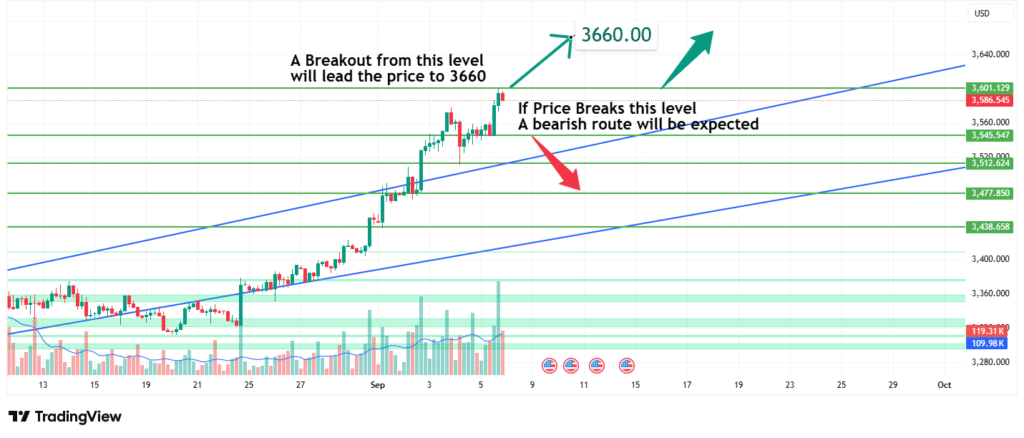

Gold Price Analysis Bulls Eye 3660 if Breakout Holds

This analysis highlights both the bullish and bearish pathways, emphasizing the importance of risk management at this inflection point.

Current Market Structure and Price Action

- Gold has been on a steady uptrend since mid-August, printing higher highs and higher lows.

- Recent bullish candles with strong volume indicate solid buying interest.

- The price is now consolidating just below 3600 USD, a historically significant barrier.

- This makes the current setup a make-or-break zone where market direction will be defined.

Key Resistance and Support Levels

- Immediate Resistance: 3600 – 3610 USD

- A breakout above this area unlocks upside potential to 3660 USD.

- Upside Target: 3660 USD

- Represents the next key resistance and measured move target.

- Support Zone 1: 3545 – 3550 USD

- Short-term buffer where buyers may attempt to defend.

- Support Zone 2: 3512 – 3520 USD

- Stronger support aligned with the rising trendline.

- Deeper Support: 3438 – 3440 USD

- A breakdown into this area would confirm a bearish reversal.

Technical Targets and Rationale

- Bullish Scenario:

- Breakout above 3600–3610 USD leads to 3660 USD.

- Momentum-driven buyers will likely chase this move, supported by trendline alignment.

- Bearish Scenario:

- Failure to break higher results in a correction.

- Initial downside targets include 3550 USD, with potential extension to 3520 USD.

- A decisive break below the rising trendline (~3512 USD) would expose 3440 USD support.

Risk Management Considerations

- Invalidation (Bullish): Daily close below 3520 USD weakens the bullish case.

- Invalidation (Bearish): A daily close above 3610 USD invalidates the bearish outlook and confirms a breakout.

- Stop-Loss Placement: Traders should adjust stops beyond invalidation levels, keeping risk to 1–2% per trade.

- Position Sizing: Proper risk allocation ensures sustainability even if the market moves against the setup.

Fundamental Backdrop

Gold’s technical setup is underpinned by broader fundamentals:

- U.S. Dollar Weakness: Dollar softness has recently boosted Gold’s rally.

- Interest Rate Outlook: Market expectations of rate cuts from the Federal Reserve continue to support demand for safe-haven assets.

- Geopolitical Risks: Elevated uncertainty in global markets is adding bullish fuel to Gold’s demand.

However, stronger-than-expected economic data or rising yields could pose downside risks.

Conclusion

Gold (XAUUSD) stands at a pivotal resistance zone around 3586–3600 USD. The market is at a decision point:

- A confirmed breakout sets the path towards 3660 USD.

- A rejection or breakdown below support could trigger a bearish retracement towards 3520 USD or lower.

Traders should monitor price action closely at this level and manage risk accordingly.

Prediction: Gold is likely to test 3660 USD if the breakout holds, but a bearish correction remains possible if price fails to sustain above 3600 USD.

Chart Source: TradingView

Disclaimer: This analysis is for educational purposes only and not financial advice. Trading involves significant risk. Always conduct independent research before entering trades.