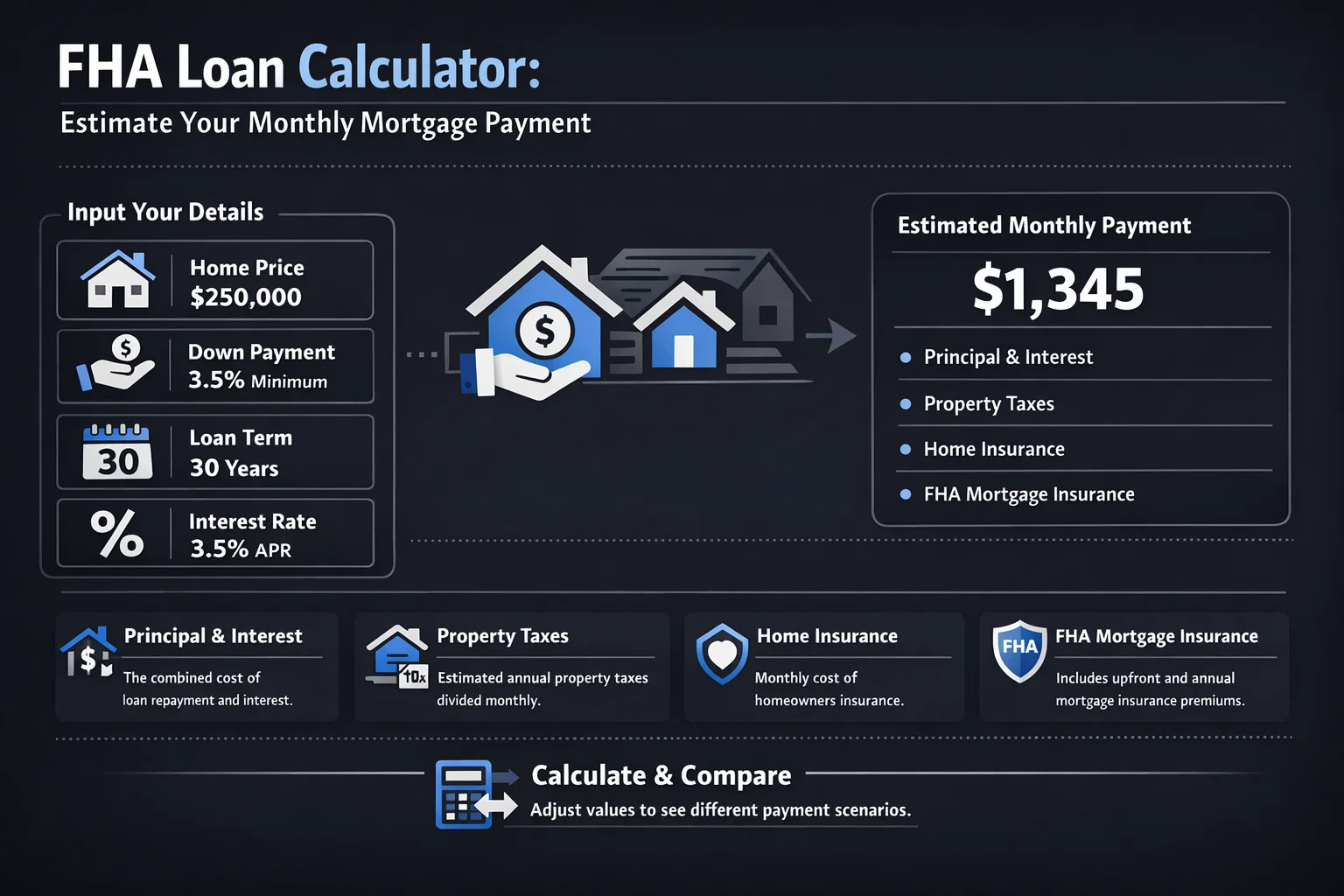

FHA Loan Calculator: Estimate Monthly Your Mortgage Payment

Last updated:

FHA Loan Calculator

Estimate your monthly FHA loan payment including mortgage insurance, taxes, and insurance

$

The purchase price of the home

%

FHA minimum is 3.5% with 580+ credit score

6.5%

Current FHA mortgage interest rate

Affects your MIP duration and interest rate

1.2%

Varies by location

$

Estimated annual homeowners insurance premium

Affects property taxes and some FHA limits

Your FHA Loan Results

Loan Amount:

$0

Down Payment:

$0

Base Loan Payment (P&I):

$0

Monthly Mortgage Insurance (MIP):

$0

Monthly Property Tax:

$0

Monthly Home Insurance:

$0

Total Monthly Payment (PITI):

$0

Upfront MIP (UFMIP):

$0

Total Interest Paid:

$0

Total Loan Cost:

$0

Payment breakdown visualization will appear here

Note: This calculator provides estimates only. Actual FHA loan terms may vary based on lender requirements, credit history, and property location. Upfront MIP is typically financed into the loan.

