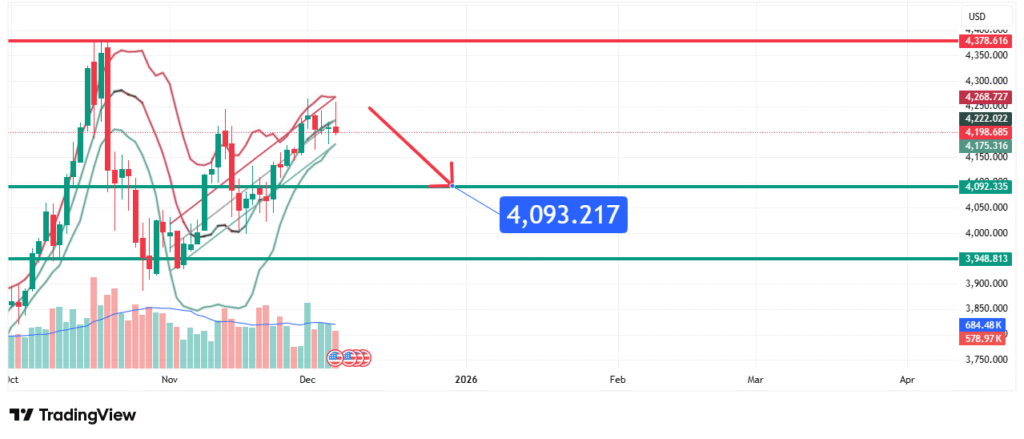

Gold Price Forecast Bearish Correction Towards $4,093 Imminent

Gold’s price has experienced a parabolic rally but is now showing signs of exhaustion and rejection around the $4,200 psychological area. This price action suggests a bearish corrective bias is forming. Our analysis projects a pullback towards a primary target of $4,093, which aligns with a previous major swing high and a key consolidation zone. This prediction is based on a confluence of technical factors, including a potential double-top formation near all-time highs and overextended momentum readings.

Current Market Structure and Price Action

The long-term market structure remains bullish. However, on the shorter-term daily chart, the price is exhibiting potential reversal characteristics. After touching an all-time high near $4,393, gold has failed to sustain upward momentum and is currently consolidating below the $4,200 level. The formation of lower highs and the rejection from the peak suggest buyer fatigue. The price is now interacting with a critical area that could determine the next directional move, with immediate risk skewed to the downside for a healthy correction.

Identification of the Key Resistance Zone

The most critical technical element is the Strong Resistance Zone between $4,175 and $4,393. The strength of this zone is derived from:

- Historical Significance: The peak near $4,393 represents the all-time high. The $4,175-$4,200 area has previously acted as both support and resistance.

- Technical Confluence: This zone represents the peak of the recent impulsive wave. A failure to break higher here often leads to a corrective retracement.

- Market Psychology: The round number of $4,200 serves as a major psychological barrier where profit-taking from the historic rally is likely to intensify.

This confluence makes it a high-probability zone for a bearish reaction and the initiation of a correction.

Technical Target(s) and Rationale

Our analysis identifies the following price target(s):

Primary Target (PT1): $4,093

This level represents a previous major swing high and a strong consolidation floor from earlier in 2024. It is a logical level for price to seek support, as it was a significant breakout point during the ascent.

Prediction: We forecast that the price will reject from the current resistance zone and move downwards towards PT1 at $4,093. A hold at this level could see consolidation before the next major directional decision.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bearish corrective thesis is invalidated if the price achieves a daily close above $4,393 (the all-time high). This would signal a resumption of the unbridled bullish trend and negate the anticipated pullback.

- Position Sizing: Any short positions taken based on this correction thesis should be sized so that a loss triggered at the invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Central Bank Policies: Market expectations for the Federal Reserve’s interest rate path remain the primary driver for gold. Any hawkish signals could strengthen the USD and pressure gold, supporting a correction.

- Geopolitical Tensions: While providing a floor for prices, the “fear premium” may already be priced in after the recent spike, allowing room for a technical pullback.

- USD Strength: A rebound in the U.S. Dollar Index (DXY) would be a direct catalyst for the predicted downward move in XAU/USD.

Conclusion

Gold is at a technical inflection point after a massive rally. The weight of evidence suggests a bearish corrective resolution is due, targeting a move down to $4,093. Traders should monitor for sustained price action below $4,175 as confirmation and manage risk diligently by respecting the key invalidation level at $4,393. The reaction at the $4,093 target zone will be crucial for determining whether this is a shallow correction or the beginning of a deeper retracement.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.