GBPJPY Technical Analysis Key Levels and Targets

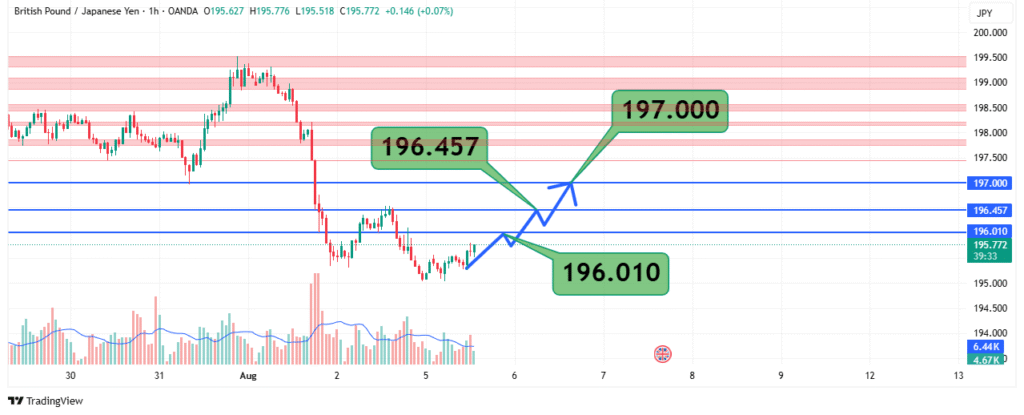

The GBP/JPY currency pair has recently shown a slight bullish bias, trading at 195.772 with a modest gain of 0.07% on the hourly chart. However, the pair faces critical resistance near 196.457–197.000, which will determine its next major move. This analysis breaks down the key price levels, trend structure, and actionable trading strategies for short-term traders.

Current Market Structure

The pair is consolidating between 195.500–196.000, reflecting a balance between buyers and sellers. The session high of 195.776 suggests bullish attempts, but the lack of a decisive breakout indicates hesitation. The 195.000–195.300 zone remains crucial support, while 196.457–197.000 acts as a formidable resistance barrier.

A breakout above 197.000 could signal a stronger uptrend, targeting 198.500. Conversely, a failure to hold 195.000 may trigger a deeper pullback toward 194.000–194.500.

Trend and Momentum Analysis

The short-term trend is neutral to slightly bullish, supported by the price holding above 195.500. However, momentum remains weak, as reflected in the RSI at 39.33 (neither overbought nor oversold). For a sustainable uptrend, buyers need to push the RSI above 50 with increasing volume.

The MACD (12,26,9) is hovering near the zero line, indicating a lack of strong directional bias. A bullish crossover above the signal line could reinforce upside potential, while a bearish cross may confirm a retracement.

Key Levels to Watch

Resistance Zones

- 196.457 (Immediate resistance)

- 197.000 (Psychological barrier)

- 198.000–198.500 (Next targets if bullish momentum strengthens)

Support Zones

- 195.500 (Near-term support)

- 195.000 (Critical demand zone)

- 194.500–194.000 (Next downside targets if support breaks)

Trading Strategies

Bullish Scenario: Breakout Trade

- Entry: Wait for a confirmed close above 196.457 with rising volume.

- Targets:

- 197.000 (First take-profit level)

- 198.000–198.500 (Extended target if momentum holds)

- Stop-Loss: Below 195.500 to limit downside risk.

Bearish Scenario: Rejection Trade

- Entry: Look for a bearish reversal pattern (e.g., pin bar, engulfing) near 196.457–197.000.

- Targets:

- 195.000 (Initial support)

- 194.500–194.000 (Lower support zone)

- Stop-Loss: Above 196.800 to avoid false breakdowns.

Indicator-Based Confirmation

- MACD: A bullish crossover above the zero line would strengthen the breakout case.

- DMI (14): Watch for +DI > -DI and ADX > 25 to confirm trend strength.

- Volume: A surge in buying volume on a breakout would validate the move.

Risk Management Considerations

- Position Sizing: Risk no more than 1–2% of capital per trade.

- Stop Placement: Use recent swing lows (for longs) or highs (for shorts) to define exits.

- Avoid Chasing: Wait for retests of key levels for better risk-reward entries.

Final Thoughts

The GBP/JPY pair is at a crossroads, with 196.457–197.000 serving as the make-or-break zone. Traders should remain patient and wait for a confirmed breakout or rejection before committing to a direction. A bullish breakout could open the path toward 198.500, while a bearish reversal may lead to a retest of 194.000.