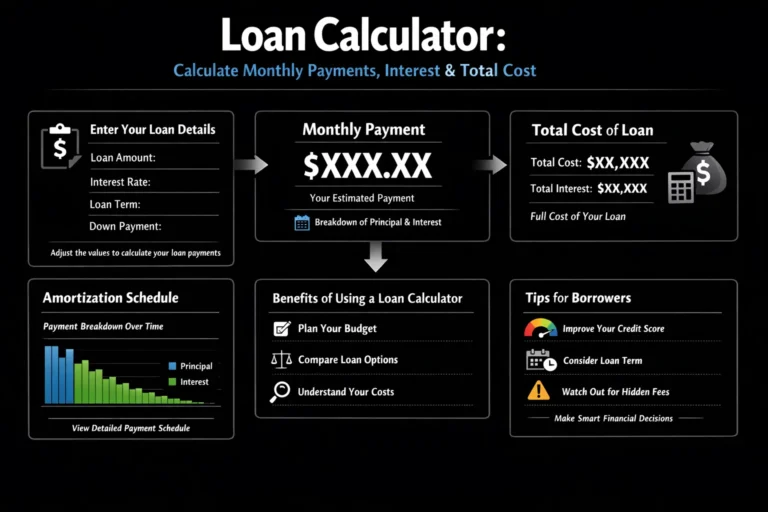

How to Use This Calculator

- Enter Home Price: Start by entering the purchase price of the home you’re considering.

- Select Down Payment Type: Choose whether to enter your down payment as a percentage (minimum 3.5% for FHA) or a specific dollar amount.

- Adjust Interest Rate: Use the slider to set your expected FHA mortgage interest rate based on current market rates.

- Choose Loan Term: Select between 15-year or 30-year FHA mortgage terms.

- Enter Credit Score: Select your credit score range as this affects your Mortgage Insurance Premium (MIP) duration.

- Set Property Tax Rate: Adjust based on your location’s average property tax rate.

- Enter Insurance Costs: Input estimated annual homeowners insurance costs.

- Select State: Choose your state for location-specific considerations.

- View Results: See your complete monthly payment breakdown and total loan costs.

Input Field Explanations

- Home Price: The total purchase price of the property

- Down Payment: FHA requires minimum 3.5% with 580+ credit score, 10% with 500-579

- Interest Rate: Annual percentage rate (APR) for your FHA loan

- Loan Term: FHA offers 15 or 30-year fixed-rate mortgages

- Credit Score: Affects your MIP duration – higher scores may remove MIP after 11 years

- Property Tax: Annual tax rate varies by county and municipality

- Home Insurance: Required for all mortgaged properties

- State: Some states have different FHA loan limits and requirements

Interpreting Results

- Loan Amount: Purchase price minus down payment

- Base Payment: Principal and interest only

- Monthly MIP: FHA Mortgage Insurance Premium (required)

- Total Monthly Payment: Complete PITI + MIP payment

- Upfront MIP: 1.75% of loan amount (typically financed)

- Total Interest: Interest paid over loan life

- Total Loan Cost: All payments including upfront MIP

Understanding the Calculation

The FHA loan calculator uses standard mortgage formulas with FHA-specific adjustments:

Principal and Interest Calculation

Monthly Payment = P × [r(1+r)^n] / [(1+r)^n - 1]

Where:

P = Loan Principal (Home Price - Down Payment)

r = Monthly Interest Rate (Annual Rate ÷ 12)

n = Total Number of Payments (Years × 12)

FHA Mortgage Insurance Premium (MIP)

