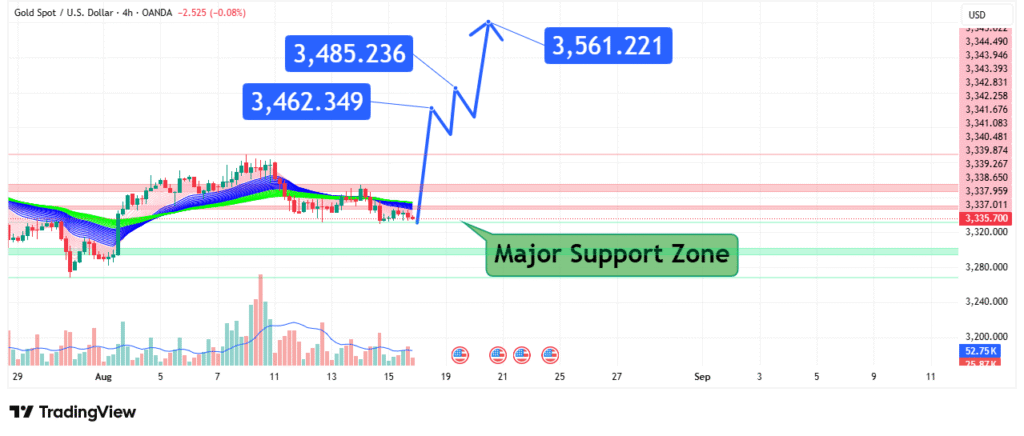

Gold Price Eyes Upside Targets $3,462, $3,485, and $3,561 in Play

Gold (XAU/USD) has been holding strong near major support levels, setting the stage for a potential upward move toward $3,462, $3,485, and ultimately $3,561. This bullish outlook is supported by technical indicators, macroeconomic trends, and historical price behavior. In this article, we’ll break down the key levels, catalysts, and trading strategies for gold’s next major move.

Why $3,462, $3,485, and $3,561 Are Key Targets

1. Technical Structure

- $3,462: Immediate resistance-turned-support level, acting as a springboard for upward momentum.

- $3,485: A critical breakout point; clearing this level could accelerate buying pressure.

- $3,561: The primary bullish target, representing a major historical resistance zone.

2. Bullish Indicators

- Strong Support Base: Gold has repeatedly bounced from the $3,340–$3,350 zone, confirming strong demand.

- RSI & Momentum: The Relative Strength Index (RSI) is holding above 50, suggesting bullish momentum.

- Moving Averages: The 50-day and 200-day MAs are acting as dynamic support, reinforcing the uptrend.

3. Macroeconomic Catalysts

- Dollar Weakness: A softening USD could propel gold higher.

- Inflation & Rate Cuts: Persistent inflation or Fed dovishness may reignite gold’s safe-haven appeal.

- Geopolitical Risks: Escalating tensions could drive flight-to-safety flows into gold.

Key Levels to Watch

Support (Downside Protection)

- $3,420–$3,440 (Near-term support)

- $3,340–$3,350 (Major demand zone – must hold for bullish case)

Resistance (Upside Targets)

- $3,462 (First target – breakout confirmation)

- $3,485 (Next hurdle – strong bullish signal if breached)

- $3,561 (Primary objective – previous high and psychological level)

Potential Scenarios

Bullish Breakout (Targets Hit: $3,462 → $3,485 → $3,561)

- A sustained move above $3,462 could trigger algorithmic and institutional buying.

- Clearing $3,485 would open the door to $3,561, with potential for an extended rally.

Bearish Rejection (If Support Fails)

- A drop below $3,340 would invalidate the bullish outlook, signaling a deeper correction.

- Next major support lies near $3,280–$3,300.

Trading Strategy

- Long Entry: Near $3,440–$3,450 with a stop-loss below $3,340.

- Take-Profit Levels:

- First Target: $3,462 (Partial exit or trail stop)

- Second Target: $3,485

- Final Target: $3,561

- Risk Management: Keep position sizes controlled due to gold’s volatility.

Conclusion

Gold is positioned for a potential bullish run toward $3,462, $3,485, and $3,561, supported by strong technicals and macroeconomic tailwinds. Traders should watch for a confirmed breakout above $3,462 to confirm upside momentum. However, a breakdown below $3,340 would shift the bias to neutral or bearish.

How did this post make you feel?

Thanks for your reaction!