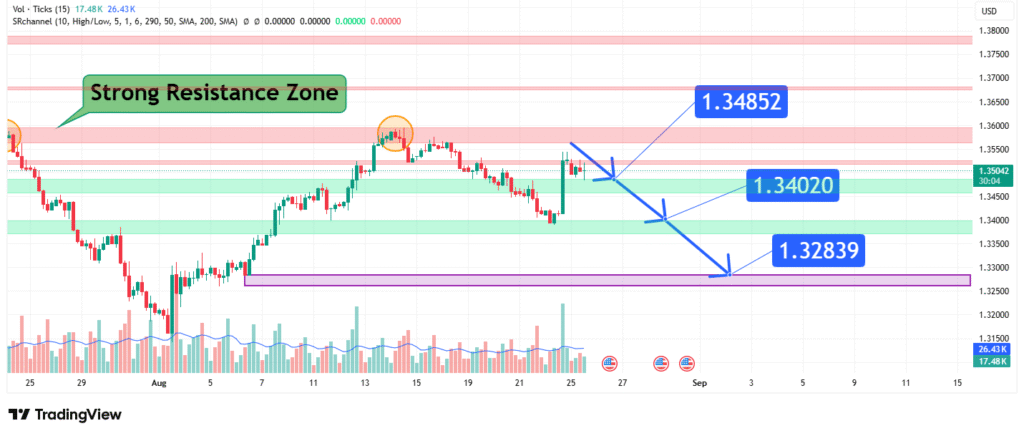

GBPUSD Price Analysis Bearish Targets at 1.348, 1.340, and 1.328

The GBP/USD pair is showing signs of weakness after facing a strong resistance zone. Current market structure suggests that sellers may regain control, opening the path toward lower support levels. Based on technical analysis, the key downside targets to watch are 1.348, 1.340, and 1.328.

Current Market Structure

The chart highlights a clear rejection from a strong resistance zone around 1.36–1.37, where sellers previously stepped in with heavy momentum. Following this rejection, GBP/USD has begun to consolidate below the resistance, signaling potential bearish continuation.

- Strong Resistance Zone: Sellers remain active between 1.36 and 1.37, capping upside moves.

- Immediate Support: The price is currently hovering near 1.3500, testing the breakdown level.

- Volume Activity: Spikes in selling volume confirm bearish momentum building up after rejection at resistance.

Technical Outlook

- Trend Direction: The overall short-term bias is bearish following the resistance rejection.

- Key Levels to Watch:

- 1.348: The first potential support zone where buyers may attempt to defend.

- 1.340: A critical support level aligned with previous price consolidation.

- 1.328: A deeper support target and potential bearish extension if downside pressure persists.

- Resistance Levels: Any recovery faces strong headwinds near 1.36–1.3650, where sellers have been active.

Fundamental Context

The GBP/USD movement is also influenced by broader macroeconomic and fundamental factors:

- U.S. Dollar Strength: Hawkish Federal Reserve policies, coupled with resilient U.S. economic data, have continued to support dollar demand.

- UK Economic Uncertainty: Weaker UK growth outlook and persistent inflationary pressures have added to the bearish narrative for the British pound.

- Risk Sentiment: Global risk-off moods generally favor the dollar, while optimism may temporarily lift the pound.

These fundamental drivers align with the technical bearish bias, suggesting that downside targets remain realistic.

Price Prediction: 1.348 → 1.340 → 1.328

Based on both technical and fundamental perspectives, GBP/USD is likely to continue its bearish correction. The downside progression may unfold in stages:

- First Target: 1.348 – Short-term support that may attract temporary buyers.

- Second Target: 1.340 – A stronger demand area that could test bearish conviction.

- Final Target: 1.328 – A major support level, representing the deeper bearish extension if momentum accelerates.

Risk Considerations

- Breakout Above Resistance: A daily close above 1.3650 would invalidate the bearish setup and open the path toward higher gains.

- Unexpected UK Data: Positive surprises in UK GDP, inflation, or Bank of England policy could strengthen the pound.

- U.S. Economic Shifts: Weaker U.S. data or dovish Fed commentary could reduce dollar demand, limiting downside potential.

Conclusion

The GBP/USD pair faces significant bearish pressure after rejection from a strong resistance zone. With sellers regaining momentum, the next targets are 1.348, 1.340, and 1.328. While short-term bounces are possible, the overall bias favors the downside unless the pair breaks convincingly above the 1.3650 resistance.

This analysis highlights a cautious approach for traders, with clear levels to watch for both bearish continuation and potential invalidation.

How did this post make you feel?

Thanks for your reaction!