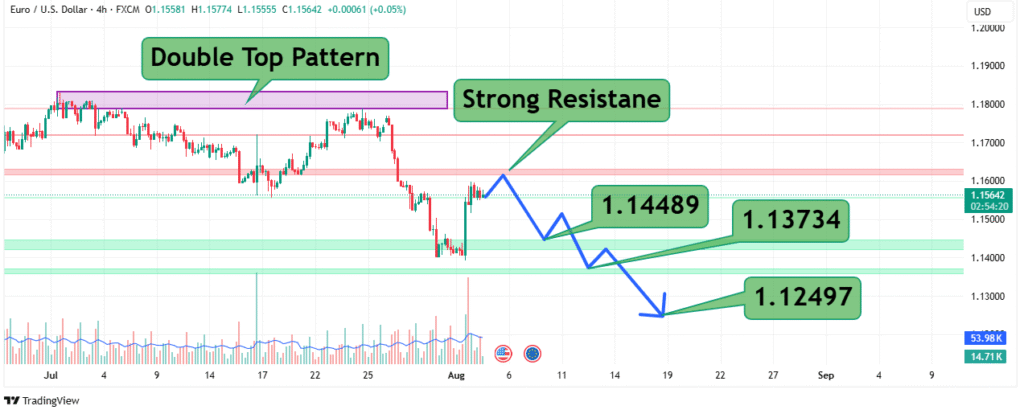

EURUSD Double Top Pattern Signals Bearish Outlook

The EUR/USD currency pair is showing signs of bearish momentum after failing to break key resistance levels. A double top pattern has formed near the 1.17000 zone, suggesting a potential reversal from the recent bullish rally. Technical indicators and price action highlight multiple support and resistance zones that traders should closely monitor in the coming sessions.

Key Technical Patterns

- Double Top Formation:

The chart clearly displays a double top near 1.17000, which is a classic reversal pattern. This pattern typically signals weakening bullish pressure and an impending downward move. - Strong Resistance Zone:

A major resistance has been identified around 1.16000–1.16500, where price previously struggled to break higher. Sellers are expected to defend this level aggressively. - Support Levels to Watch:

- 1.14489: First key support; a break below this may confirm deeper downside.

- 1.13734: Secondary support zone, aligning with previous demand areas.

- 1.12497: Strong support; potential downside target if bearish momentum continues.

Current Market Status

As of the latest session, EUR/USD trades around 1.15642, slightly above the first support zone. The pair faces strong selling pressure as it approaches the resistance level, with bearish patterns aligning with broader market sentiment favoring the U.S. Dollar amid risk-off conditions.

Price Prediction and Scenarios

Bearish Scenario

- Failure to break above 1.16000 may lead to selling pressure toward 1.14489.

- A confirmed break below 1.14489 opens the door to test 1.13734 and potentially 1.12497 in the short term.

Bullish Scenario

- A strong breakout above 1.16500 would invalidate the double top pattern and target the next resistance near 1.18000.

Trading Strategy Insights

- Short-Term Traders: Look for short entries near 1.16000–1.16500 resistance with stops above 1.17000 and targets toward 1.14500.

- Swing Traders: A confirmed break below 1.14489 could provide opportunities to target lower zones around 1.12500.

- Risk Management: Maintain strict stop-loss levels due to potential volatility in the Forex market, especially around U.S. economic data releases.

Conclusion

EUR/USD is currently facing a critical juncture with a double top pattern and heavy resistance overhead. Unless bulls reclaim momentum above 1.16500, the path of least resistance appears downward toward 1.14500 and beyond. Traders should watch these key levels for confirmation and plan their entries and exits accordingly.