- Upfront MIP: 1.75% of base loan amount

- Monthly MIP: Varies by loan term and LTV ratio

- 30-year loans: 0.55% to 0.85% annually

- 15-year loans: 0.45% to 0.70% annually

- Divided by 12 for monthly amount

Property Taxes

Monthly Property Tax = (Home Price × Tax Rate) ÷ 12

Homeowners Insurance

Monthly Insurance = Annual Premium ÷ 12

Total Monthly Payment (PITI + MIP)

Total = Principal & Interest + Monthly MIP + Property Tax + Insurance

Example Calculation

Scenario: $350,000 home with 3.5% down payment, 6.5% interest rate, 30-year term

- Down Payment: $350,000 × 3.5% = $12,250

- Loan Amount: $350,000 – $12,250 = $337,750

- Monthly P&I: $2,134.87 (calculated using mortgage formula)

- Upfront MIP: $337,750 × 1.75% = $5,910.63 (financed)

- Monthly MIP: $337,750 × 0.55% ÷ 12 = $154.80

- Property Tax: $350,000 × 1.2% ÷ 12 = $350.00

- Insurance: $1,200 ÷ 12 = $100.00

- Total Monthly: $2,134.87 + $154.80 + $350.00 + $100.00 = $2,739.67

How to Apply These Results to Your Financial Strategy

If Your Monthly Payment Is Too High:

- Increase down payment to reduce loan amount and MIP

- Consider a 15-year loan for lower interest rates and shorter MIP duration

- Look for less expensive homes within your budget

- Improve credit score to potentially qualify for better rates

If You Want to Maximize Affordability:

- Use the minimum 3.5% down payment if you have strong credit

- Factor in potential MIP removal after 11 years for cash flow planning

- Consider FHA streamline refinance options when rates drop

Budget Planning Strategies:

- Emergency Fund: Maintain 3-6 months of total housing payments

- Closing Costs: Budget 2-5% of home price for additional fees

- Maintenance Reserve: Set aside 1% of home value annually for repairs

Common Mistakes to Avoid

- Underestimating Total Costs: Remember to include MIP, taxes, and insurance

- Ignoring MIP Duration: Monthly MIP may last the entire loan term

- Maxing Out Budget: Leave room for unexpected expenses

- Overlooking Credit Impact: Lower scores increase MIP costs significantly

Adjusting Inputs for Financial Goals

- To Lower Monthly Payment: Increase down payment, improve credit score, choose 30-year term

- To Reduce Total Interest: Choose 15-year term, make extra payments

- To Minimize MIP Costs: Aim for ≤90% LTV and credit score ≥680

Advanced FHA Calculation Scenarios

1. FHA 203(k) Rehabilitation Loans

- Calculate combined purchase + renovation costs

- Factor in contingency reserves (10-20%)

- Include temporary housing costs during renovation

2. FHA Streamline Refinance

- No appraisal required in many cases

- Reduced upfront MIP (0.01% for certain refinances)

- Must demonstrate net tangible benefit

3. FHA with Gift Funds

- 100% of down payment can be gifted from family

- Documentation required for gift letters

- Affects debt-to-income calculations differently

4. FHA for Multi-Unit Properties (2-4 units)

- Rental income can be used to qualify

- Higher loan limits apply

- Different MIP calculations for investment properties

Impact of Financial Decisions

Extra Payments Analysis:

- $100 extra monthly on $300,000 loan at 6.5% saves $40,000 interest

- Bi-weekly payments vs monthly saves approximately 4 years of payments

Refinancing Considerations:

- Break-even analysis: Closing costs ÷ Monthly savings = Months to recover

- MIP implications: Refinancing may restart MIP duration

Down Payment Strategies:

- 3.5% vs 10% down: Compare MIP savings vs opportunity cost of cash

- Down payment assistance programs: May affect overall costs

Important FHA Loan Considerations

- Closing Costs: Typically 2-5% of loan amount (appraisal, title, origination)

- Prepaid Items: Property taxes, insurance, interest collected at closing

- Monthly HOA Fees: If applicable to your property

- Private Mortgage Insurance (PMI): Not applicable to FHA (uses MIP instead)

- Rate Fluctuations: Interest rates change daily

- Lender-specific Fees: Underwriting, processing, document preparation

Assumptions Made

- Fixed Interest Rate: Calculations assume rate remains constant

- Consistent Tax Rates: Property taxes assumed constant (typically increase annually)

- Steady Insurance Costs: Homeowners insurance rates may change

- No Extra Payments: Calculations assume regular payments only

- MIP Rules: Based on current FHA guidelines (subject to change)

