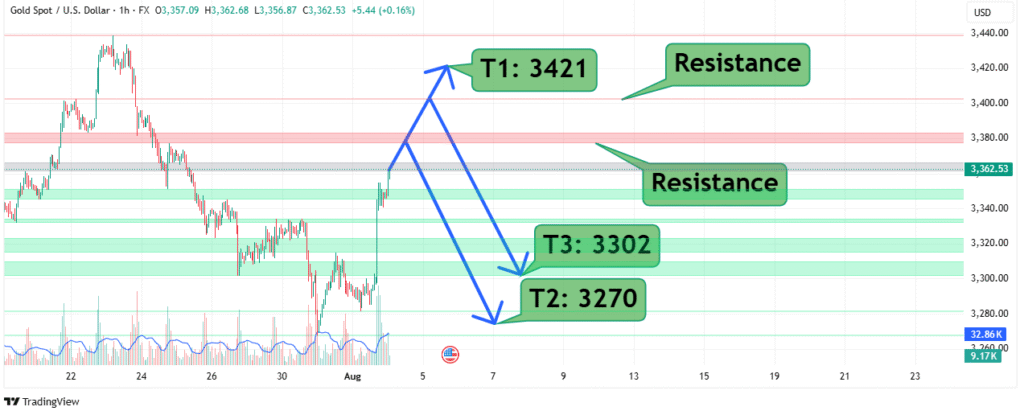

Gold Price Forecast - Key Resistance Levels and Target Zones

Gold (XAU/USD) prices have recently shown strong bullish momentum, breaking out of a consolidation phase and heading toward critical resistance levels. The current market structure highlights important zones traders should monitor for potential reversals or continuation moves.

Current Market Overview

As of August 2, 2025, Gold is trading near $3,362.53 after a recent upward move. The market is approaching significant resistance zones, which could determine the next price trajectory. Technical analysis suggests two primary resistance areas and three target zones (T1, T2, T3) that traders can use to plan entries and exits.

Key Resistance Levels

- First Resistance Zone (~$3,380 – $3,400)

- This zone represents the immediate hurdle for bulls. A clean breakout and daily close above this level may open the door to higher targets.

- Major Resistance Zone (~$3,420)

- Labeled near T1: $3,421, this zone is the next significant barrier. Historically, price reactions here have triggered notable reversals.

Target Zones and Potential Movements

Upside Target (T1)

- Price Level: $3,421

- If momentum continues, gold could test this level before facing strong selling pressure.

Downside Targets

- T3: $3,302

- A moderate retracement zone where buyers might re-enter.

- T2: $3,270

- A deeper support level; breaking below could signal bearish continuation toward lower ranges.

Expected Price Path (Based on Chart Projection)

- Price may initially rally toward T1: $3,421.

- After testing this resistance, a pullback toward T3 ($3,302) or deeper to T2 ($3,270) is probable.

- These zones could serve as re-accumulation levels if bullish fundamentals remain intact.

Technical Insights

- Volume: Increased trading volume during the latest upswing suggests strong buyer interest.

- Support Zones: Multiple green-shaded areas between $3,270–$3,340 indicate demand clusters.

- Trend: The higher timeframe trend remains bullish, but near-term corrections are likely at resistance levels.

Trading Strategy Consideration

- Aggressive Traders: May look for short opportunities near $3,421 with tight stop-loss above $3,430.

- Conservative Traders: Wait for pullbacks to $3,302 or $3,270 to join the broader uptrend.

- Risk Management: Maintain proper position sizing; gold volatility remains high.

Conclusion

Gold prices are approaching a critical resistance zone at $3,421. A breakout or rejection here will define the next major swing. Traders should monitor price action closely around these key levels, watching for confirmation signals before entering trades.