When to Consult Professionals

- Complex Financial Situations: Self-employment, irregular income

- Credit Issues: Scores below 580 or recent derogatory marks

- Property-specific Concerns: Unique homes, zoning issues

- State-specific Programs: Down payment assistance, first-time buyer programs

- Tax Implications: Mortgage interest deduction, property tax deductions

FHA-Specific Limitations

- Loan Limits: Vary by county (check FHA county loan limits)

- Property Requirements: Must meet FHA minimum property standards

- Primary Residence Only: FHA loans are for primary residences only

- MIP Duration: May last life of loan depending on LTV and term

- Debt-to-Income Ratios: Typically 31% housing, 43% total (exceptions possible)

Glossary of Terms

- MIP: Mortgage Insurance Premium (FHA’s version of PMI)

- UFMIP: Upfront Mortgage Insurance Premium (1.75% of loan amount)

- LTV: Loan-to-Value ratio (loan amount ÷ home value)

- DTI: Debt-to-Income ratio (monthly debts ÷ monthly income)

- PITI: Principal, Interest, Taxes, Insurance

- FICO: Credit scoring model used by most mortgage lenders

- APR: Annual Percentage Rate (includes interest + fees)

Frequently Asked Questions About FHA Loans

What is the minimum credit score for an FHA loan?

The minimum credit score for an FHA loan is 500. However, with a score of 500-579, you’ll need a 10% down payment. With a score of 580 or higher, you can qualify for the minimum 3.5% down payment. Individual lenders may have higher requirements, often requiring at least 620 for most FHA loans.

How long do I have to pay FHA mortgage insurance (MIP)?

For 30-year FHA loans with less than 10% down payment, MIP lasts for the entire loan term. For loans with 10% or more down, MIP typically lasts 11 years. For 15-year loans, MIP lasts 11 years regardless of down payment if your loan-to-value ratio is 90% or less. If your LTV is above 90%, MIP lasts the full 15 years.

Can I use gift funds for my FHA down payment?

Yes, 100% of your FHA down payment can come from gift funds from family members, employers, labor unions, or government agencies. The gift giver must provide a letter stating the funds are a gift (not a loan) and include their relationship to you. You’ll also need to provide documentation showing the transfer of funds.

What are the FHA loan limits for my area?

FHA loan limits vary by county and are based on median home prices in each area. For 2024, the standard FHA loan limit for a single-family home ranges from $498,257 in low-cost areas to $1,149,825 in high-cost areas. You can check the specific limit for your county on the HUD website or consult with an FHA-approved lender.

How does FHA compare to conventional loans?

FHA loans typically have lower credit score requirements (500 minimum vs 620 for conventional), lower down payments (3.5% vs 3-20%), and more flexible debt-to-income ratios. However, FHA requires both upfront and monthly mortgage insurance regardless of down payment, while conventional loans only require PMI with less than 20% down, and PMI can be removed once you reach 20% equity.

Can I refinance my FHA loan to remove mortgage insurance?

Yes, you can refinance from an FHA loan to a conventional loan once you have at least 20% equity in your home to eliminate mortgage insurance. This is often done through an FHA streamline refinance (for current FHA loans) or a conventional refinance. However, you cannot simply remove MIP from an existing FHA loan without refinancing.

What properties qualify for FHA financing?

FHA loans can be used for single-family homes, 2-4 unit multi-family properties (if you occupy one unit), FHA-approved condominiums, and manufactured homes with permanent foundations. The property must meet FHA minimum property standards for safety, security, and structural integrity. Investment properties and vacation homes do not qualify for FHA financing.

Other Financial Calculators You Might Find Useful

- Conventional Mortgage Calculator: Compare FHA loans with conventional mortgage options to see which saves you more money over time.

- Debt-to-Income Ratio Calculator: Determine if you qualify for an FHA loan based on your current debt obligations and income.

- Rent vs Buy Calculator: Analyze whether buying a home with an FHA loan makes more financial sense than renting in your area.

- Refinance Calculator: Calculate potential savings from refinancing your existing mortgage to an FHA streamline refinance.

- Home Affordability Calculator: Determine how much house you can realistically afford based on your income, debts, and down payment.

- Amortization Schedule Calculator: View detailed payment breakdowns showing how much goes to principal vs interest each month.

- VA Loan Calculator: Compare FHA benefits with VA loan options if you’re a veteran or active military member.